Employee S Wisconsin Withholding Exemption CertificateNew Hire Form

What is the Employee S Wisconsin Withholding Exemption Certificate?

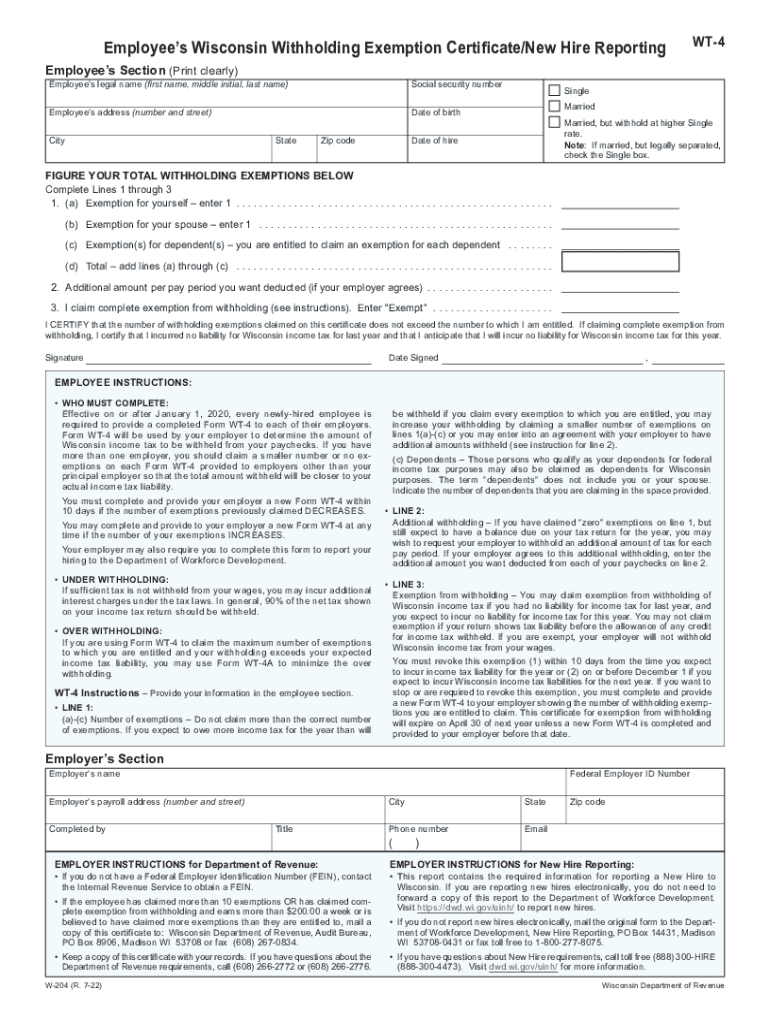

The Employee S Wisconsin Withholding Exemption Certificate is a crucial document for employees in Wisconsin. It allows individuals to claim exemption from state income tax withholding if they meet specific criteria. This form is particularly relevant for new hires who anticipate having no tax liability for the year. Understanding this certificate is essential for ensuring compliance with Wisconsin tax laws while optimizing take-home pay.

How to Use the Employee S Wisconsin Withholding Exemption Certificate

To effectively use the Employee S Wisconsin Withholding Exemption Certificate, employees must complete the form accurately and submit it to their employer. The employer will then use the information provided to determine the appropriate amount of state tax withholding. It is important to review the form annually, as changes in personal circumstances may affect eligibility for exemption. Employees should keep a copy for their records and ensure that the employer updates their payroll system accordingly.

Steps to Complete the Employee S Wisconsin Withholding Exemption Certificate

Completing the Employee S Wisconsin Withholding Exemption Certificate involves several straightforward steps:

- Obtain the form from your employer or download it from the appropriate state resources.

- Fill in personal information, including your name, address, and Social Security number.

- Indicate your eligibility for exemption by checking the relevant boxes.

- Sign and date the form to certify the information is accurate.

- Submit the completed form to your employer for processing.

Legal Use of the Employee S Wisconsin Withholding Exemption Certificate

The legal use of the Employee S Wisconsin Withholding Exemption Certificate is governed by Wisconsin state tax laws. Employees must ensure they meet the eligibility requirements to avoid penalties. Misuse of the exemption can lead to under-withholding, resulting in tax liabilities at year-end. It is advisable to consult a tax professional if there are uncertainties regarding eligibility or the completion of the form.

Key Elements of the Employee S Wisconsin Withholding Exemption Certificate

Key elements of the Employee S Wisconsin Withholding Exemption Certificate include:

- Personal identification information of the employee.

- Criteria for claiming exemption from withholding.

- Signature and date to validate the submission.

- Instructions for the employer on processing the exemption.

Eligibility Criteria for the Employee S Wisconsin Withholding Exemption Certificate

To qualify for the Employee S Wisconsin Withholding Exemption Certificate, an employee must meet specific eligibility criteria. Typically, this includes having no tax liability for the previous year and expecting none for the current year. Additionally, individuals must be residents of Wisconsin and provide accurate information on the form. It is essential to review these criteria annually, as personal circumstances may change.

Quick guide on how to complete employee s wisconsin withholding exemption certificatenew hire

Complete Employee S Wisconsin Withholding Exemption CertificateNew Hire effortlessly on any device

Virtual document management has gained signNow traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, alter, and electronically sign your documents swiftly without delays. Manage Employee S Wisconsin Withholding Exemption CertificateNew Hire on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Employee S Wisconsin Withholding Exemption CertificateNew Hire with ease

- Find Employee S Wisconsin Withholding Exemption CertificateNew Hire and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method of delivering your form—via email, SMS, or invite link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Employee S Wisconsin Withholding Exemption CertificateNew Hire to ensure excellent communication at every step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the pricing options for employee Wisconsin new registrations?

airSlate SignNow offers flexible pricing plans for employee Wisconsin new users. You can choose from various subscription tiers based on your team's size and usage needs, ensuring affordability and value. Each plan includes essential features tailored for efficient document management.

-

How does airSlate SignNow benefit employee Wisconsin new processes?

airSlate SignNow streamlines employee Wisconsin new processes by simplifying document signing and sharing. Its intuitive interface allows users to quickly eSign documents from anywhere, enhancing productivity and reducing turnaround times for important paperwork.

-

What features does airSlate SignNow offer for employee Wisconsin new?

For employee Wisconsin new, airSlate SignNow provides features such as customizable templates, real-time tracking, and automatic reminders. These tools enhance collaboration and ensure that documents are completed efficiently and accurately. Advanced security measures also protect sensitive employee information.

-

Can airSlate SignNow integrate with other software for employee Wisconsin new?

Yes, airSlate SignNow easily integrates with a variety of software and applications for employee Wisconsin new. This includes popular platforms like Google Drive, Salesforce, and Microsoft Office, allowing for seamless workflows and synchronization of data across various systems.

-

Is airSlate SignNow suitable for small businesses in employee Wisconsin new?

Absolutely! airSlate SignNow is a perfect fit for small businesses operating in employee Wisconsin new. Its cost-effective plans and user-friendly design make it accessible for teams of all sizes, helping small businesses streamline their document signing processes without extensive resources.

-

What industries can benefit from using airSlate SignNow for employee Wisconsin new?

Various industries can benefit from airSlate SignNow for employee Wisconsin new, including healthcare, education, and finance. Its versatility in handling different document types caters to diverse operational needs. Organizations can ensure compliance and enhance efficiency in their document workflows.

-

How secure is airSlate SignNow for employee Wisconsin new users?

Security is a top priority for airSlate SignNow, especially for employee Wisconsin new users. The platform employs advanced encryption protocols and complies with industry standards to protect sensitive data. Businesses can confidently manage their documents without worrying about unauthorized access.

Get more for Employee S Wisconsin Withholding Exemption CertificateNew Hire

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services new jersey form

- Temporary lease agreement to prospective buyer of residence prior to closing new jersey form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction new 497319243 form

- Landlord security form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return new jersey form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return new jersey form

- Letter from tenant to landlord containing request for permission to sublease new jersey form

- Nj letter rent 497319248 form

Find out other Employee S Wisconsin Withholding Exemption CertificateNew Hire

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure