IRS 1099 NEC Rev January 2022

What is the IRS 1099 NEC Rev January?

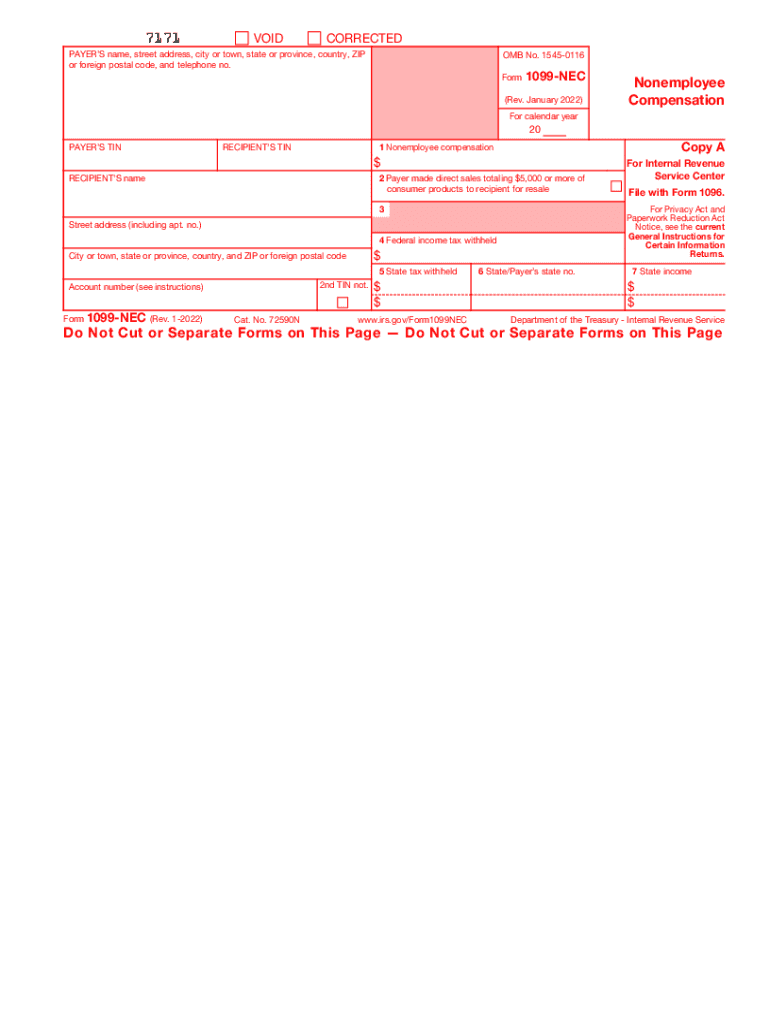

The IRS 1099 NEC Rev January is a tax form used to report non-employee compensation. This form is specifically designed for businesses that pay independent contractors, freelancers, or other non-employees. It is essential for accurately reporting payments of six hundred dollars or more made to individuals who are not employees of the business. The 1099 NEC replaces the 1099 MISC for this purpose, streamlining the reporting process for businesses and ensuring compliance with IRS regulations.

Steps to complete the IRS 1099 NEC Rev January

Completing the IRS 1099 NEC Rev January involves several key steps:

- Gather necessary information about the payee, including their name, address, and Social Security Number or Employer Identification Number.

- Report the total amount paid to the payee in the designated box on the form.

- Ensure that the form is filled out accurately, as errors can lead to penalties.

- File the completed form with the IRS by the deadline, which is typically January thirty-first of the following year.

Filing Deadlines / Important Dates

For the 2022 tax year, the deadline for filing the IRS 1099 NEC Rev January is January thirty-first, 2023. This deadline applies to both paper and electronic submissions. It is crucial to meet this deadline to avoid penalties. Additionally, recipients of the form must receive their copies by the same date, ensuring they have adequate time to report their income on their tax returns.

Legal use of the IRS 1099 NEC Rev January

The legal use of the IRS 1099 NEC Rev January is governed by IRS regulations. Businesses are required to issue this form to report any payments made to non-employees for services rendered. Failure to comply with these regulations can result in penalties for the business. Properly completing and filing the 1099 NEC ensures that both the payer and payee fulfill their tax obligations, maintaining transparency in financial transactions.

Who Issues the Form

The IRS 1099 NEC Rev January is typically issued by businesses that have paid independent contractors or non-employees. This includes sole proprietors, partnerships, corporations, and other business entities that engage non-employees for services. It is the responsibility of the payer to ensure that the form is issued accurately and on time, reflecting the total amount paid during the tax year.

Penalties for Non-Compliance

Failure to file the IRS 1099 NEC Rev January on time or providing incorrect information can result in significant penalties. The IRS imposes fines based on how late the form is filed and the size of the business. For example, if the form is filed more than thirty days late, the penalty can be higher than if it is filed on time. It is essential for businesses to understand these penalties and take the necessary steps to comply with filing requirements.

Quick guide on how to complete irs 1099 nec rev january 2022

Prepare IRS 1099 NEC Rev January effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the features needed to create, modify, and electronically sign your documents quickly without delays. Manage IRS 1099 NEC Rev January on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign IRS 1099 NEC Rev January easily

- Find IRS 1099 NEC Rev January and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign IRS 1099 NEC Rev January to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1099 nec rev january 2022

Create this form in 5 minutes!

People also ask

-

What are 1099s 2022, and why are they important?

1099s 2022 are tax forms used to report income received other than wages, salaries, and tips. They are essential for ensuring accurate tax reporting and compliance with IRS regulations. Businesses need to file them to avoid potential penalties and to keep their finances in order.

-

How can airSlate SignNow help with 1099s 2022?

airSlate SignNow simplifies the process of preparing and sending 1099s 2022 through its user-friendly eSignature solution. It allows businesses to easily manage the signing process of tax documents digitally, ensuring timely delivery and compliance. This streamlined workflow saves time and reduces errors associated with manual processes.

-

Is there a cost associated with using airSlate SignNow for 1099s 2022?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, including features designed specifically for managing 1099s 2022. These plans are cost-effective, allowing businesses of all sizes to choose a plan that suits their budget while still gaining access to comprehensive eSigning features. Pricing details can be found on the airSlate SignNow website.

-

What features does airSlate SignNow offer for managing 1099s 2022?

airSlate SignNow provides features like customizable templates, real-time tracking, and automated reminders specifically for 1099s 2022. These tools enhance efficiency by minimizing the time required to send, sign, and receive completed documents. The platform also ensures data security and compliance throughout the process.

-

Can I integrate airSlate SignNow with other software I use for 1099s 2022?

Absolutely! airSlate SignNow offers integrations with popular software solutions that businesses may already be using for 1099s 2022. Whether it’s accounting software or document management tools, these integrations help streamline processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for 1099s 2022?

Using airSlate SignNow for 1099s 2022 offers numerous benefits, including faster turnaround times and improved document accuracy. The digital signature solution also reduces the need for physical paperwork, making the entire process more environmentally friendly. Additionally, users can access their documents from anywhere, enhancing flexibility in managing tax forms.

-

How secure is airSlate SignNow for handling 1099s 2022?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like 1099s 2022. The platform utilizes advanced encryption protocols and adheres to compliance standards to protect user data. This ensures that your documents are safe from unauthorized access throughout the signing process.

Get more for IRS 1099 NEC Rev January

Find out other IRS 1099 NEC Rev January

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself