Form ST 100 ATT New York State and Local Quarterly Sales and Use Tax Credit Worksheet Revised 922 2022

Understanding the Form ST 100 ATT

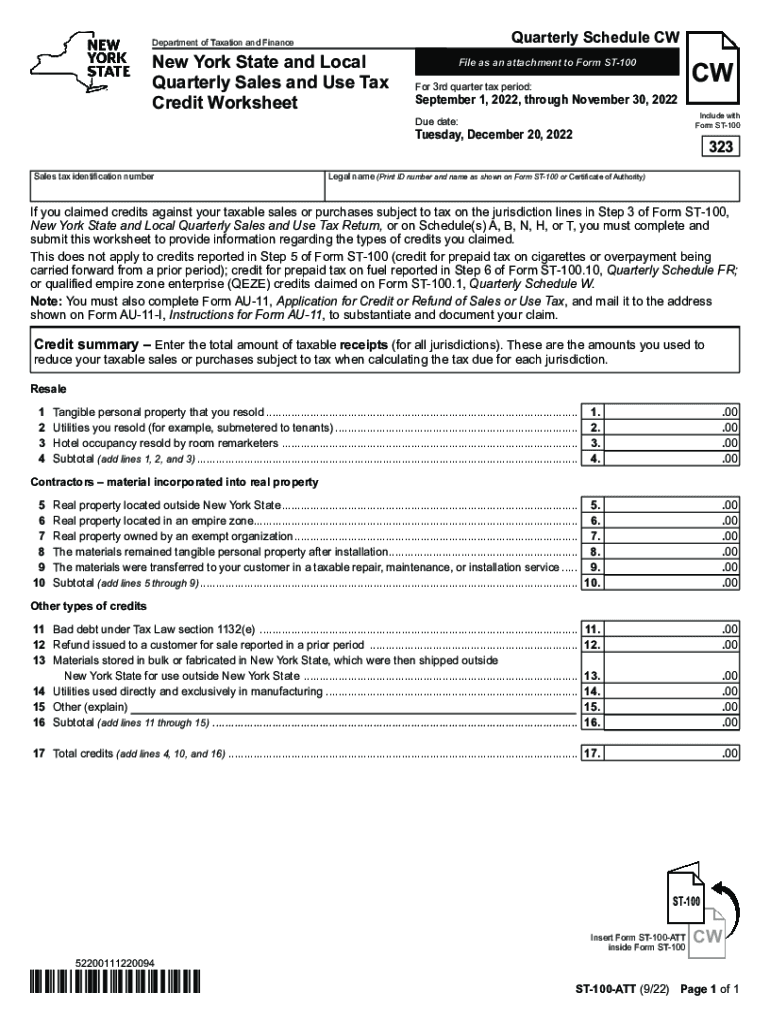

The Form ST 100 ATT is a New York State and Local Quarterly Sales and Use Tax Credit Worksheet. This form is essential for businesses that are eligible for tax credits related to sales and use tax. It allows taxpayers to calculate and claim credits for taxes paid on purchases that are subsequently resold or used in the production of taxable goods. Familiarity with this form is crucial for ensuring compliance with New York tax regulations and maximizing potential credits.

Steps to Complete the Form ST 100 ATT

Completing the Form ST 100 ATT involves several key steps:

- Gather relevant documentation, including receipts and records of taxable purchases.

- Fill in the business information section, including the name, address, and identification number.

- Calculate the total amount of sales tax paid on qualifying purchases.

- Apply any applicable credits based on the specific guidelines provided by New York State.

- Review the completed form for accuracy before submission.

Ensuring that all calculations are correct is vital, as errors can lead to delays or penalties.

Legal Use of the Form ST 100 ATT

The Form ST 100 ATT must be used in accordance with New York State tax laws. It is legally binding when completed accurately and submitted on time. Businesses must ensure they meet the eligibility criteria for claiming credits, as misuse of the form can result in penalties. Understanding the legal implications of this form is essential for maintaining compliance and avoiding potential audits.

Filing Deadlines and Important Dates

Timely submission of the Form ST 100 ATT is critical. The filing deadlines are typically aligned with the quarterly tax periods. Businesses should be aware of these dates to avoid late fees and penalties:

- First Quarter: Due April 20

- Second Quarter: Due July 20

- Third Quarter: Due October 20

- Fourth Quarter: Due January 20

Keeping a calendar of these deadlines can help ensure that submissions are made on time.

Obtaining the Form ST 100 ATT

The Form ST 100 ATT can be obtained through the New York State Department of Taxation and Finance website. It is available in both printable and fillable PDF formats, allowing businesses to choose the method that best suits their needs. Accessing the most current version of the form is important to ensure compliance with any updates or changes in tax law.

Key Elements of the Form ST 100 ATT

Several key elements are essential for completing the Form ST 100 ATT accurately:

- Business identification information

- Total sales tax paid on eligible purchases

- Details of any credits being claimed

- Signature and date of submission

Each of these components plays a critical role in the processing of the form and the approval of any claimed credits.

Quick guide on how to complete form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 922

Easily Prepare Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Edit and Electronically Sign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922 Effortlessly

- Obtain Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you want to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 922

Create this form in 5 minutes!

People also ask

-

What is the form st100 nys form primarily used for?

The form st100 nys form is used for reporting sales tax in New York State. This form helps businesses accurately document sales tax collected from customers. Understanding how to fill out the form st100 nys form is crucial to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the form st100 nys form?

AirSlate SignNow provides a user-friendly platform that allows you to fill out and eSign the form st100 nys form efficiently. With its digital signature capabilities, you can complete and send the form quickly, reducing the time spent on paperwork. This makes managing sales tax documentation more streamlined for businesses.

-

Is there a cost associated with using airSlate SignNow for the form st100 nys form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. You can choose a plan that best suits your requirements for processing documents like the form st100 nys form. The investment in our platform can save you time and prevent compliance issues, making it cost-effective.

-

What features does airSlate SignNow offer for managing documents like the form st100 nys form?

AirSlate SignNow includes features like eSigning, document templates, and workflow automation, all of which are useful for the form st100 nys form. These tools help enhance efficiency and accuracy when preparing tax documents. Utilizing these features ensures that your filings are not only easier but also compliant.

-

Can I integrate airSlate SignNow with other software for handling the form st100 nys form?

Absolutely, airSlate SignNow integrates with various software applications, improving the management of documents like the form st100 nys form. Connect with popular tools such as CRMs and accounting software to streamline your processes. This integration capability enhances overall productivity for businesses.

-

How does using airSlate SignNow enhance the security of the form st100 nys form?

AirSlate SignNow prioritizes security, ensuring that your form st100 nys form and other sensitive documents are protected. Our platform utilizes encryption and secure cloud storage to keep your information safe from unauthorized access. This commitment to security gives businesses peace of mind when handling important tax forms.

-

What is the turnaround time for completing the form st100 nys form with airSlate SignNow?

The turnaround time for completing the form st100 nys form with airSlate SignNow varies based on your preparation time. However, the electronic signing platform signNowly reduces the time needed to finalize and send documents. With templates and automation available, you can expect a quicker completion process.

Get more for Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922

- Interrogatories to plaintiff for motor vehicle occurrence new mexico form

- Interrogatories to defendant for motor vehicle accident new mexico form

- Llc notices resolutions and other operations forms package new mexico

- New mexico disclosure 497320060 form

- Nm child support 497320061 form

- New mexico child worksheet form

- Service publication in form

- New mexico abatement 497320064 form

Find out other Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 922

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document