Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California 2022-2026

What is the California Form CDTFA 501 DG?

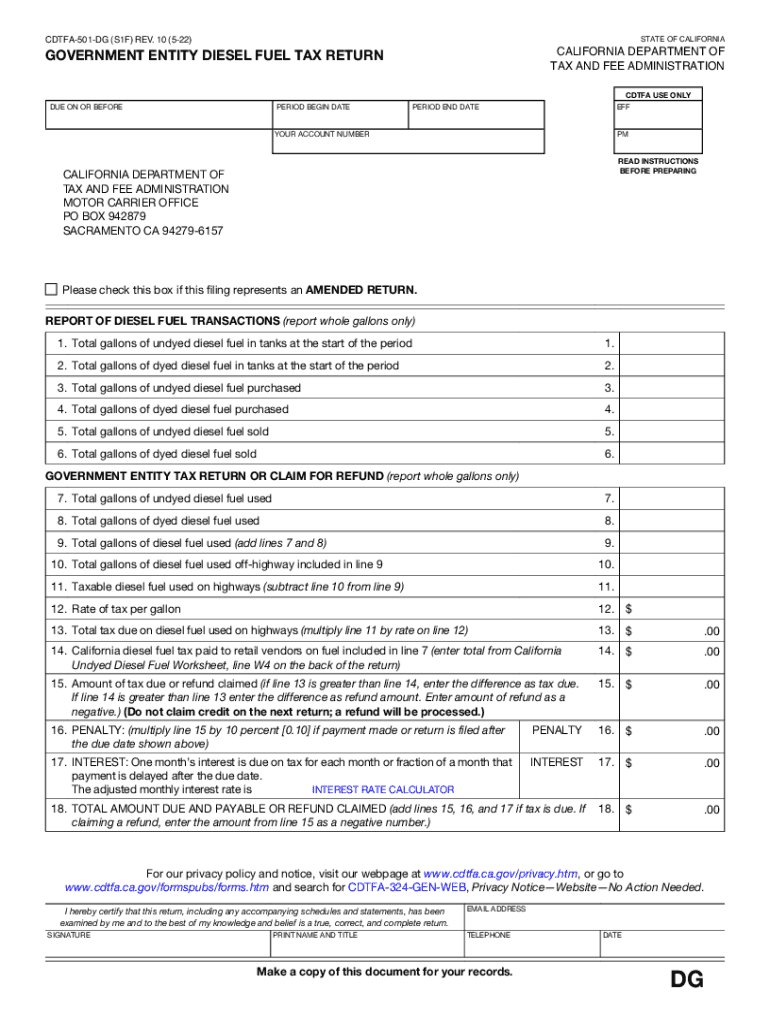

The California Form CDTFA 501 DG, also known as the Government Entity Diesel Fuel Tax Return, is a specific tax form used by government entities in California to report and pay diesel fuel taxes. This form is essential for ensuring compliance with state tax regulations regarding diesel fuel usage. It provides a structured way for entities to disclose their fuel consumption and calculate the appropriate tax owed to the state.

Steps to Complete the California Form CDTFA 501 DG

Completing the California Form CDTFA 501 DG involves several key steps:

- Gather necessary information, including details about the diesel fuel purchased and used.

- Fill out the form with accurate data, ensuring all sections are completed as required.

- Calculate the total diesel fuel tax owed based on the reported usage.

- Review the form for accuracy before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal Use of the California Form CDTFA 501 DG

The California Form CDTFA 501 DG is legally binding when completed and submitted according to state regulations. It is crucial for government entities to adhere to the guidelines set forth by the California Department of Tax and Fee Administration (CDTFA) to maintain compliance. Failure to use the form correctly can result in fines or legal repercussions.

Key Elements of the California Form CDTFA 501 DG

Understanding the key elements of the California Form CDTFA 501 DG is vital for proper completion:

- Entity Information: Details about the government entity, including name and address.

- Fuel Usage: Accurate reporting of the amount of diesel fuel purchased and used.

- Tax Calculation: A section to calculate the total tax based on reported fuel usage.

- Signature: Required signature of an authorized representative to validate the form.

How to Obtain the California Form CDTFA 501 DG

The California Form CDTFA 501 DG can be obtained directly from the California Department of Tax and Fee Administration's website. It is available in a downloadable format, allowing users to fill it out electronically or print it for manual completion. Ensuring you have the most current version of the form is essential for compliance.

Filing Deadlines for the California Form CDTFA 501 DG

Filing deadlines for the California Form CDTFA 501 DG are set by the CDTFA and must be adhered to in order to avoid penalties. Typically, these forms are due quarterly, but specific deadlines may vary based on the entity's reporting schedule. It is important to check the CDTFA website for the most current information regarding deadlines.

Quick guide on how to complete form cdtfa 501 dg ampquotgovernment entity diesel fuel tax returnampquot california

Accomplish Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California effortlessly on any gadget

Web-based document administration has become popular among businesses and individuals alike. It offers a perfect environmentally friendly substitute to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly and without interruptions. Manage Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California with ease

- Find Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cdtfa 501 dg ampquotgovernment entity diesel fuel tax returnampquot california

Create this form in 5 minutes!

People also ask

-

What is the california form diesel tax and why is it important?

The california form diesel tax is a tax levied on diesel fuel purchases in California, aimed at funding transportation projects and environmental initiatives. Understanding this form is crucial for businesses operating in the state to ensure compliance and avoid penalties.

-

How does airSlate SignNow simplify the california form diesel tax filing process?

AirSlate SignNow streamlines the filing of the california form diesel tax by allowing users to complete, sign, and submit documents electronically. This reduces paperwork and minimizes errors, ensuring that submissions are timely and accurate.

-

Can I track the status of my california form diesel tax submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow users to monitor the status of their california form diesel tax submissions. This feature ensures transparency and helps businesses stay informed about their compliance status.

-

What are the pricing options for using airSlate SignNow for california form diesel tax documents?

AirSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. By opting for our services for california form diesel tax documents, businesses can benefit from an affordable solution that enhances efficiency without compromising on quality.

-

Is airSlate SignNow compliant with california form diesel tax regulations?

Absolutely! airSlate SignNow is designed to be compliant with all relevant regulations regarding the california form diesel tax. This compliance ensures that your tax documents are processed in accordance with state laws, providing peace of mind for users.

-

What features does airSlate SignNow offer for managing california form diesel tax documents?

AirSlate SignNow includes features such as eSigning, document templates, and secure cloud storage specifically tailored for california form diesel tax documents. These features enhance user experience by making the process more efficient and user-friendly.

-

Can I integrate airSlate SignNow with other software for california form diesel tax processing?

Yes, airSlate SignNow offers numerous integrations with popular accounting and tax software to facilitate the processing of california form diesel tax. This interoperability enhances workflow and ensures that all necessary data is seamlessly transferred and managed.

Get more for Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California

- New york corporation trust form

- Notice of terms of contract by corporation or llc new york form

- Ny 2 court form

- New york joint tenancy form

- Lien holder form ny

- Quitclaim deed by two individuals to husband and wife new york form

- Warranty deed from two individuals to husband and wife new york form

- New york form ny

Find out other Form CDTFA 501 DG "Government Entity Diesel Fuel Tax Return" California

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word