Form ST 100 ATT New York State and Local Quarterly Sales and Use Tax Credit Worksheet Revised 923 2023-2026

Understanding the ST 100 Form

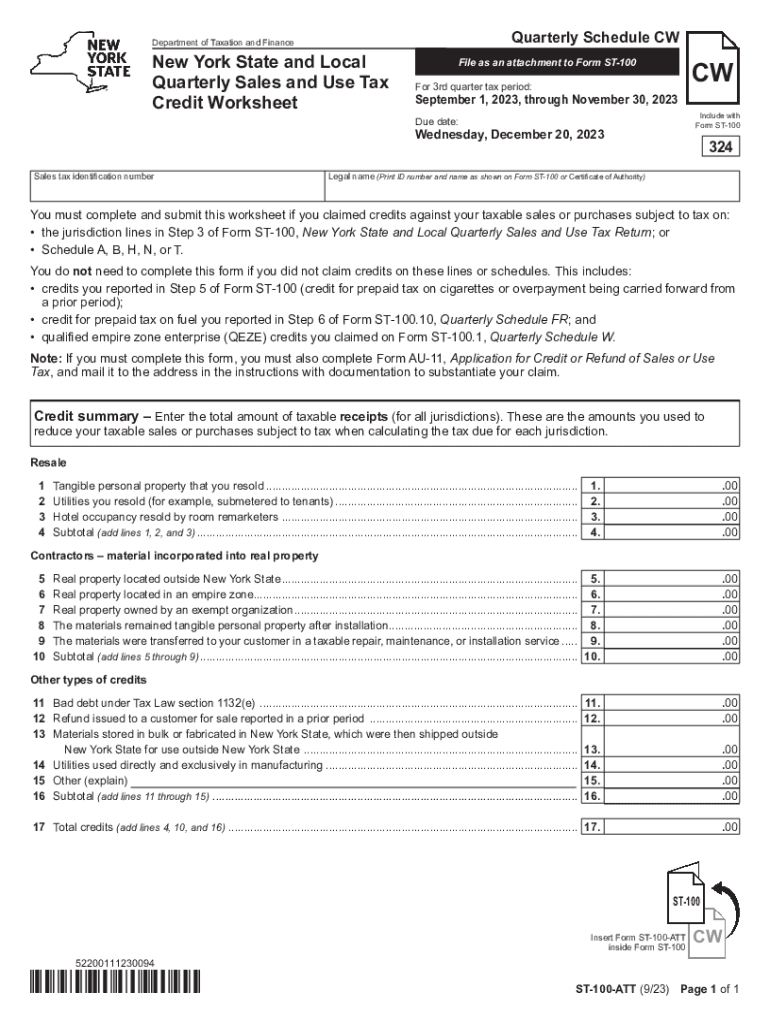

The ST 100 form, officially known as the New York State and Local Quarterly Sales and Use Tax Return, is a crucial document for businesses operating within New York. This form is used to report sales and use tax collected during a specific quarter. It ensures compliance with state tax laws and helps businesses accurately calculate their tax obligations. The form is typically required from retailers, wholesalers, and other entities that sell tangible personal property or taxable services in New York State.

Steps to Complete the ST 100 Form

Completing the ST 100 form involves several steps to ensure accuracy and compliance. First, gather all necessary sales records for the quarter, including total sales and any exempt sales. Next, calculate the total sales tax collected based on the applicable tax rates. Enter these figures into the appropriate sections of the form. Be sure to include any deductions or credits, such as those for exempt sales or prior overpayments. Finally, review the completed form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Filing Deadlines for the ST 100 Form

Timely filing of the ST 100 form is essential to avoid penalties. The form is due on the 20th day of the month following the end of each quarter. For example, the filing deadlines are April 20 for the first quarter, July 20 for the second quarter, October 20 for the third quarter, and January 20 for the fourth quarter. Businesses should mark these dates on their calendars to ensure compliance and avoid late fees.

Obtaining the ST 100 Form

The ST 100 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available in a printable format, allowing businesses to fill it out manually. Additionally, many accounting software solutions provide digital versions of the form, streamlining the completion and submission process. Ensure that you are using the most current version of the form to comply with state regulations.

Key Elements of the ST 100 Form

The ST 100 form includes several key sections that businesses must complete. These sections typically cover total sales, taxable sales, exempt sales, and the total sales tax collected. Additionally, there are areas for reporting any deductions, credits, or adjustments from previous filings. Understanding these elements is vital for accurate reporting and compliance with New York tax laws.

Legal Use of the ST 100 Form

The ST 100 form serves a legal purpose in the reporting of sales and use tax obligations. It is a legal requirement for businesses that meet certain sales thresholds in New York State. Failure to file this form can result in penalties and interest on unpaid taxes. Therefore, it is important for businesses to understand their legal obligations regarding the ST 100 form and ensure timely and accurate submissions.

Quick guide on how to complete form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 923

Complete Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923 effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923 with ease

- Find Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authenticity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, either by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device of your choice. Modify and eSign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923 while ensuring exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 923

Create this form in 5 minutes!

How to create an eSignature for the form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 923

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 100 form, and why is it important?

The ST 100 form is a crucial document used for sales tax exemption in various states. It allows businesses to declare their tax-exempt status when purchasing goods or services. By using the ST 100 form, companies can ensure compliance with tax regulations and reduce unnecessary costs.

-

How can airSlate SignNow streamline the completion of the ST 100 form?

AirSlate SignNow offers a secure platform for electronically signing and sending the ST 100 form quickly and efficiently. With its user-friendly interface, you can fill out the form, add necessary signatures, and send it directly to vendors without any hassle. This saves time and ensures accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the ST 100 form?

AirSlate SignNow provides a cost-effective solution tailored to meet diverse business needs, including the handling of the ST 100 form. Pricing plans vary based on features and user count, and many businesses find it a valuable investment due to the time savings and increased efficiency it offers.

-

What features does airSlate SignNow offer for handling the ST 100 form?

AirSlate SignNow includes features such as customizable templates, cloud storage, and easy document tracking to facilitate the management of the ST 100 form. The ability to collaborate in real-time with team members further enhances productivity. These features ensure a seamless signing process that is both efficient and reliable.

-

Can I integrate airSlate SignNow with other software to manage the ST 100 form more efficiently?

Yes, airSlate SignNow supports integrations with various applications, allowing you to manage the ST 100 form alongside your existing tools. This includes CRM systems, project management software, and more, which can streamline workflows and enhance productivity across your organization.

-

What are the benefits of using airSlate SignNow for the ST 100 form compared to traditional methods?

Using airSlate SignNow for the ST 100 form signNowly reduces paperwork and administrative time compared to traditional methods. The electronic signing process is not only faster but also environmentally friendly, eliminating the need for paper documents. Additionally, you have a secure audit trail of all transactions.

-

How does airSlate SignNow ensure the security of my ST 100 form?

AirSlate SignNow prioritizes the security of your documents, including the ST 100 form, by utilizing advanced encryption protocols and secure storage solutions. This means that your sensitive information is protected at all times, giving you peace of mind when handling important tax documents.

Get more for Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923

Find out other Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 923

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online