Form 2350SP Application for Extension of Time to File U S Income Tax Return Spanish Version 2022

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

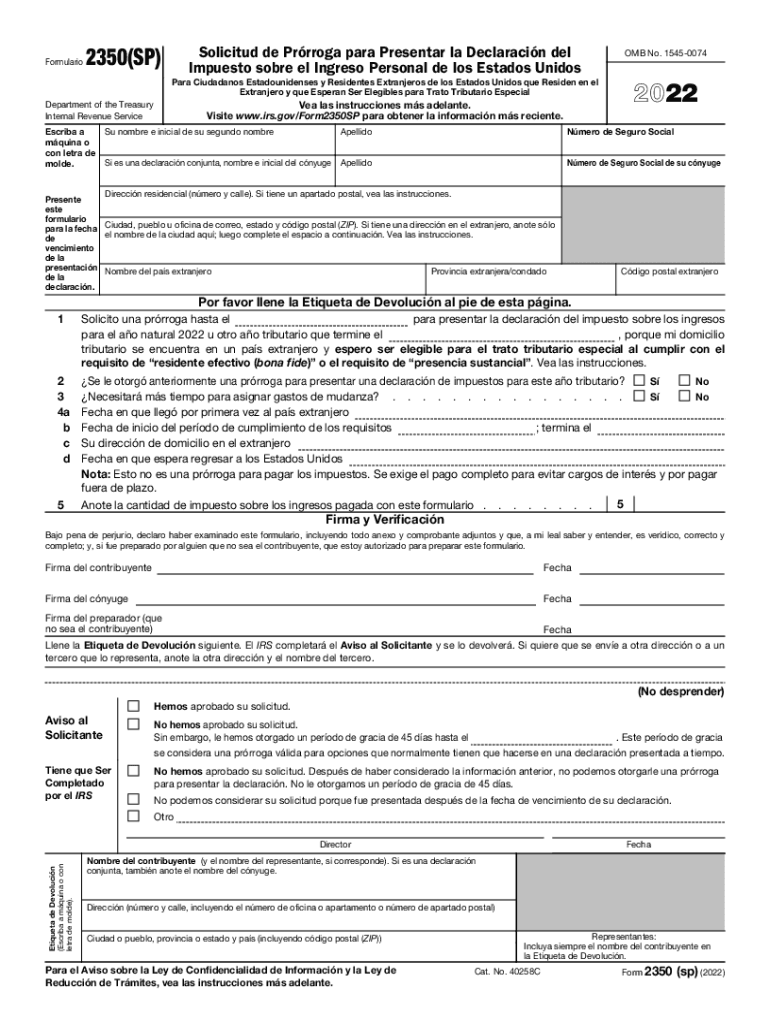

The Form 2350SP is a Spanish version of the application for an extension of time to file a U.S. income tax return. This form is specifically designed for taxpayers who require additional time to prepare their tax returns while ensuring they comply with IRS regulations. It is particularly useful for individuals who are living abroad or those who may have complex tax situations that necessitate a longer preparation period. By submitting this form, taxpayers can avoid late filing penalties while allowing themselves the necessary time to accurately report their income and deductions.

Steps to complete the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Completing the Form 2350SP involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and any relevant tax information. Next, fill out the form with your personal details, including your name, address, and Social Security number. It is crucial to indicate the tax year for which you are requesting an extension. After completing the form, review it carefully for any errors or omissions. Finally, submit the form to the IRS either electronically or by mail, depending on your preference and the specific instructions provided on the form.

Legal use of the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

The legal use of the Form 2350SP is governed by IRS regulations, which stipulate that the form must be filed by the tax deadline to avoid penalties. The form serves as a formal request for an extension, allowing taxpayers to extend their filing deadline without incurring late fees. It is important to note that while the extension allows for more time to file, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Compliance with these regulations ensures that the extension is legally recognized and protects the taxpayer's rights.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 2350SP is essential for compliance. Generally, the form must be submitted by the original due date of the tax return, which is typically April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes in deadlines each tax year, as they can vary. Timely submission of the form is crucial to avoid penalties and ensure that the extension is valid.

Required Documents

When completing the Form 2350SP, certain documents are necessary to facilitate the process. Taxpayers should gather any income statements, such as W-2s or 1099s, along with documentation of deductions and credits they plan to claim. Additionally, having your previous year's tax return on hand can help ensure that you include all relevant information. Collecting these documents in advance can streamline the completion of the form and minimize the risk of errors.

Eligibility Criteria

To be eligible to use the Form 2350SP, taxpayers must meet specific criteria set forth by the IRS. This form is primarily intended for U.S. citizens and resident aliens who are living abroad or who require additional time to prepare their tax returns due to complex financial situations. It is essential to ensure that you are eligible for an extension under IRS guidelines, as improper use of the form can lead to penalties or complications with your tax filings.

Quick guide on how to complete 2022 form 2350sp application for extension of time to file us income tax return spanish version

Accomplish Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to design, modify, and electronically sign your documents quickly and without interruptions. Manage Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version effortlessly

- Obtain Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Highlight crucial sections of your documents or conceal confidential details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, monotonous form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version to ensure effective communication at every phase of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 2350sp application for extension of time to file us income tax return spanish version

Create this form in 5 minutes!

People also ask

-

Does the IRS have forms in Spanish?

EL IRS en Español provides Spanish-speaking individuals access to forms and publications, information and tools, including the EITC Assistant, online payment agreements, Where's my Refund? and Spanish Free File.

-

Can form 4868 be filed electronically?

You can file Form 4868 electronically by accessing IRS e-file using your tax software or by using a tax professional who uses e-file. 3. You can file a paper Form 4868 and enclose payment of your estimate of tax due (optional).

-

What is Form 4868 automatic extension of time to file?

Use Form 4868 to apply for 6 more months (4 if “out of the country” (defined later under Taxpayers who are out of the country) and a U.S. citizen or resident) to file Form 1040, 1040-SR, 1040-NR, or 1040-SS. Gift and generation-skipping transfer (GST) tax return (Form 709).

-

What is the tax extension deadline for 2024?

The deadline is October 15, 2024. An extension to file your tax return is not an extension to pay. Pay the amount you owe by April 15, 2024 to avoid penalties and interest.

-

What is the IRS form for tax extension?

File Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. You can file by mail, online with an IRS e-filing partner or through a tax professional. Estimate how much tax you owe for the year on the extension form: Subtract the taxes you already paid for the filing year.

-

Is there an extension of time to file 2022?

If you need more time to file your taxes, request an extension by the April tax filing due date. This gives you until October 15 to file without penalties. Make sure you pay any tax you owe by the April filing date. The extension is only for filing your return.

-

What happens if you miss the October 15 tax extension deadline?

If you miss the October extension filing deadline, you'll have failure to file penalties that are retroactive to your original filing date (typically October 15) and, potentially, failure to pay penalties retroactive to the original payment due date (typically April 15).

-

What is the 2350 application for extension of time to file Income Tax Return?

Use Form 2350 to ask for an extension of time to file your tax return only if you expect to file Form 2555 and you need the time to meet either the bona fide residence test or the physical presence test to qualify for the foreign earned income exclusion and/or the foreign housing exclusion or deduction.

Get more for Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

- Nm deed personal form

- Warranty deed individual to two individuals as joint tenants with the right of survivorship new mexico form

- New mexico workers 497319869 form

- Warranty deed to child reserving a life estate in the parents new mexico form

- Warranty deed two individuals to one individual new mexico form

- Nm discovery form

- Employers response to workers compensation complaint new mexico form

- Discovery interrogatories from defendant to plaintiff with production requests new mexico form

Find out other Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free