Form 8554 Rev 2 Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement 2022

Understanding Form 8554 Rev 2 for Enrolled Retirement Plan Agents

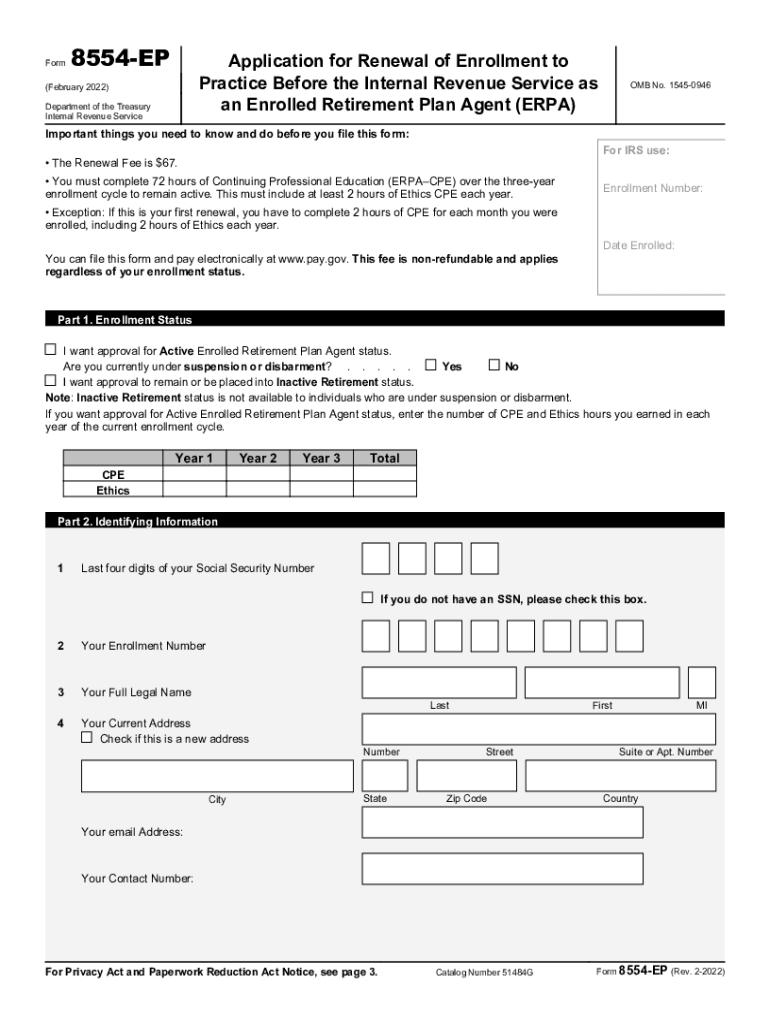

The Form 8554 Rev 2 serves as the application for renewal of enrollment to practice before the Internal Revenue Service (IRS) as an enrolled retirement plan agent (ERPA). This form is essential for professionals who provide services related to retirement plans and wish to maintain their standing with the IRS. The ERPA designation allows agents to represent clients in matters concerning retirement plans, ensuring compliance with federal regulations. Understanding the purpose and importance of this form is crucial for those in the retirement planning field.

Steps to Complete Form 8554 Rev 2

Completing the Form 8554 Rev 2 requires careful attention to detail to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary information, including your personal identification details and prior enrollment information.

- Complete all sections of the form, ensuring that all required fields are filled out accurately.

- Review the form for any errors or omissions before submission.

- Sign and date the form to certify that the information provided is true and correct.

By following these steps, you can facilitate a smooth renewal process for your ERPA status.

Legal Use of Form 8554 Rev 2

The legal validity of the Form 8554 Rev 2 is grounded in compliance with IRS regulations. When submitted correctly, the form allows enrolled retirement plan agents to maintain their authorization to represent clients. It is essential to ensure that all information provided is accurate and up-to-date, as any discrepancies may lead to delays or denial of the application. Adhering to the legal requirements associated with this form is vital for maintaining professional integrity and compliance.

Filing Deadlines and Important Dates

Timely submission of Form 8554 Rev 2 is critical for maintaining your enrollment status. The IRS typically sets specific deadlines for the renewal of enrollment. It is advisable to check the IRS website or consult with a tax professional to stay informed about any changes to these deadlines. Missing a deadline may result in a lapse of your ERPA status, which could impact your ability to serve clients effectively.

Required Documents for Submission

When preparing to submit Form 8554 Rev 2, ensure you have all necessary documents ready. This may include:

- Proof of prior enrollment as an ERPA.

- Identification documents, such as a driver's license or Social Security number.

- Any additional documentation that supports your application, as specified by the IRS.

Having these documents organized will streamline the submission process and help avoid potential issues.

Application Process and Approval Time

The application process for Form 8554 Rev 2 involves submitting the completed form to the IRS, after which the agency will review your application. The approval time can vary based on the volume of applications received and the completeness of your submission. Generally, applicants can expect a processing period of several weeks. It is advisable to submit your application well in advance of any deadlines to allow for potential delays.

Quick guide on how to complete form 8554 rev 2 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

Complete Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement effortlessly

- Find Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8554 rev 2 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

Create this form in 5 minutes!

How to create an eSignature for the form 8554 rev 2 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

How to create an e-signature for your PDF document online

How to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is an enrolled retirement plan agent?

An enrolled retirement plan agent is a professional authorized by the IRS to represent plan sponsors and participants in matters related to retirement plans. They provide expert guidance on compliance and tax implications, ensuring that retirement plans meet regulatory standards. Hiring an enrolled retirement plan agent can help you navigate the complexities of retirement planning effectively.

-

How can airSlate SignNow assist an enrolled retirement plan agent in their work?

airSlate SignNow provides enrolled retirement plan agents with an efficient platform to send and eSign documents securely. The solution simplifies the documentation process, enabling agents to focus more on their clients rather than administrative tasks. It ensures all documents are compliant and easily accessible, saving time and enhancing productivity.

-

What are the pricing options for airSlate SignNow for enrolled retirement plan agents?

airSlate SignNow offers flexible pricing plans tailored to various needs, including options specifically designed for enrolled retirement plan agents. These plans include features such as unlimited document sends and eSignatures, making it cost-effective for agents. You can choose a plan based on your business size and volume of documents to manage.

-

What features does airSlate SignNow offer for enrolled retirement plan agents?

AirSlate SignNow includes features specifically beneficial for enrolled retirement plan agents, such as custom templates, real-time tracking, and secure storage. These features simplify the signing process and ensure that all documents are organized and accessible at any time. Additionally, the platform allows for collaboration with clients, facilitating seamless communication.

-

How does airSlate SignNow enhance client interactions for enrolled retirement plan agents?

With airSlate SignNow, enrolled retirement plan agents can enhance client interactions by providing an intuitive eSigning experience. Clients can review and sign documents from anywhere, anytime, which speeds up the approval process signNowly. This convenience fosters trust and satisfaction, making it easier to maintain long-term client relationships.

-

Can airSlate SignNow integrate with other software used by enrolled retirement plan agents?

Yes, airSlate SignNow offers integrations with various software applications commonly used by enrolled retirement plan agents. This includes CRMs, project management tools, and cloud storage services, ensuring that your workflows remain cohesive. By integrating these systems, agents can streamline their operations and improve overall efficiency.

-

What security measures does airSlate SignNow implement for enrolled retirement plan agents?

AirSlate SignNow prioritizes the security of its users, including enrolled retirement plan agents, by employing advanced encryption and secure cloud storage solutions. All documents are stored safely, and user access is controlled to protect sensitive client information. These robust security measures ensure compliance with data protection regulations.

Get more for Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement

- Engineering mathematics 1 balaji text book pdf download form

- Journeyperson to apprentice ratio verification worksheet form

- Suffolk county home improvement license renewal form

- Cdms ttd form

- Model declaratie deducere personala 2022 form

- Referral or precertification request azblue form

- Neuter certificate template form

- Sponsorship evaluation form

Find out other Form 8554 Rev 2 Application For Renewal Of Enrollment To Practice Before The Internal Revenue Service As An Enrolled Retirement

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template