Do Not Mail to Department of Revenue Services DRS 2020

What is the Do Not Mail To Department Of Revenue Services DRS

The Do Not Mail To Department Of Revenue Services (DRS) is a designation that allows taxpayers to opt out of receiving certain mailings from the DRS. This option is particularly useful for individuals who wish to minimize unsolicited correspondence related to tax matters. By choosing this designation, taxpayers can ensure that they only receive essential communications, streamlining their interactions with the agency.

How to use the Do Not Mail To Department Of Revenue Services DRS

To utilize the Do Not Mail To DRS option, taxpayers must complete the necessary form and submit it to the DRS. This process typically involves providing personal information such as name, address, and taxpayer identification number. Once the form is processed, the DRS will update its records to reflect the taxpayer's preference, reducing the volume of non-essential mail received.

Steps to complete the Do Not Mail To Department Of Revenue Services DRS

Completing the Do Not Mail To DRS involves several straightforward steps:

- Obtain the appropriate form from the DRS website or contact their office for assistance.

- Fill out the form with accurate personal information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the DRS via the specified method, typically by mail or online submission.

- Await confirmation from the DRS regarding the status of your request.

Legal use of the Do Not Mail To Department Of Revenue Services DRS

The legal use of the Do Not Mail To DRS designation is supported by state regulations that govern taxpayer rights and privacy. Taxpayers have the right to control the communications they receive from government agencies, and opting out of non-essential mailings is a recognized practice. It is important for taxpayers to understand their rights and ensure that their preferences are honored by the DRS.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific filing deadlines and important dates related to the Do Not Mail To DRS. Typically, these deadlines coincide with the tax filing season, and it is advisable to submit the Do Not Mail request well in advance of key dates to ensure proper processing. Keeping track of these dates helps taxpayers avoid missing critical communications from the DRS.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Do Not Mail To DRS form. The methods include:

- Online Submission: Many taxpayers prefer to submit forms electronically through the DRS website, where available.

- Mail: The completed form can be mailed directly to the DRS office. Ensure that it is sent to the correct address to avoid delays.

- In-Person: Taxpayers may also choose to deliver the form in person at designated DRS locations during business hours.

Penalties for Non-Compliance

While opting out of non-essential mailings is a right, taxpayers should be aware that failure to comply with tax regulations can result in penalties. Non-compliance may include issues such as not filing required forms or missing deadlines. It is crucial to stay informed about obligations to avoid potential fines or legal repercussions.

Quick guide on how to complete do not mail to department of revenue services drs

Complete Do Not Mail To Department Of Revenue Services DRS effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents quickly without delays. Manage Do Not Mail To Department Of Revenue Services DRS on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Do Not Mail To Department Of Revenue Services DRS with ease

- Obtain Do Not Mail To Department Of Revenue Services DRS and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure private information with tools that airSlate SignNow offers specifically for that intention.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigating, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Do Not Mail To Department Of Revenue Services DRS and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not mail to department of revenue services drs

Create this form in 5 minutes!

How to create an eSignature for the do not mail to department of revenue services drs

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

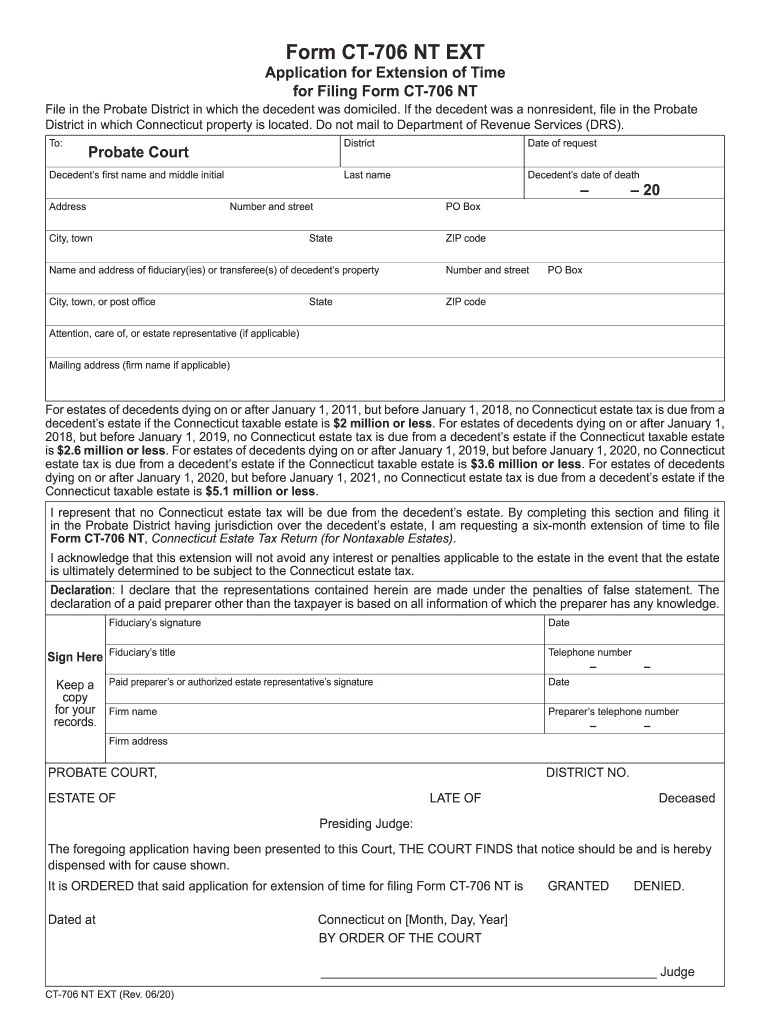

What is the form ct 706 nt ext?

The form ct 706 nt ext is a tax form required for extending the filing deadline for the Connecticut estate tax return. It allows estate representatives to request an extension, giving them additional time to gather necessary documents and complete the filing process.

-

How can I use airSlate SignNow to complete the form ct 706 nt ext?

With airSlate SignNow, you can easily upload and fill out the form ct 706 nt ext online. Our user-friendly platform simplifies the signing process and allows you to send it for electronic signatures quickly, ensuring you meet your filing deadlines.

-

Is airSlate SignNow cost-effective for filing the form ct 706 nt ext?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage documents like the form ct 706 nt ext. Our pricing plans are designed to fit various needs, allowing you to save costs while streamlining your eSignature processes.

-

What features does airSlate SignNow offer for the form ct 706 nt ext?

AirSlate SignNow provides multiple features for handling the form ct 706 nt ext, including templates, customizable fields, and easy document sharing. Additionally, you can track the status of your documents in real-time, ensuring you stay updated throughout the filing process.

-

Can I integrate airSlate SignNow with other tools for the form ct 706 nt ext?

Absolutely! AirSlate SignNow supports integrations with a variety of tools and applications that can be beneficial when dealing with the form ct 706 nt ext. This integration capability ensures you can sync your workflow and enhance productivity across platforms.

-

What are the benefits of using airSlate SignNow for the form ct 706 nt ext?

Using airSlate SignNow for the form ct 706 nt ext streamlines the signing and filing process, reducing your administrative burden. You gain peace of mind knowing your documents are secure and compliant with legal standards while increasing efficiency in managing your estate tax paperwork.

-

How secure is airSlate SignNow when managing the form ct 706 nt ext?

Security is a top priority at airSlate SignNow. When you manage the form ct 706 nt ext, your documents are protected with robust encryption, ensuring that sensitive information remains confidential and compliant with industry regulations.

Get more for Do Not Mail To Department Of Revenue Services DRS

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return utah form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return utah form

- Letter from tenant to landlord containing request for permission to sublease utah form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages utah form

- Utah sublease form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable utah form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration utah form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497427479 form

Find out other Do Not Mail To Department Of Revenue Services DRS

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free