Form 2350SP Application for Extension of Time to File U S Income Tax Return Spanish Version 2021

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

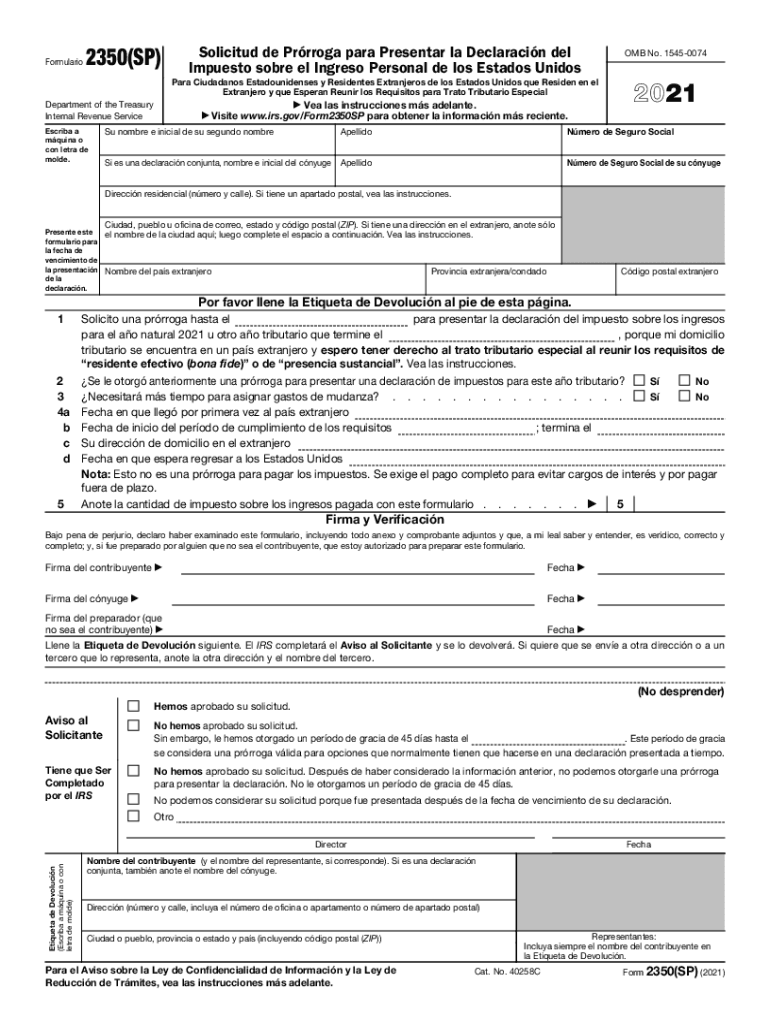

The Form 2350SP is a specific application designed to request an extension of time for filing a U.S. income tax return, tailored for Spanish-speaking taxpayers. This form is particularly useful for individuals who may need additional time to prepare their tax documents due to various circumstances, such as complex financial situations or personal challenges. By submitting this form, taxpayers can avoid penalties associated with late filing while ensuring compliance with U.S. tax laws.

How to use the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Using the Form 2350SP involves a straightforward process. Taxpayers must fill out the form accurately, providing necessary personal information, including their name, address, and taxpayer identification number. Once completed, the form can be submitted electronically or via mail. It is essential to ensure that the form is submitted before the original filing deadline to secure the extension. This allows taxpayers to file their returns without incurring late fees.

Steps to complete the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

Completing the Form 2350SP requires several key steps:

- Gather necessary personal and financial information.

- Download the Form 2350SP from an authorized source.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form electronically or by mail before the deadline.

Legal use of the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

The Form 2350SP is recognized as a legal document under U.S. tax law. To ensure its validity, it must be completed in accordance with IRS regulations. This includes providing accurate information and submitting the form within the specified time frame. Failure to adhere to these guidelines may result in penalties or denial of the extension request.

Filing Deadlines / Important Dates

Taxpayers must be aware of the critical deadlines associated with the Form 2350SP. The form should be submitted before the original due date of the tax return to avoid penalties. Typically, this is April 15 for most individual tax returns. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates is essential for maintaining compliance.

Required Documents

When completing the Form 2350SP, certain documents may be necessary to support the extension request. These can include:

- Previous year’s tax return for reference.

- Any relevant financial documents that may affect the current tax return.

- Proof of identity, such as a Social Security number or Individual Taxpayer Identification Number.

Eligibility Criteria

To qualify for an extension using the Form 2350SP, taxpayers must meet specific criteria. Generally, any individual who is required to file a U.S. income tax return can apply for an extension. However, it is crucial to note that this form does not apply to all types of income or tax situations, so understanding the eligibility requirements is vital for successful application.

Quick guide on how to complete 2021 form 2350sp application for extension of time to file us income tax return spanish version

Effortlessly Prepare Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version on any device using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Easiest Method to Edit and eSign Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version Effortlessly

- Obtain Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tedious form searching, or errors that require reprinting new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 2350sp application for extension of time to file us income tax return spanish version

Create this form in 5 minutes!

People also ask

-

What is the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version?

The Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version is an official IRS form designed to allow taxpayers who are Spanish speakers to request an extension for filing their income tax return. This application is specifically tailored for those who prefer to work in Spanish, ensuring that all details are clearly understood. Utilizing airSlate SignNow, you can easily complete and eSign this form online.

-

How does airSlate SignNow simplify the Form 2350SP Application process?

airSlate SignNow simplifies the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version by providing a user-friendly interface and real-time collaboration features. Users can fill out the form electronically, apply eSignatures, and securely send it directly to the IRS. Streamlining this process saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow to file the Form 2350SP?

airSlate SignNow offers various pricing plans tailored to meet your specific needs. Each plan includes access to the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version and a suite of features to enhance your eSigning experience. You can choose a plan based on your usage, making it a cost-effective solution for individuals and businesses alike.

-

What features are included with airSlate SignNow when dealing with the Form 2350SP?

When using airSlate SignNow for the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version, you will benefit from numerous features, including customizable templates, easy eSigning, cloud storage, and real-time tracking. These features ensure that you can manage your tax documents efficiently while maintaining compliance with IRS requirements.

-

What are the benefits of using airSlate SignNow for tax forms like Form 2350SP?

Using airSlate SignNow for tax forms such as the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows users to complete forms quickly and securely, ensuring you never miss a deadline while also protecting sensitive information.

-

Can airSlate SignNow integrate with other applications for filing the Form 2350SP?

Yes, airSlate SignNow seamlessly integrates with various applications and software, making it easier to manage your tax documents, including the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version. This integration allows for smooth data transfers and improved overall productivity, allowing you to utilize your existing tools more effectively.

-

Is support available for users of airSlate SignNow when filling out Form 2350SP?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with the Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version. Whether you need help navigating the platform or have questions about the form itself, our dedicated support team is available to ensure you have a smooth experience.

Get more for Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

- Insulation contract for contractor utah form

- Paving contract for contractor utah form

- Site work contract for contractor utah form

- Siding contract for contractor utah form

- Refrigeration contract for contractor utah form

- Drainage contract for contractor utah form

- Foundation contract for contractor utah form

- Plumbing contract for contractor utah form

Find out other Form 2350SP Application For Extension Of Time To File U S Income Tax Return Spanish Version

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer