Form 8554 Rev 11 Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement 2022-2026

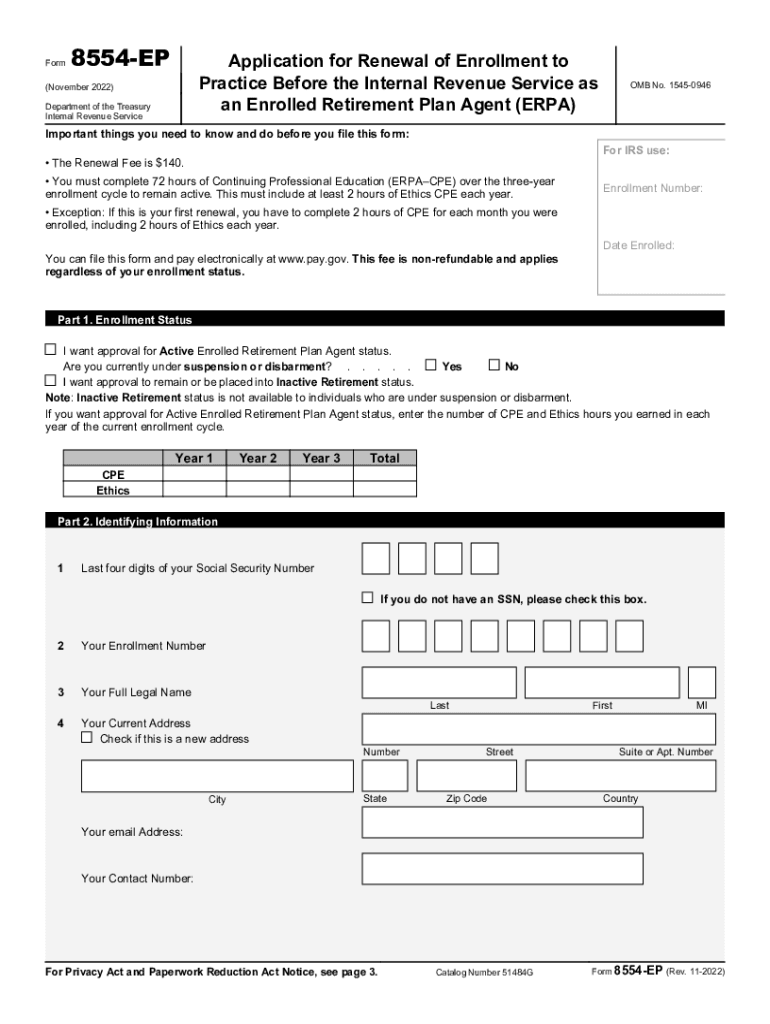

What is the 8554 EP form?

The 8554 EP form, officially known as the Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA), is a crucial document for professionals who provide tax advice and services related to retirement plans. This form is specifically designed for those who wish to renew their enrollment status with the IRS, ensuring they remain qualified to represent clients in matters concerning retirement plan compliance and other related issues.

Steps to complete the 8554 EP form

Completing the 8554 EP form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and professional information, including your IRS enrollment number and details about your practice. Next, carefully fill out each section of the form, ensuring that all information is current and accurate. Pay special attention to the eligibility criteria and any required supporting documents. Once completed, review the form for errors before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 8554 EP form to maintain your enrollment status. Typically, the renewal application must be submitted by December 31 of the year preceding the expiration of your current enrollment. Keeping track of these dates can help prevent lapses in your ability to practice before the IRS.

Eligibility Criteria

To qualify for renewal using the 8554 EP form, applicants must meet specific eligibility criteria set by the IRS. This includes having a valid IRS enrollment number, completing continuing education requirements, and maintaining good standing with the IRS. Additionally, applicants should not have any disqualifying factors such as disciplinary actions or unresolved tax issues.

Required Documents

When submitting the 8554 EP form, certain documents may be required to support your application. Commonly required documents include proof of continuing education credits, a copy of your current enrollment card, and any relevant tax compliance documents. Ensuring that you have these documents ready can streamline the renewal process and help avoid delays.

Form Submission Methods

The 8554 EP form can be submitted through various methods, depending on your preference and the requirements of the IRS. Options typically include online submission via the IRS e-Services platform, mailing a paper copy to the appropriate IRS address, or in-person submission at designated IRS offices. Each method has its own processing times, so consider your needs when choosing how to submit.

Legal use of the 8554 EP form

The legal use of the 8554 EP form is paramount for maintaining compliance with IRS regulations. By properly completing and submitting this form, enrolled retirement plan agents can ensure their ability to represent clients effectively. It is important to understand that any inaccuracies or omissions can lead to potential penalties or loss of enrollment status, underscoring the importance of meticulous attention to detail when handling this form.

Quick guide on how to complete form 8554 rev 11 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

Complete Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It presents a perfect environmentally friendly substitute for conventional printed and signed documents, as you can obtain the accurate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents swiftly without delays. Handle Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement on any platform with airSlate SignNow Android or iOS applications and streamline your document-based processes today.

The simplest method to modify and eSign Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement seamlessly

- Find Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, time-consuming form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8554 rev 11 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

Create this form in 5 minutes!

People also ask

-

What is the 8554 ep form and why do I need it?

The 8554 ep form is an essential document used for electronic signatures in various business transactions. airSlate SignNow simplifies the process of completing and submitting this form, helping you maintain compliance while saving time. By using our platform, you ensure that your 8554 ep form is securely signed and stored.

-

How much does it cost to use airSlate SignNow for the 8554 ep form?

airSlate SignNow offers flexible pricing plans tailored to suit businesses of all sizes. Depending on your needs, you can choose a plan that provides access to features necessary for managing the 8554 ep form. Our affordable rates ensure you get a cost-effective solution without compromising on quality.

-

What features does airSlate SignNow offer for the 8554 ep form?

airSlate SignNow provides advanced features specifically designed to enhance your experience with the 8554 ep form. These include customizable templates, real-time tracking, and automated workflows, streamlining the entire signing process. Our platform makes handling documents smoother and more efficient.

-

Can I integrate airSlate SignNow with other applications when managing the 8554 ep form?

Yes, airSlate SignNow offers seamless integrations with a wide range of applications, enhancing your capability to manage the 8554 ep form. Whether you're using CRM systems, cloud storage, or other business tools, our platform can easily connect to facilitate a smoother workflow. This ensures your documents are always in sync.

-

How secure is the airSlate SignNow platform when handling the 8554 ep form?

Security is a priority at airSlate SignNow. We utilize industry-standard encryption and compliance measures to protect your 8554 ep form and all related documents. You can rest assured that your sensitive information is safeguarded throughout the signing process.

-

Is the 8554 ep form easy to use with airSlate SignNow?

Absolutely! One of the core advantages of using airSlate SignNow is its user-friendly interface, making it easy to fill out and submit the 8554 ep form. Our step-by-step guidance ensures that even those who aren't tech-savvy can complete their documents without hassle.

-

How quickly can I get my 8554 ep form completed using airSlate SignNow?

With airSlate SignNow, you can signNowly reduce the time it takes to complete the 8554 ep form. Our intuitive platform allows for fast document preparation and expedited signatures, meaning you can finalize your transactions in minutes. This efficiency is crucial for keeping your business moving forward.

Get more for Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement

- Living trust for individual who is single divorced or wwidow or widower with no children nevada form

- Living trust for individual who is single divorced or wwidow or widower with children nevada form

- Living trust for husband and wife with one child nevada form

- Living trust for husband and wife with minor and or adult children nevada form

- Nevada trust 497320842 form

- Living trust property record nevada form

- Account trust nevada form

- Assignment to living trust nevada form

Find out other Form 8554 Rev 11 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now