Form 8554 2020

What is the Form 8554

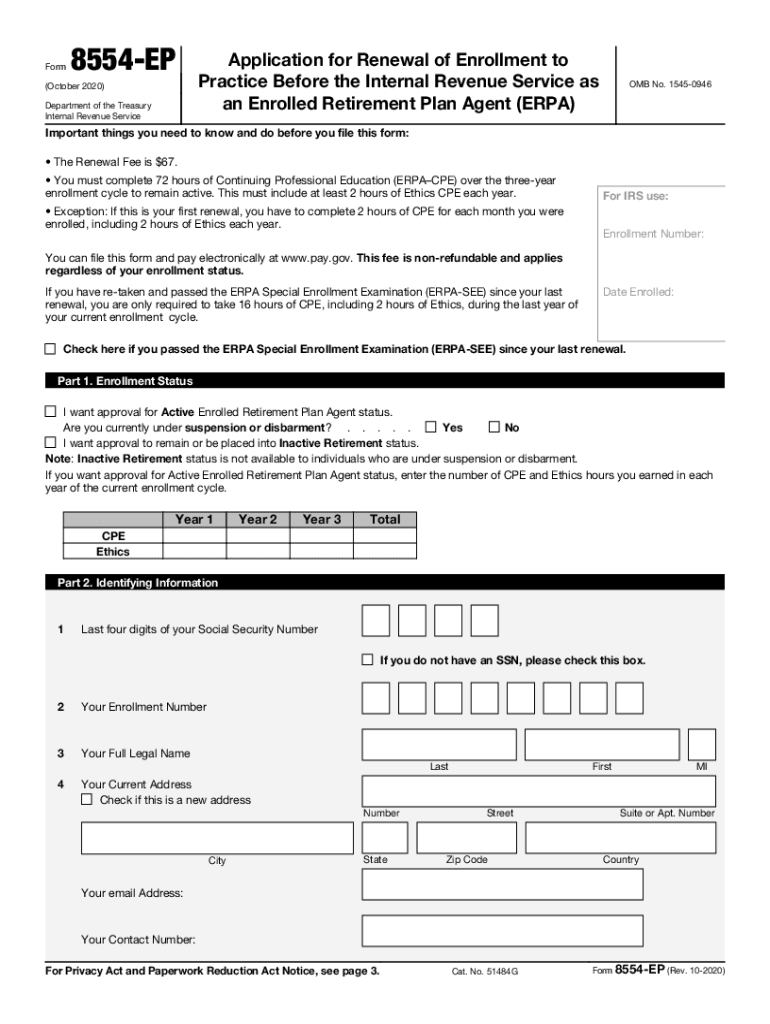

The Form 8554 is a document used by certain tax-exempt organizations to apply for recognition of their tax-exempt status under the Internal Revenue Code. This form is essential for organizations that wish to confirm their eligibility for tax exemptions, ensuring compliance with IRS regulations. By submitting the form, organizations can receive official acknowledgment from the IRS, which is crucial for maintaining their tax-exempt status.

How to use the Form 8554

Using the Form 8554 involves several key steps. First, organizations must accurately complete the form, providing all necessary information regarding their structure, activities, and finances. Once completed, the form needs to be submitted to the IRS. It is important to ensure that all details are correct to avoid delays or rejections. Organizations may also need to gather supporting documents that demonstrate their eligibility for tax-exempt status, which should accompany the form upon submission.

Steps to complete the Form 8554

Completing the Form 8554 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the organization, including its legal name, address, and Employer Identification Number (EIN).

- Provide a detailed description of the organization’s purpose and activities.

- Complete all sections of the form, ensuring accuracy in financial information and compliance with IRS guidelines.

- Review the form for completeness and correctness before submission.

- Submit the form along with any required supporting documents to the appropriate IRS address.

Legal use of the Form 8554

The legal use of the Form 8554 is governed by IRS regulations. To ensure that the form is legally binding, organizations must adhere to specific guidelines outlined by the IRS. This includes providing truthful and accurate information, as any discrepancies can lead to penalties or loss of tax-exempt status. Additionally, organizations should keep copies of the submitted form and any correspondence with the IRS for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8554 can vary based on the organization’s fiscal year and specific circumstances. It is crucial for organizations to be aware of these deadlines to ensure timely submission. Generally, organizations should file the form within a certain period after their formation or when they first apply for tax-exempt status. Keeping track of these important dates helps prevent any lapses in compliance with IRS requirements.

Eligibility Criteria

To qualify for filing the Form 8554, organizations must meet specific eligibility criteria set by the IRS. Typically, this includes being organized and operated exclusively for exempt purposes, such as charitable, educational, or religious activities. Additionally, organizations must not engage in substantial lobbying or political activities. Understanding these criteria is essential for organizations to determine their eligibility for tax-exempt status.

Quick guide on how to complete form 8554 579104844

Complete Form 8554 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly and without obstacles. Manage Form 8554 on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and electronically sign Form 8554 with ease

- Obtain Form 8554 and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and is legally equivalent to a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of submission, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, the hassle of tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Form 8554 to ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8554 579104844

Create this form in 5 minutes!

People also ask

-

What is Form 8554 and why is it important?

Form 8554 is an essential document that allows tax professionals to renew their PTIN (Preparer Tax Identification Number) for the upcoming tax year. Understanding Form 8554 is crucial as it ensures that tax professionals stay compliant with IRS regulations and continue to provide services without disruptions.

-

How can airSlate SignNow help with completing Form 8554?

airSlate SignNow simplifies the process of completing Form 8554 by allowing users to easily eSign and send documents electronically. With our intuitive interface, you can quickly fill out and share Form 8554 securely, ensuring that you meet all filing deadlines with ease.

-

Is there a fee associated with using airSlate SignNow for Form 8554?

While airSlate SignNow offers various pricing plans, creating and managing Form 8554 comes at no additional cost. You can choose from different subscription tiers that best fit your needs, allowing you to manage all your eSigning requirements efficiently.

-

What features does airSlate SignNow offer for managing Form 8554?

airSlate SignNow provides robust features for managing Form 8554, including customizable templates, real-time tracking, and secure storage. These functionalities enhance efficiency, ensuring you can focus more on your business and less on paperwork.

-

Can I integrate airSlate SignNow with other tools for Form 8554?

Yes, airSlate SignNow offers integration with several popular applications that can streamline the completion and submission process for Form 8554. By connecting with tools like Google Drive and Dropbox, you can manage all your documents in one place effortlessly.

-

What are the benefits of using airSlate SignNow for Form 8554?

Using airSlate SignNow for Form 8554 allows you to save time and reduce the risk of errors. Our platform ensures that your documents are securely signed and stored, providing peace of mind as you navigate the complexities of tax preparation.

-

Is airSlate SignNow user-friendly for those unfamiliar with Form 8554?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone, including those unfamiliar with Form 8554, to complete their documents. Our guided interface helps users navigate the eSigning process smoothly.

Get more for Form 8554

- Notice of entry of decree utah form

- Utah complaint form

- Exercising option purchase 497427549 form

- Non military affidavit form

- Utah separation form

- Assignment of lease and rent from borrower to lender utah form

- Utah child support worksheet form

- Assignment of lease from lessor with notice of assignment utah form

Find out other Form 8554

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter