Portal Ct Gov MediaForm CT 706 NT EXT Connecticut 2022

Understanding the CT Form 706 NT

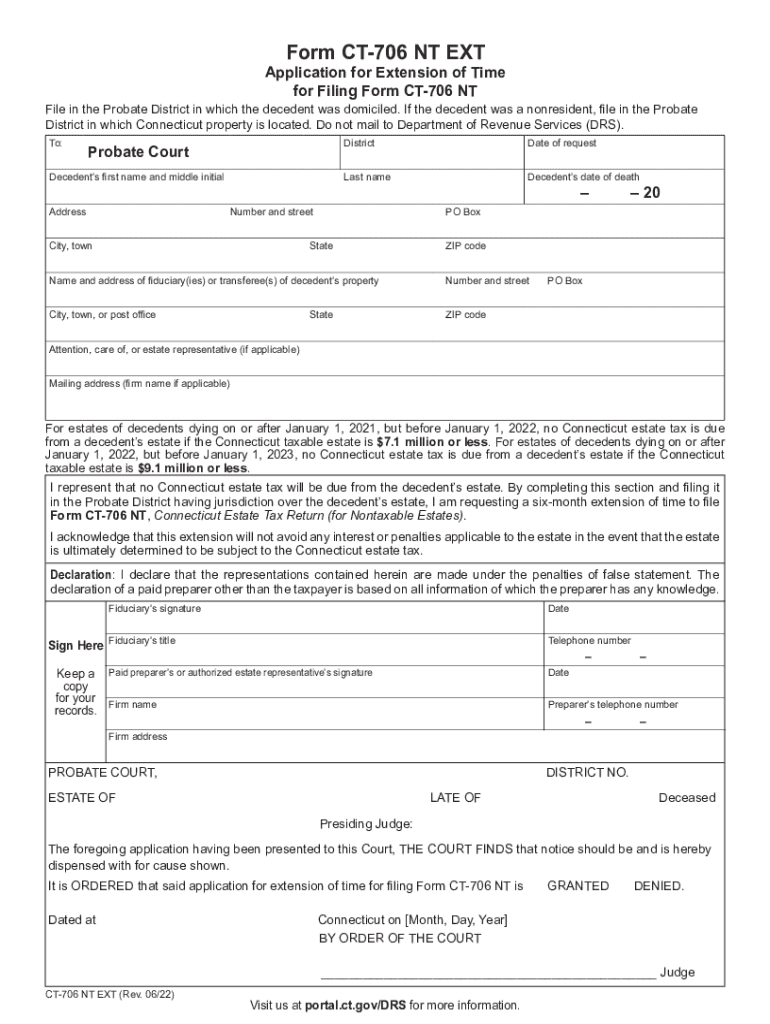

The CT Form 706 NT is a crucial document used in the state of Connecticut for estate tax purposes. Specifically, this form is designed for estates that do not require a federal estate tax return. It is essential for reporting the value of the estate and determining any applicable state taxes. The form captures various details about the decedent's assets, liabilities, and other relevant information. By accurately completing this form, executors can ensure compliance with state laws and avoid potential penalties.

Steps to Complete the CT Form 706 NT

Completing the CT Form 706 NT involves several key steps. First, gather all necessary documentation, including information about the decedent's assets and liabilities. Next, fill out the form by providing details such as the decedent's name, date of death, and the value of the estate. It is important to accurately report all assets, including real estate, bank accounts, and investments. After completing the form, review it for accuracy before submitting. Finally, ensure that the form is filed by the appropriate deadline to avoid any penalties.

Filing Deadlines for the CT Form 706 NT

Filing deadlines for the CT Form 706 NT are critical to ensure compliance with Connecticut state tax laws. Generally, the form must be filed within nine months of the decedent's date of death. However, if an extension is needed, executors can file for a CT Form 706 NT EXT, which allows for additional time to complete the filing. It is essential to be aware of these deadlines to prevent any late fees or complications with the estate settlement process.

Required Documents for Filing the CT Form 706 NT

When preparing to file the CT Form 706 NT, specific documents are required to support the information provided. These documents typically include the decedent's will, death certificate, and any relevant financial statements that detail the estate's assets and liabilities. Additionally, appraisals for real estate or valuable personal property may be necessary to establish the correct value of the estate. Gathering these documents in advance can streamline the filing process and ensure accuracy.

Legal Use of the CT Form 706 NT

The legal use of the CT Form 706 NT is paramount for executors managing an estate. This form serves as the official declaration of the estate's value and tax obligations, ensuring that all legal requirements are met. Proper use of the form helps protect the executor from potential legal challenges and penalties associated with inaccurate reporting. It is advisable to consult with a legal professional or tax advisor to ensure that the form is completed correctly and in accordance with state laws.

Digital vs. Paper Version of the CT Form 706 NT

When filing the CT Form 706 NT, executors have the option to submit either a digital or paper version of the form. The digital version offers advantages such as ease of access, reduced processing time, and the ability to use electronic signatures for faster completion. Conversely, some individuals may prefer the traditional paper method for its tangible nature. Regardless of the method chosen, it is essential to ensure that the form is filed correctly and on time to comply with state regulations.

Quick guide on how to complete portalctgov mediaform ct 706 nt ext connecticut

Complete Portal ct gov mediaForm CT 706 NT EXT Connecticut effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Portal ct gov mediaForm CT 706 NT EXT Connecticut on any platform using airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The easiest method to alter and eSign Portal ct gov mediaForm CT 706 NT EXT Connecticut seamlessly

- Find Portal ct gov mediaForm CT 706 NT EXT Connecticut and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, repetitive form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Portal ct gov mediaForm CT 706 NT EXT Connecticut and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov mediaform ct 706 nt ext connecticut

Create this form in 5 minutes!

People also ask

-

What is the ct form 706 nt?

The ct form 706 nt is a Connecticut estate tax return form used for reporting an estate's value. It is specifically designed for estates that do not have a federal estate tax obligation. By using the ct form 706 nt, executors ensure compliance with Connecticut's estate tax laws, allowing for proper estate administration.

-

How can airSlate SignNow help with the ct form 706 nt?

airSlate SignNow streamlines the signing and submission process for the ct form 706 nt. With our easy-to-use platform, you can easily send, eSign, and manage your estate documents securely online. This ensures that your estate tax return is properly filed without any unnecessary delays.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit different needs, making it cost-effective for businesses and individuals alike. You can choose between monthly and annual subscriptions, ensuring you have the right tools to manage forms like the ct form 706 nt. Check our website for detailed pricing information and special offers.

-

Are there any features specifically for handling estate tax forms?

Yes, airSlate SignNow includes features tailored for efficiently managing estate tax forms such as the ct form 706 nt. Our platform allows for document templates, secure eSigning, and automated reminders, making it easier to stay organized and compliant. This ensures timely filing of crucial tax documents.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, simplifying your workflow when managing documents like the ct form 706 nt. Whether you need to connect with cloud storage, CRM systems, or other tools, our platform ensures that your document management remains efficient and effective.

-

What are the benefits of eSigning the ct form 706 nt?

eSigning the ct form 706 nt via airSlate SignNow provides numerous benefits, including enhanced security and faster processing times. With eSignature, you eliminate the need for physical copies and mail delays. This ensures that your estate tax returns are handled promptly and securely, reducing the risk of errors.

-

Is airSlate SignNow secure for submitting sensitive documents like the ct form 706 nt?

Yes, airSlate SignNow prioritizes security and compliance to protect your sensitive information, especially for documents like the ct form 706 nt. We use advanced encryption and secure authentication methods to safeguard your data. You can confidently submit and manage your estate tax forms on our platform.

Get more for Portal ct gov mediaForm CT 706 NT EXT Connecticut

- New hampshire divorce contract form

- New hampshire child support form

- New hampshire petition form

- New hampshire petition 497318772 form

- New hampshire paternity form

- New hampshire custody 497318774 form

- Landlord tenant closing statement to reconcile security deposit new hampshire form

- Name change for 497318776 form

Find out other Portal ct gov mediaForm CT 706 NT EXT Connecticut

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online