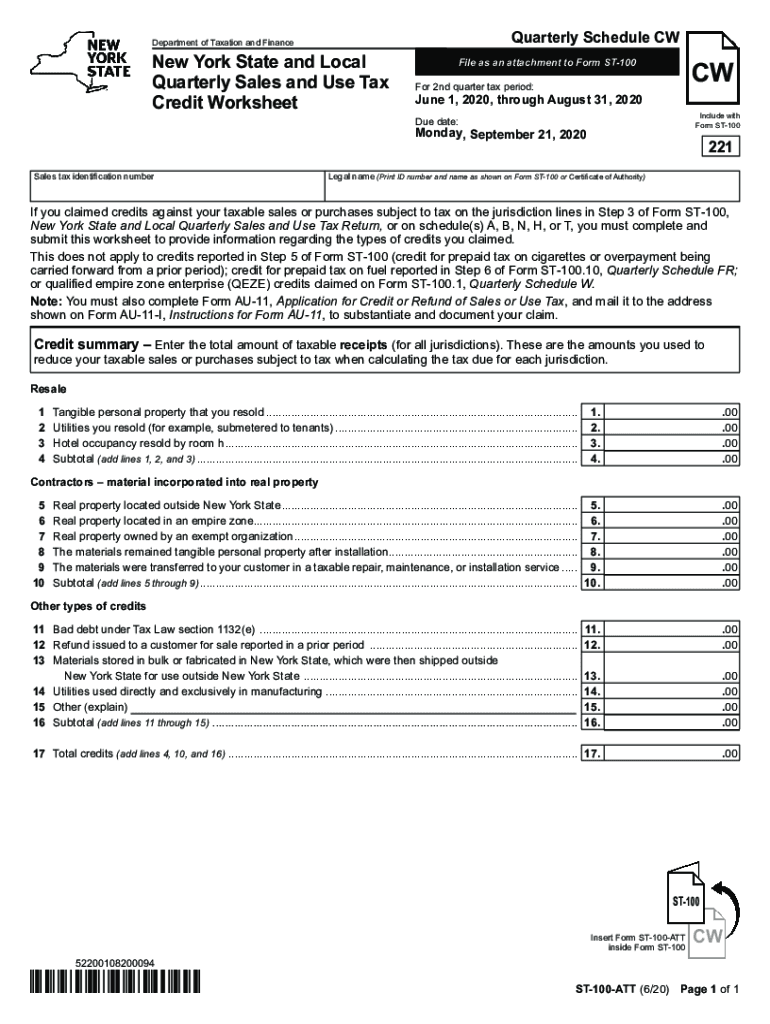

Form ST 100 ATT New York State and Local Quarterly Sales and Use Tax Credit Worksheet Revised 620 2020

Understanding the ST 100 Fillable Form

The ST 100 fillable form is a crucial document used for reporting New York State and local sales and use tax. This form is specifically designed for businesses to report their quarterly sales tax obligations. It includes sections for detailing taxable sales, exempt sales, and the amount of tax owed. By completing the ST 100, businesses ensure compliance with state tax regulations while accurately reporting their financial activities.

Steps to Complete the ST 100 Fillable Form

Completing the ST 100 fillable form involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant sales data, including total sales, exempt sales, and any applicable deductions.

- Fill Out the Form: Enter the required information into the designated fields of the form. Ensure all figures are accurate and reflect your sales records.

- Review for Accuracy: Double-check all entries for errors or omissions before finalizing the form.

- Sign and Date: Ensure that the form is signed and dated to validate the submission.

Legal Use of the ST 100 Fillable Form

The ST 100 fillable form is legally binding when completed correctly and submitted on time. It complies with New York State tax laws, making it essential for businesses to file this form to avoid penalties. The information provided must be truthful and accurate, as discrepancies can lead to audits or legal repercussions.

Filing Deadlines for the ST 100 Fillable Form

Businesses must adhere to specific filing deadlines for the ST 100 fillable form. Generally, the form is due on the last day of the month following the end of the quarter. For example, the due date for the first quarter (January to March) is April 30. Missing these deadlines can result in penalties, so it is crucial to stay informed about the specific dates applicable to your business.

Obtaining the ST 100 Fillable Form

The ST 100 fillable form can be easily obtained through the New York State Department of Taxation and Finance website. It is available in a digital format that allows for easy completion and submission. Additionally, businesses can request paper copies if necessary, although the electronic version is recommended for efficiency.

Examples of Using the ST 100 Fillable Form

Businesses across various sectors utilize the ST 100 fillable form to report their sales tax. For instance, a retail store would report its total sales, including taxable and exempt items, while a service provider would detail the services rendered and any applicable sales tax. Each business type may have unique considerations, but the core purpose of the form remains the same: to ensure compliance with sales tax obligations.

Quick guide on how to complete form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 620

Prepare Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, update, and eSign your documents quickly and without delays. Manage Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620 on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620 easily

- Find Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight signNow sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Modify and eSign Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 620

Create this form in 5 minutes!

How to create an eSignature for the form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 620

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the ST 100 fillable form?

The ST 100 fillable form is a standardized tax form used in specific jurisdictions to report sales and use tax. With airSlate SignNow, users can easily create and send this form for electronic signatures, ensuring compliance and efficiency in handling tax documents.

-

How can I create an ST 100 fillable form using airSlate SignNow?

Creating an ST 100 fillable form with airSlate SignNow is straightforward. Simply upload your template, use our easy drag-and-drop interface to add fields, and customize it to suit your business needs. This allows you to quickly generate the form needed for your transactions.

-

Is it easy to eSign the ST 100 fillable form with airSlate SignNow?

Yes, airSlate SignNow makes it very easy to eSign the ST 100 fillable form. Users can invite signers to review and sign the document electronically, speeding up the process while ensuring the security and legality of the signatures collected.

-

What are the benefits of using the ST 100 fillable form through airSlate SignNow?

Using the ST 100 fillable form through airSlate SignNow streamlines your tax reporting process. It minimizes paperwork, reduces errors, and saves time, allowing you to focus on core business activities while ensuring that your tax documents are properly completed and submitted.

-

Are there any costs associated with using airSlate SignNow for the ST 100 fillable form?

airSlate SignNow offers various pricing plans to accommodate different business needs. While creating and eSigning the ST 100 fillable form can be done at no extra cost, some features may be available only to premium users, so it’s beneficial to review the pricing options.

-

Can I integrate airSlate SignNow with other software for managing the ST 100 fillable form?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easier to manage your ST 100 fillable form. Whether it's customer relationship management (CRM) systems or document storage solutions, integration enhances workflow efficiency and document management.

-

What security measures does airSlate SignNow have for handling the ST 100 fillable form?

AirSlate SignNow prioritizes security and employs robust measures to protect your documents, including the ST 100 fillable form. With features like bank-level encryption, secure server storage, and compliance with legal regulations, your data remains safe and sound throughout the signing process.

Get more for Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620

Find out other Form ST 100 ATT New York State And Local Quarterly Sales And Use Tax Credit Worksheet Revised 620

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF