Form 8554 2012

What is the Form 8554

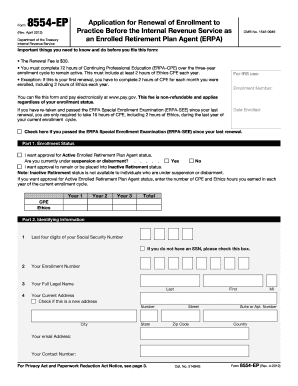

The Form 8554 is a document used by businesses and individuals to apply for a renewal of their enrollment to practice before the Internal Revenue Service (IRS). This form is essential for tax professionals who wish to maintain their eligibility to represent clients in matters related to federal taxes. It is particularly relevant for enrolled agents, who must submit this form to ensure their credentials remain active.

How to use the Form 8554

Using the Form 8554 involves several key steps. First, applicants must gather necessary information, including their personal details and any previous enrollment information. Next, they should complete the form accurately, ensuring all sections are filled out as required. After completing the form, it should be submitted to the IRS, either electronically or via mail, depending on the applicant's preference. It is crucial to ensure that the form is submitted before the deadline to avoid any lapses in enrollment.

Steps to complete the Form 8554

Completing the Form 8554 requires careful attention to detail. Here are the steps to follow:

- Gather personal and professional information, including your Social Security number and prior enrollment details.

- Fill out the form, ensuring accuracy in all entries.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS, either electronically or by mailing it to the appropriate address.

- Keep a copy of the submitted form for your records.

Legal use of the Form 8554

The legal use of the Form 8554 is governed by IRS regulations. It must be completed and submitted in compliance with the guidelines set forth by the IRS. This ensures that the enrollment remains valid and that the individual or business is authorized to represent clients before the IRS. Failure to adhere to these regulations can result in penalties or loss of enrollment status.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8554 are critical for maintaining enrollment status. Typically, the form must be submitted by the end of the enrollment period, which is usually every three years. It is important to check the IRS website or official communications for specific dates related to your enrollment cycle to ensure timely submission.

Eligibility Criteria

To be eligible to file the Form 8554, applicants must meet certain criteria. This includes being a tax professional, such as an enrolled agent, who has previously been granted enrollment to practice before the IRS. Additionally, applicants must demonstrate compliance with any continuing education requirements and adhere to ethical standards set by the IRS.

Quick guide on how to complete form 8554

Effortlessly Prepare Form 8554 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without setbacks. Manage Form 8554 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process now.

The easiest way to modify and eSign Form 8554 seamlessly

- Obtain Form 8554 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 8554 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8554

Create this form in 5 minutes!

People also ask

-

What is Form 8554 and how is it used in eSigning?

Form 8554 is an important document used by businesses to apply for renewal of their Electronic Filing Identification Number (EFIN). With airSlate SignNow, you can easily eSign Form 8554, streamlining the process and ensuring your document is signed securely and efficiently.

-

How does airSlate SignNow ensure the security of my Form 8554?

airSlate SignNow provides advanced security features, including encryption and secure storage, to protect your Form 8554. We comply with industry standards to ensure that your sensitive information remains confidential throughout the eSigning process.

-

What are the pricing options for using airSlate SignNow to sign Form 8554?

airSlate SignNow offers flexible pricing plans to fit different business needs. Whether you are a small startup or a large corporation needing to eSign Form 8554, we provide affordable options that give you access to all essential features.

-

Can I integrate airSlate SignNow with other tools for managing Form 8554?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easy to manage Form 8554 and other documents. Whether you use CRM systems or cloud storage, our platform can seamlessly connect to streamline your workflows.

-

What features of airSlate SignNow are beneficial for handling Form 8554?

AirSlate SignNow offers several features that enhance the eSigning experience for Form 8554, including customizable templates, automated reminders, and real-time tracking. These tools help ensure that your document is signed promptly and efficiently.

-

Is there a mobile app for signing Form 8554 on the go?

Yes, airSlate SignNow offers a mobile app that allows you to eSign Form 8554 and manage your documents from anywhere. This flexibility ensures that you can complete important paperwork without being tied to your desk.

-

What benefits can businesses gain by using airSlate SignNow for Form 8554?

By using airSlate SignNow for Form 8554, businesses can increase efficiency, reduce paperwork delays, and enhance compliance. Our user-friendly platform not only saves time but also improves the overall document management process.

Get more for Form 8554

Find out other Form 8554

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple