Form Ct 706 Nt Ext 2015

What is the Form Ct 706 Nt Ext

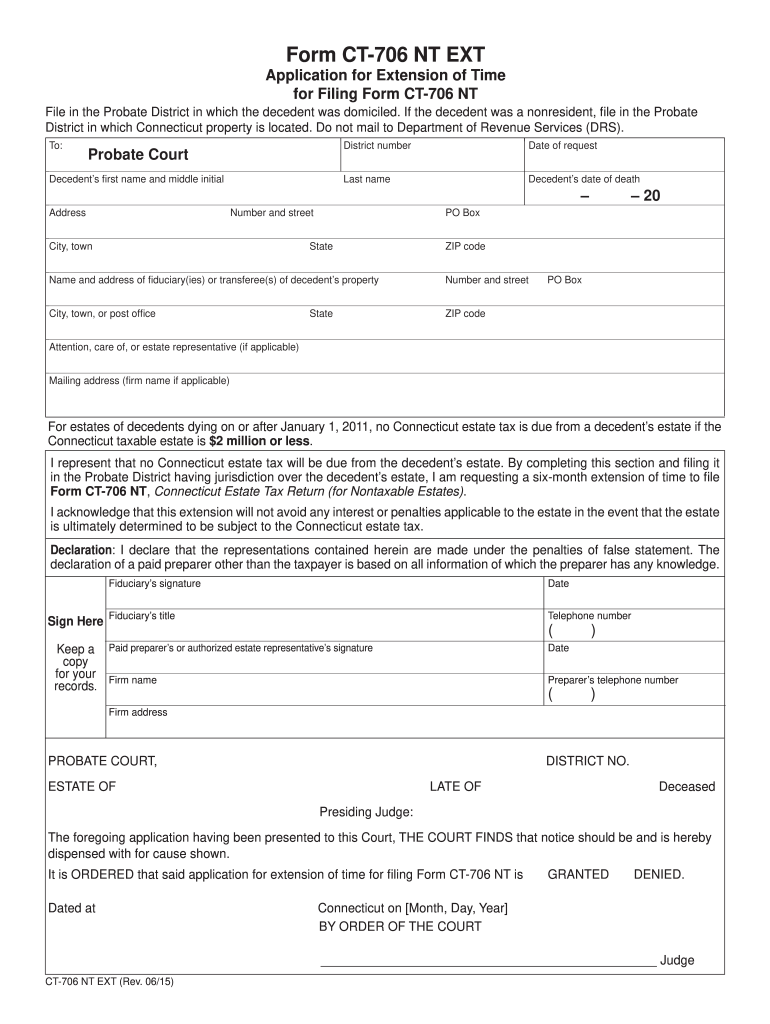

The Form Ct 706 Nt Ext is a tax extension form used in the state of Connecticut. It allows taxpayers to request an extension of time to file their Connecticut estate tax return. This form is particularly important for executors or administrators of estates, as it provides additional time to gather necessary documentation and complete the filing process. By submitting this form, individuals can avoid penalties associated with late filing while ensuring compliance with state tax regulations.

How to use the Form Ct 706 Nt Ext

Using the Form Ct 706 Nt Ext involves a straightforward process. First, obtain the form from the Connecticut Department of Revenue Services website or through authorized tax professionals. Once you have the form, fill it out by providing relevant estate information, including the decedent's details and the estimated tax liability. After completing the form, submit it to the appropriate state agency by the specified deadline. This will grant you an extension for filing the full estate tax return.

Steps to complete the Form Ct 706 Nt Ext

Completing the Form Ct 706 Nt Ext requires careful attention to detail. Follow these steps:

- Gather necessary documents, including the decedent's will, financial statements, and any previous tax returns.

- Fill out the form with accurate information, ensuring all fields are completed.

- Calculate the estimated estate tax liability based on the information provided.

- Sign and date the form, confirming that the information is true and accurate.

- Submit the form to the Connecticut Department of Revenue Services by the deadline to avoid penalties.

Legal use of the Form Ct 706 Nt Ext

The legal use of the Form Ct 706 Nt Ext is essential for compliance with Connecticut tax laws. By filing this form, executors or administrators of estates can legally extend their filing deadline for the estate tax return. This extension is recognized by the state, allowing individuals to avoid late fees and potential legal issues. It is crucial to ensure that the form is submitted correctly and on time to maintain its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 706 Nt Ext are critical to ensure compliance. Typically, the form must be filed by the original due date of the estate tax return. This is usually nine months after the date of the decedent's death. It is advisable to check for any updates or changes to deadlines annually, as state regulations may vary. Timely filing is essential to avoid penalties and ensure a smooth estate settlement process.

Form Submission Methods (Online / Mail / In-Person)

The Form Ct 706 Nt Ext can be submitted through various methods. Taxpayers have the option to file the form online through the Connecticut Department of Revenue Services portal, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate state office or delivered in person. Each submission method has specific guidelines, so it is important to follow the instructions provided on the form to ensure proper processing.

Quick guide on how to complete form ct 706 nt ext 2015

Your assistance manual on how to prepare your Form Ct 706 Nt Ext

If you’re interested in learning how to generate and submit your Form Ct 706 Nt Ext, here are some straightforward guidelines to streamline the tax declaration process.

To begin, all you need to do is set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to modify, generate, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and can revisit to modify details as necessary. Make your tax administration simpler with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to finalize your Form Ct 706 Nt Ext in a short time:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Form Ct 706 Nt Ext in our editor.

- Complete the required fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can lead to more mistakes and delay refunds. Furthermore, before e-filing your taxes, confirm the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 706 nt ext 2015

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the form ct 706 nt ext 2015

How to make an electronic signature for the Form Ct 706 Nt Ext 2015 in the online mode

How to create an eSignature for your Form Ct 706 Nt Ext 2015 in Google Chrome

How to generate an eSignature for putting it on the Form Ct 706 Nt Ext 2015 in Gmail

How to create an eSignature for the Form Ct 706 Nt Ext 2015 straight from your smart phone

How to create an electronic signature for the Form Ct 706 Nt Ext 2015 on iOS devices

How to make an electronic signature for the Form Ct 706 Nt Ext 2015 on Android

People also ask

-

What is Form Ct 706 Nt Ext and why do I need it?

Form Ct 706 Nt Ext is a tax form used for requesting an extension for filing the Connecticut estate tax return. If you're managing an estate and need more time to prepare the necessary documents, filing Form Ct 706 Nt Ext can help you avoid penalties for late submission.

-

How can I fill out Form Ct 706 Nt Ext using airSlate SignNow?

With airSlate SignNow, filling out Form Ct 706 Nt Ext is straightforward. You can easily upload the form, fill in the required information, and use our intuitive interface to eSign and send it directly to the relevant authorities without any hassle.

-

Is there a cost associated with using airSlate SignNow for Form Ct 706 Nt Ext?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost may vary depending on the features you need, but using our platform to manage Form Ct 706 Nt Ext can save you time and streamline your document processes.

-

What features does airSlate SignNow offer for Form Ct 706 Nt Ext?

airSlate SignNow provides a variety of features for handling Form Ct 706 Nt Ext, including document editing, eSignature capabilities, and secure cloud storage. Our platform ensures that your documents are easy to manage and that you can track their status in real-time.

-

Can I integrate airSlate SignNow with other applications for Form Ct 706 Nt Ext?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and CRMs, allowing you to manage Form Ct 706 Nt Ext alongside your other business tools. This integration simplifies your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for Form Ct 706 Nt Ext?

Using airSlate SignNow for Form Ct 706 Nt Ext provides numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. Our platform enables you to complete the form quickly and ensure that it is filed correctly and on time.

-

How secure is airSlate SignNow when handling Form Ct 706 Nt Ext?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Form Ct 706 Nt Ext and other sensitive documents, ensuring that your information remains confidential and secure throughout the signing process.

Get more for Form Ct 706 Nt Ext

- Complex care discharge planning initiative for complex patients with anticipated los 4 days this patient care plan is to be form

- P11d 2014 expenses and benefits 2013 14 use form p11d at the end of the tax year to report expenses and benefits youve provided

- Access to cannabis for medical purposes regulations production for own medical purposes and production by a designated person form

- Application for authority to transactforeign limited liability company application for authority to transactforeign limited form

- Business services rhode island nellie m gorbearegister your business in ri rhode island nellie m gorbeabusiness services rhode form

- Boost alternate form for income verification for 2019 2020 scholarships boost alternate form for income verification for 2019

- Kansas business center electronic annual report filing systemgeneral filing instructions kansas secretary of stategeneral form

- Name change minor utah courtsname change minor utah courtslegally change the name of a child under 18 massgovname change forms

Find out other Form Ct 706 Nt Ext

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online