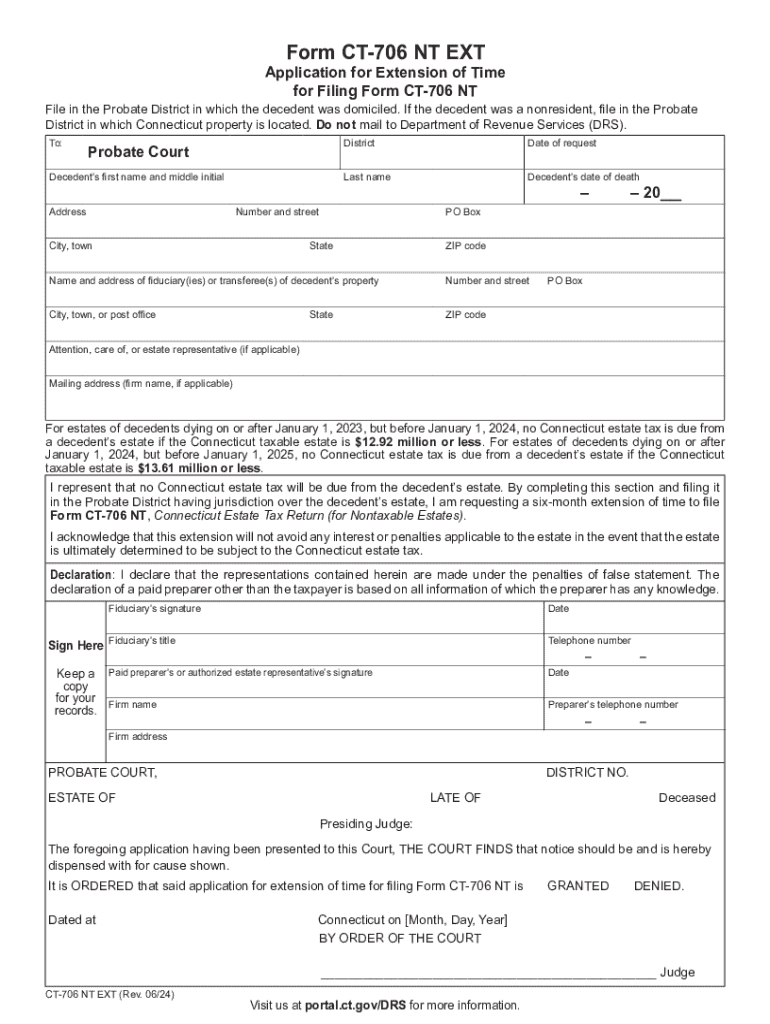

Form or 706 EXT, Application for Extension of Time to File 2024-2026

What is the Connecticut CT 706 NT Application?

The Connecticut CT 706 NT application is a form used to request an extension of time to file a Connecticut estate tax return. This form is particularly relevant for estates that may require additional time to gather necessary documentation or complete the filing process. The CT 706 NT application allows executors or administrators of estates to formally request an extension, ensuring compliance with state regulations while managing the complexities of estate settlement.

Steps to Complete the Connecticut CT 706 NT Application

Completing the Connecticut CT 706 NT application involves several key steps:

- Gather necessary information about the estate, including details of assets, liabilities, and beneficiaries.

- Fill out the application form accurately, providing all required information as specified in the instructions.

- Review the completed form for any errors or omissions to ensure accuracy.

- Submit the application before the original filing deadline to avoid penalties.

It is important to follow the guidelines provided in the form instructions to ensure a smooth application process.

Legal Use of the Connecticut CT 706 NT Application

The Connecticut CT 706 NT application serves a legal purpose by allowing estates to formally request additional time for filing their estate tax return. This application is essential for compliance with Connecticut tax laws, as it helps prevent penalties associated with late filings. Executors and administrators must ensure that the application is filed in accordance with state regulations to maintain the legal standing of the estate.

Filing Deadlines for the Connecticut CT 706 NT Application

Filing deadlines for the Connecticut CT 706 NT application are crucial for compliance. Generally, the application must be submitted by the original due date of the estate tax return. It is advisable to check the specific deadlines, as they may vary depending on the circumstances of the estate. Timely submission of the application helps avoid interest and penalties that could accrue from late filings.

Required Documents for the Connecticut CT 706 NT Application

When submitting the Connecticut CT 706 NT application, certain documents may be required to support the request for an extension. These may include:

- A copy of the original estate tax return or a draft version.

- Documentation of the estate's assets and liabilities.

- Any additional information that may assist in the processing of the application.

Having these documents ready can facilitate a smoother application process and ensure that all necessary information is provided.

Form Submission Methods for the Connecticut CT 706 NT Application

The Connecticut CT 706 NT application can be submitted through various methods, including:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing the completed form to the appropriate state office.

- In-person delivery at designated state offices.

Choosing the right submission method can help ensure timely processing of the application.

Create this form in 5 minutes or less

Find and fill out the correct form or 706 ext application for extension of time to file

Create this form in 5 minutes!

How to create an eSignature for the form or 706 ext application for extension of time to file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Connecticut CT 706 NT app?

The Connecticut CT 706 NT app is a specialized tool designed to streamline the eSigning process for documents in Connecticut. It allows users to easily send, sign, and manage documents electronically, ensuring compliance with state regulations. This app is particularly beneficial for businesses looking to enhance their document workflow.

-

How much does the Connecticut CT 706 NT app cost?

The pricing for the Connecticut CT 706 NT app is competitive and designed to fit various business needs. Users can choose from different subscription plans based on their usage and features required. For detailed pricing information, it's best to visit the airSlate SignNow website.

-

What features does the Connecticut CT 706 NT app offer?

The Connecticut CT 706 NT app offers a range of features including document templates, real-time tracking, and secure eSigning capabilities. Users can also integrate the app with other tools to enhance productivity. These features make it an ideal choice for businesses looking to simplify their document management.

-

How can the Connecticut CT 706 NT app benefit my business?

Using the Connecticut CT 706 NT app can signNowly improve your business's efficiency by reducing the time spent on document handling. It allows for faster turnaround times on contracts and agreements, which can lead to quicker decision-making. Additionally, the app enhances security and compliance, protecting sensitive information.

-

Is the Connecticut CT 706 NT app easy to use?

Yes, the Connecticut CT 706 NT app is designed with user-friendliness in mind. Its intuitive interface allows users to navigate through the eSigning process with ease, even for those who may not be tech-savvy. This ease of use helps businesses adopt the app quickly without extensive training.

-

Can I integrate the Connecticut CT 706 NT app with other software?

Absolutely! The Connecticut CT 706 NT app supports integrations with various software applications, enhancing its functionality. This allows businesses to connect their existing tools and streamline their workflows, making document management even more efficient.

-

What types of documents can I sign with the Connecticut CT 706 NT app?

The Connecticut CT 706 NT app supports a wide range of document types, including contracts, agreements, and forms. This versatility makes it suitable for various industries, from real estate to legal services. Users can easily upload and send any document for eSigning.

Get more for Form OR 706 EXT, Application For Extension Of Time To File

- Sample assistive technology evaluation report swaaac form

- Restitution payment form

- Renewal application for license for nursing home the tennessee health state tn form

- Form e24

- Foot and ankle clinic queensway carleton hospital form

- The homer fund matching grant pre approval packet form

- Georgia insurance commissioner form

- Field trip photo and directory approval form

Find out other Form OR 706 EXT, Application For Extension Of Time To File

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online