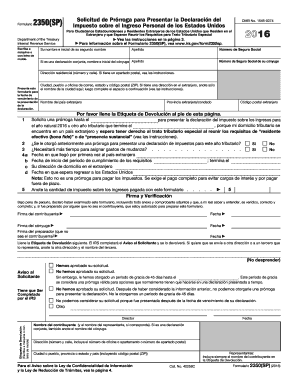

Form 2350SP Application for Extension of Time to File U S Income Tax Return Spanish Version Irs 2016

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs

The Form 2350SP is a specialized application designed for Spanish-speaking taxpayers in the United States who need an extension of time to file their U.S. income tax return. This form is particularly useful for individuals who may not be able to meet the standard filing deadline due to various circumstances, such as being outside the country on the due date. By submitting this form, taxpayers can request additional time to prepare their tax returns without incurring penalties for late filing.

Steps to complete the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs

Completing the Form 2350SP involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary personal information, including your Social Security number and details about your income sources. Next, fill out the form with the required information, ensuring that all entries are clear and legible. Pay special attention to the sections that ask for your reason for requesting the extension. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the instructions provided, either electronically or via mail.

How to use the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs

The Form 2350SP is used to formally request an extension of time to file your U.S. income tax return. To use the form effectively, begin by determining whether you qualify for an extension based on your circumstances. Complete the form accurately, providing all required information. Once submitted, the IRS will process your request and notify you of your new filing deadline. It is important to remember that while the extension allows additional time to file, any taxes owed must still be paid by the original due date to avoid penalties and interest.

IRS Guidelines

The IRS provides specific guidelines for using the Form 2350SP. These guidelines outline who is eligible to apply for an extension, the required documentation, and the process for submission. Taxpayers should review these guidelines carefully to ensure they meet all criteria and understand the implications of requesting an extension. It is also advisable to stay informed about any changes to IRS regulations that may affect the filing process.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 2350SP is crucial for compliance. Typically, the request for an extension must be submitted by the original due date of the tax return. The IRS usually allows a six-month extension, but specific deadlines can vary based on individual circumstances. Taxpayers should keep track of these important dates to avoid penalties and ensure timely submission of their tax returns.

Legal use of the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs

The legal use of the Form 2350SP hinges on its compliance with IRS regulations. When properly completed and submitted, the form serves as a legitimate request for an extension, protecting taxpayers from penalties associated with late filing. It is essential to ensure that all information is accurate and that the form is submitted within the designated time frame to maintain its legal validity.

Quick guide on how to complete 2016 form 2350sp application for extension of time to file us income tax return spanish version irs

Effortlessly prepare Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs on any device

The management of online documents has gained popularity among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and electronically sign Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs with ease

- Find Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 2350sp application for extension of time to file us income tax return spanish version irs

Create this form in 5 minutes!

People also ask

-

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs?

The Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs is a specific application that allows individuals to request an extension of time to file their U.S. income tax returns in Spanish. This form is essential for Spanish-speaking taxpayers who need additional time to prepare their tax returns.

-

How does airSlate SignNow help with the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs?

airSlate SignNow simplifies the process of completing and submitting the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs by providing an easy-to-use platform for document creation and eSignature. Our solution ensures that you can fill out and send the form quickly, helping you meet your IRS deadlines with ease.

-

What are the pricing options for using airSlate SignNow to manage the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs?

airSlate SignNow offers various pricing plans tailored to meet different business needs, allowing users to choose the most cost-effective solution for managing the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs. Pricing is flexible, with options for individuals and teams, ensuring that you find a plan that fits your budget.

-

What features does airSlate SignNow include for handling the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs?

Features of airSlate SignNow include seamless document editing, secure eSigning, and real-time tracking for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs. This allows users to manage their forms efficiently, ensuring that their tax applications are processed promptly.

-

Can I customize the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs using airSlate SignNow?

Yes, airSlate SignNow provides customizable templates which allow you to tailor the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs to meet your specific needs. You can modify the template with your information, ensuring accuracy before submission.

-

Are there any integrations available with airSlate SignNow for managing the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs?

airSlate SignNow integrates with a wide range of applications and tools to streamline the management of the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs. These integrations help improve workflow efficiency, making it easier to synchronize your documents with other platforms.

-

What are the benefits of using airSlate SignNow for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs?

Using airSlate SignNow provides several benefits, including enhanced security, reduced processing time, and improved accessibility for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs. Our platform ensures that your documents are safely stored and easily retrievable whenever needed.

Get more for Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs

- Commercial contract for contractor utah form

- Excavator contract for contractor utah form

- Renovation contract for contractor utah form

- Residential cleaning contract for contractor utah form

- Concrete mason contract for contractor utah form

- Demolition contract for contractor utah form

- Framing contract for contractor utah form

- Security contract for contractor utah form

Find out other Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors