Form CT 400 Estimated Tax for Corporations Tax Year 2022-2026

What is the Form CT 400 Estimated Tax For Corporations Tax Year

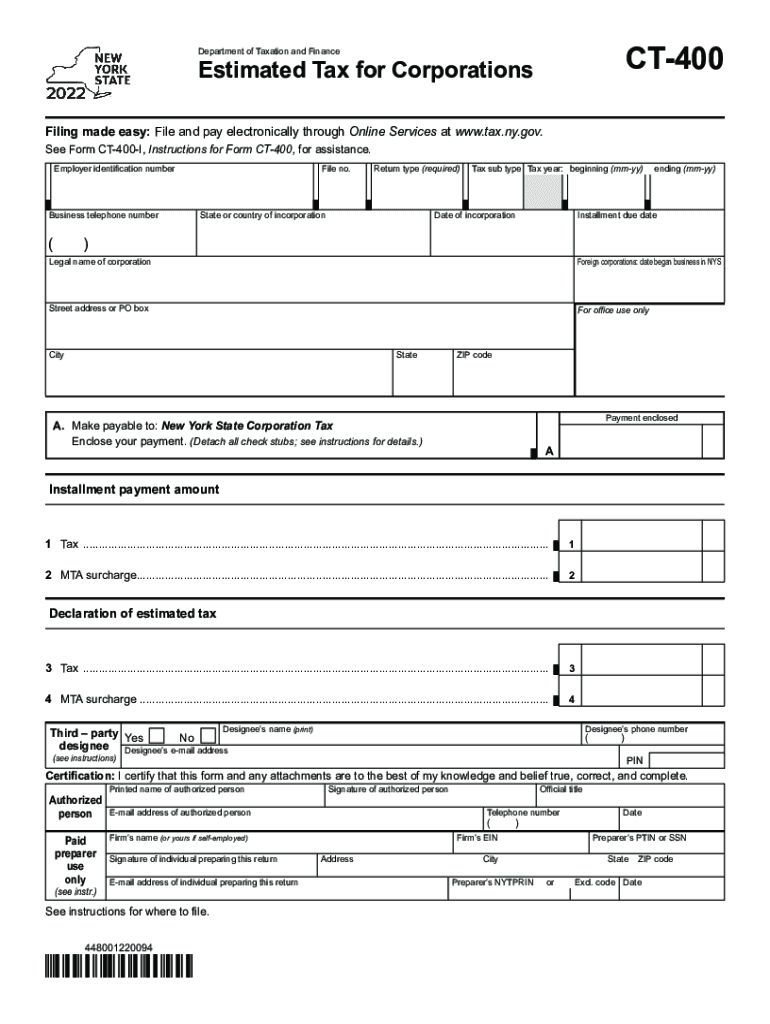

The Form CT 400 is used by corporations in New York to report and pay estimated taxes for the tax year. This form is essential for corporations that expect to owe tax of $500 or more when filing their annual tax return. It allows businesses to make quarterly estimated tax payments, ensuring they comply with state tax obligations. Understanding the purpose and requirements of the CT 400 is crucial for maintaining good standing with tax authorities.

How to use the Form CT 400 Estimated Tax For Corporations Tax Year

Using the Form CT 400 involves several key steps. First, corporations must calculate their estimated tax liability based on projected income, deductions, and credits for the year. Once the estimated amount is determined, businesses can fill out the CT 400 form, providing necessary information such as the corporation's name, address, and tax identification number. It is important to submit the form along with the payment by the specified due dates to avoid penalties and interest.

Steps to complete the Form CT 400 Estimated Tax For Corporations Tax Year

Completing the Form CT 400 requires careful attention to detail. Here are the steps to follow:

- Gather financial information, including income statements and previous tax returns.

- Calculate the estimated tax liability for the current year.

- Fill out the CT 400 form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form along with the payment by the due date.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Form CT 400. The estimated tax payments are typically due on the 15th day of the month following the end of each quarter. For example, the first payment is due on April 15, the second on June 15, the third on September 15, and the fourth on December 15. Missing these deadlines can result in penalties, so it is crucial for businesses to stay organized and aware of these important dates.

Penalties for Non-Compliance

Failure to file the Form CT 400 or to make timely estimated tax payments can lead to significant penalties. New York State imposes interest and penalties on unpaid taxes, which can accumulate quickly. Additionally, corporations may face a penalty for underpayment if their estimated payments do not meet the required thresholds. Understanding these consequences can help businesses prioritize compliance and avoid unnecessary financial burdens.

Legal use of the Form CT 400 Estimated Tax For Corporations Tax Year

The legal use of the Form CT 400 is governed by New York State tax laws. Corporations are required to use this form to report and remit estimated taxes, which helps ensure that they meet their tax obligations. Proper completion and submission of the form are necessary for the payments to be considered valid. Businesses should maintain records of their submissions and payments to support compliance in the event of an audit or review by tax authorities.

Quick guide on how to complete form ct 400 estimated tax for corporations tax year 2022

Effortlessly Prepare Form CT 400 Estimated Tax For Corporations Tax Year on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form CT 400 Estimated Tax For Corporations Tax Year on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Form CT 400 Estimated Tax For Corporations Tax Year Effortlessly

- Obtain Form CT 400 Estimated Tax For Corporations Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form CT 400 Estimated Tax For Corporations Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 400 estimated tax for corporations tax year 2022

Create this form in 5 minutes!

People also ask

-

What is the CT 400 form and why is it important?

The CT 400 form is an essential tax document that businesses in Connecticut must complete to report their profits and calculate their tax liabilities. Properly filing the CT 400 form helps ensure compliance with state regulations and can prevent potential penalties. Using airSlate SignNow simplifies the eSigning process for this form, making it easier to complete.

-

How can airSlate SignNow help in completing the CT 400 form?

airSlate SignNow streamlines the process of completing the CT 400 form by allowing users to fill out, sign, and send the document electronically. The platform ensures that all necessary signatures are obtained swiftly and securely, reducing the time spent on paperwork. This efficiency can signNowly enhance overall productivity for businesses.

-

Are there any costs associated with using airSlate SignNow for the CT 400 form?

Yes, airSlate SignNow operates on a subscription-based model that provides various pricing tiers depending on your business needs. Each plan offers a set of features designed to make signing documents like the CT 400 form straightforward and effective. It’s advisable to review their pricing page for a detailed breakdown of what each plan includes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a variety of features that enhance document management, such as customizable templates, automated workflows, and advanced security measures. These features ensure that your CT 400 form is not only easy to complete but also securely stored and tracked. Additionally, you can manage all your documents from a centralized dashboard.

-

Can I integrate airSlate SignNow with other business tools I use?

Absolutely! airSlate SignNow offers robust integrations with popular tools such as Google Drive, Microsoft Office, and various CRM platforms. This capability allows you to streamline your processes and easily access your CT 400 form alongside other documents. Integrating your tools minimizes disruption and enhances overall efficiency.

-

Is airSlate SignNow secure for signing the CT 400 form?

Yes, airSlate SignNow prioritizes security, implementing industry-standard encryption and compliance protocols to safeguard your documents. When you eSign the CT 400 form using their platform, your sensitive information is kept protected. This commitment to security provides peace of mind for businesses managing important tax documents.

-

How quickly can I get started with airSlate SignNow for my CT 400 form?

Getting started with airSlate SignNow is quick and easy. Simply sign up for an account, choose the appropriate plan, and you can start creating and sending your CT 400 form within minutes. The user-friendly interface ensures that you can navigate the platform with ease, making document processing a breeze.

Get more for Form CT 400 Estimated Tax For Corporations Tax Year

- Codicil will form 497319730

- Legal last will and testament form for married person with adult and minor children from prior marriage new jersey

- Legal last will and testament form for domestic partner with adult and minor children from prior marriage new jersey

- Civil union marriage form

- Legal last will and testament form for married person with adult and minor children new jersey

- Last will testament blank form

- New jersey partner 497319736 form

- Mutual wills package with last wills and testaments for married couple with adult and minor children new jersey form

Find out other Form CT 400 Estimated Tax For Corporations Tax Year

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe