Form 2350 Sp Application for Extension of Time to File U S Income Tax Return Spanish Version 2024-2026

What is the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version

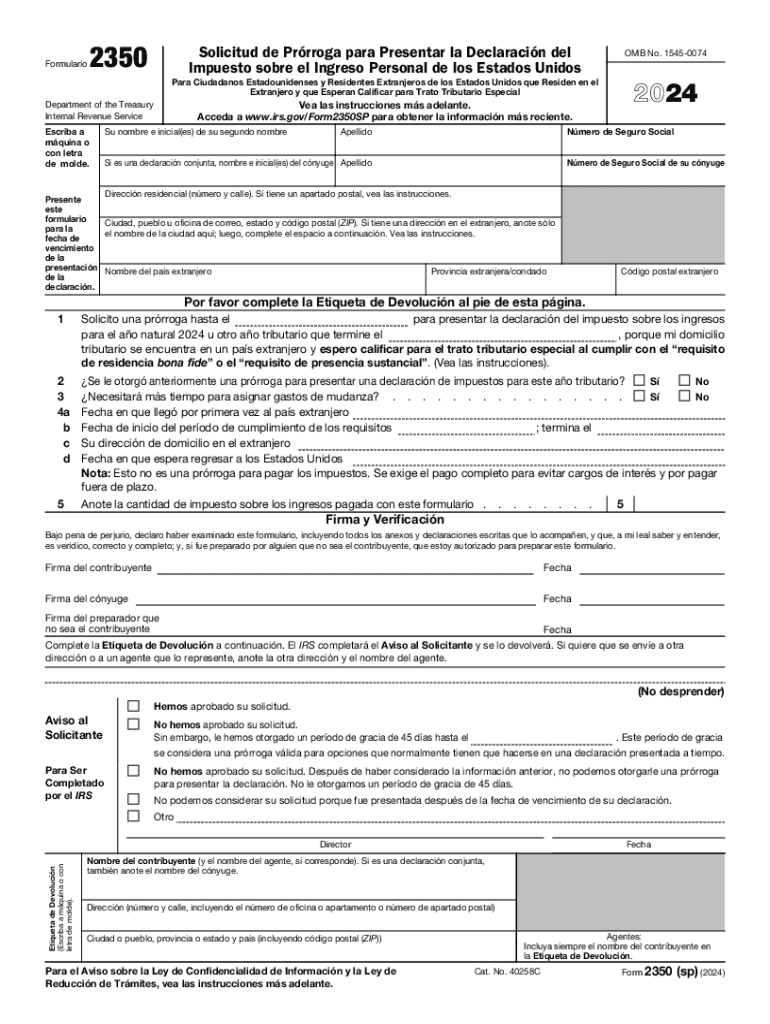

The Form 2350 sp, officially known as the Application for Extension of Time to File U.S. Income Tax Return (Spanish Version), is a crucial document for individuals who need additional time to file their federal income tax returns in the United States. This form is specifically designed for Spanish-speaking taxpayers, ensuring they can understand and complete their tax obligations effectively. It allows eligible taxpayers to request an extension beyond the standard filing deadline, providing them with more time to gather necessary documentation and prepare their returns accurately.

How to use the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version

Using the Form 2350 sp involves several straightforward steps. First, ensure you meet the eligibility criteria, which typically includes being a U.S. citizen or resident alien living abroad or having a valid reason for needing extra time. Next, download the form from the IRS website or obtain it from a tax professional. Complete the form by providing the required personal information, including your name, address, and taxpayer identification number. Once filled out, submit the form to the IRS by the specified deadline to ensure your request for an extension is processed.

Steps to complete the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version

Completing the Form 2350 sp involves a series of clear steps:

- Gather your personal information, including your Social Security number or Individual Taxpayer Identification Number.

- Fill out the form with accurate details, ensuring that all sections are completed as required.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the completed form to the IRS either electronically or by mail, depending on your preference and the IRS guidelines.

Key elements of the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version

Several key elements are essential to understand when dealing with the Form 2350 sp. These include:

- Personal Information: Accurate details about the taxpayer, including name, address, and identification numbers.

- Reason for Extension: A brief explanation of why additional time is needed to file the tax return.

- Signature: The taxpayer must sign and date the form to validate the request.

- Submission Deadline: The form must be submitted by the original tax filing deadline to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 2350 sp is crucial for compliance. Typically, the form must be filed by the original tax return due date, which is usually April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of these dates to avoid late penalties and ensure that your extension request is accepted.

Eligibility Criteria

To qualify for using the Form 2350 sp, taxpayers must meet specific eligibility criteria. Primarily, it is intended for individuals who are U.S. citizens or resident aliens living outside the United States or those who require additional time due to specific circumstances, such as military service or other valid reasons. Taxpayers must ensure they are aware of their eligibility before submitting the form to avoid complications or rejections.

Create this form in 5 minutes or less

Find and fill out the correct form 2350 sp application for extension of time to file u s income tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 2350 sp application for extension of time to file u s income tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

The Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version is a document that allows taxpayers to request an extension for filing their U.S. income tax return in Spanish. This form is essential for individuals who need additional time to prepare their tax documents while ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version. Our solution streamlines the process, allowing users to fill out the form digitally and securely send it to the IRS without any hassle.

-

Is there a cost associated with using airSlate SignNow for the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can efficiently manage the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version without breaking the bank.

-

What features does airSlate SignNow offer for the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version. These features enhance user experience and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version. This flexibility helps you manage your documents seamlessly across different platforms.

-

What are the benefits of using airSlate SignNow for the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Using airSlate SignNow for the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, ensuring that your tax documents are filed correctly and on time.

-

Is airSlate SignNow user-friendly for completing the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate it effortlessly.

Get more for Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version

Find out other Form 2350 sp Application For Extension Of Time To File U S Income Tax Return Spanish Version

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile