About Form 1120 H, U S Income Tax Return for Homeowners Associations

About Form 1120 H, U S Income Tax Return For Homeowners Associations

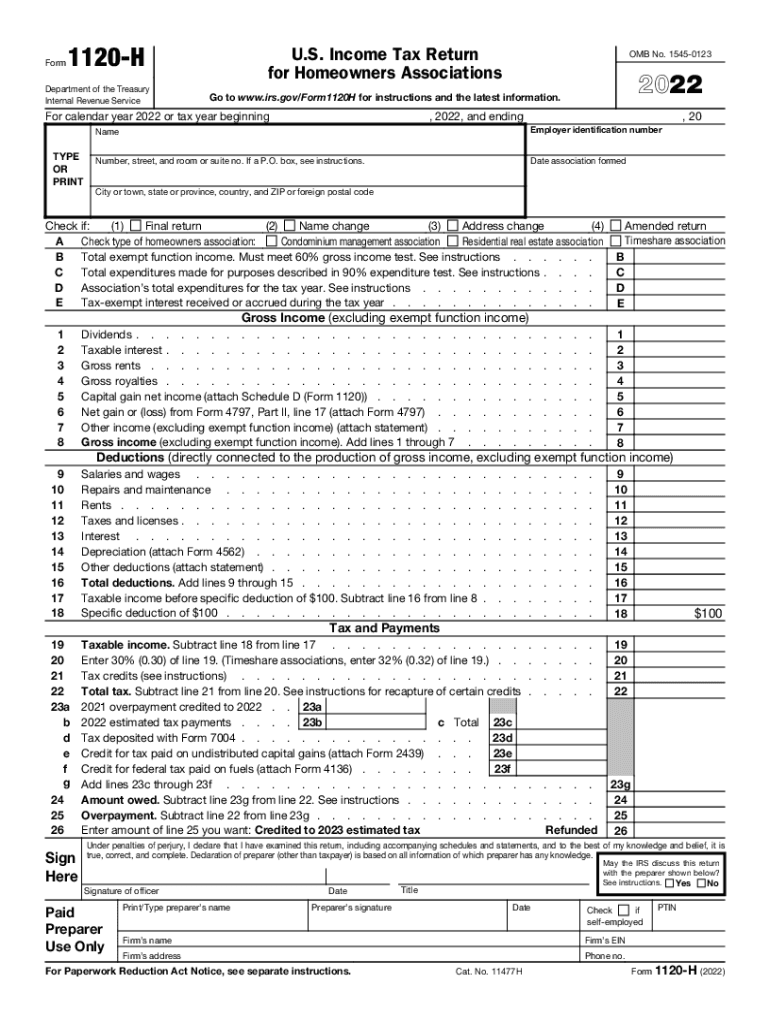

The 2022 Form 1120 H is specifically designed for homeowners associations (HOAs) in the United States. This tax return allows these organizations to report their income, deductions, and credits to the Internal Revenue Service (IRS). It is essential for HOAs to file this form if they meet specific criteria, such as having at least 85% of their income from membership dues, assessments, or fees. This form simplifies the tax process for associations that qualify, allowing them to benefit from a streamlined filing experience.

Steps to Complete the 2022 Form 1120 H

Completing the 2022 Form 1120 H involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any relevant receipts. Next, fill out the form by entering the total income, deductions, and credits applicable to your association. It is crucial to ensure that all figures are accurate and reflect the financial activities of the HOA. After completing the form, review it for any errors before submitting it to the IRS. Remember to keep a copy for your records.

IRS Guidelines for Form 1120 H

The IRS provides specific guidelines for filing the 2022 Form 1120 H. These guidelines outline eligibility criteria, filing procedures, and deadlines. It is important for homeowners associations to familiarize themselves with these requirements to avoid penalties. The IRS mandates that the form must be filed by the due date, which is typically the fifteenth day of the fourth month following the end of the association's tax year. Additionally, associations must ensure compliance with all reporting requirements to maintain their tax-exempt status.

Filing Deadlines for Form 1120 H

The filing deadline for the 2022 Form 1120 H is crucial for homeowners associations to note. Typically, the form is due on the fifteenth day of the fourth month after the end of the tax year. For associations following a calendar year, this means the form must be submitted by April 15, 2023. If an association needs more time, it can file for an extension, but this does not extend the time to pay any taxes owed. Timely filing helps avoid penalties and ensures compliance with IRS regulations.

Required Documents for Form 1120 H

To successfully complete the 2022 Form 1120 H, homeowners associations must gather several required documents. Key documents include financial statements that detail income and expenses, bank statements, and any supporting documentation for deductions claimed. Additionally, records of membership dues and assessments should be maintained to substantiate income reported on the form. Having these documents organized and readily available can streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance with Form 1120 H

Homeowners associations that fail to file the 2022 Form 1120 H on time or do not comply with IRS regulations may face penalties. The IRS can impose fines for late filings, which can accumulate over time. Additionally, if an association fails to meet the income requirements or does not maintain proper records, it risks losing its tax-exempt status. Understanding these potential penalties can motivate associations to prioritize timely and accurate filings.

Digital vs. Paper Version of Form 1120 H

Associations have the option to file the 2022 Form 1120 H either digitally or on paper. Filing electronically can expedite the process and reduce the chances of errors, as many tax software programs offer built-in checks for common mistakes. Conversely, some associations may prefer to submit a paper version for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted by the deadline to avoid penalties.

Quick guide on how to complete about form 1120 h us income tax return for homeowners associations

Effortlessly Prepare About Form 1120 H, U S Income Tax Return For Homeowners Associations on Any Device

The management of online documents has become increasingly prevalent among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage About Form 1120 H, U S Income Tax Return For Homeowners Associations on any device using the airSlate SignNow Android or iOS applications and streamline your document-based operations today.

How to Edit and eSign About Form 1120 H, U S Income Tax Return For Homeowners Associations with Ease

- Obtain About Form 1120 H, U S Income Tax Return For Homeowners Associations and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review your information and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign About Form 1120 H, U S Income Tax Return For Homeowners Associations to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 form 1120 h and who needs it?

The 2022 form 1120 h is a tax return specifically for homeowners associations that meet certain criteria. This form is essential for those associations to report their income, deductions, and ensure compliance with IRS regulations. If your association qualifies, filing this form is necessary to avoid penalties.

-

How can airSlate SignNow assist with the 2022 form 1120 h?

airSlate SignNow streamlines the process of sending and eSigning the 2022 form 1120 h. Our platform allows you to easily manage all necessary documents and signatures in one place, ensuring a quicker and more efficient filing process. This can save your organization time and reduce the hassle associated with tax season.

-

Is there a cost associated with using airSlate SignNow for the 2022 form 1120 h?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Our cost-effective solution provides flexibility, allowing you to choose a plan that suits your volume of document management, including for the 2022 form 1120 h. We focus on delivering value while keeping your expenses manageable.

-

What features does airSlate SignNow offer for preparing the 2022 form 1120 h?

With airSlate SignNow, you get features like customizable templates, secure document storage, and automated reminders. These tools simplify the preparation of the 2022 form 1120 h by helping you keep track of important deadlines and ensuring all necessary signatures are obtained efficiently. Our user-friendly interface makes it easy for anyone to navigate the process.

-

Can airSlate SignNow integrate with accounting software for the 2022 form 1120 h?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software solutions. This integration allows you to easily pull in data needed for the 2022 form 1120 h and ensures that all your financial information is easily accessible and accurate, helping to streamline your filing process.

-

What are the benefits of using airSlate SignNow for the 2022 form 1120 h?

Using airSlate SignNow for the 2022 form 1120 h offers numerous benefits such as increased efficiency, reduced errors, and a secure signing environment. You'll be able to track document status in real-time, ensuring that all necessary parties have completed their actions. This can signNowly reduce the stress related to tax filing for your organization.

-

How secure is airSlate SignNow for handling the 2022 form 1120 h?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with stringent data protection regulations to safeguard your sensitive information, such as the 2022 form 1120 h. You can trust that your documents are secure while being prepared and shared.

Get more for About Form 1120 H, U S Income Tax Return For Homeowners Associations

Find out other About Form 1120 H, U S Income Tax Return For Homeowners Associations

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online