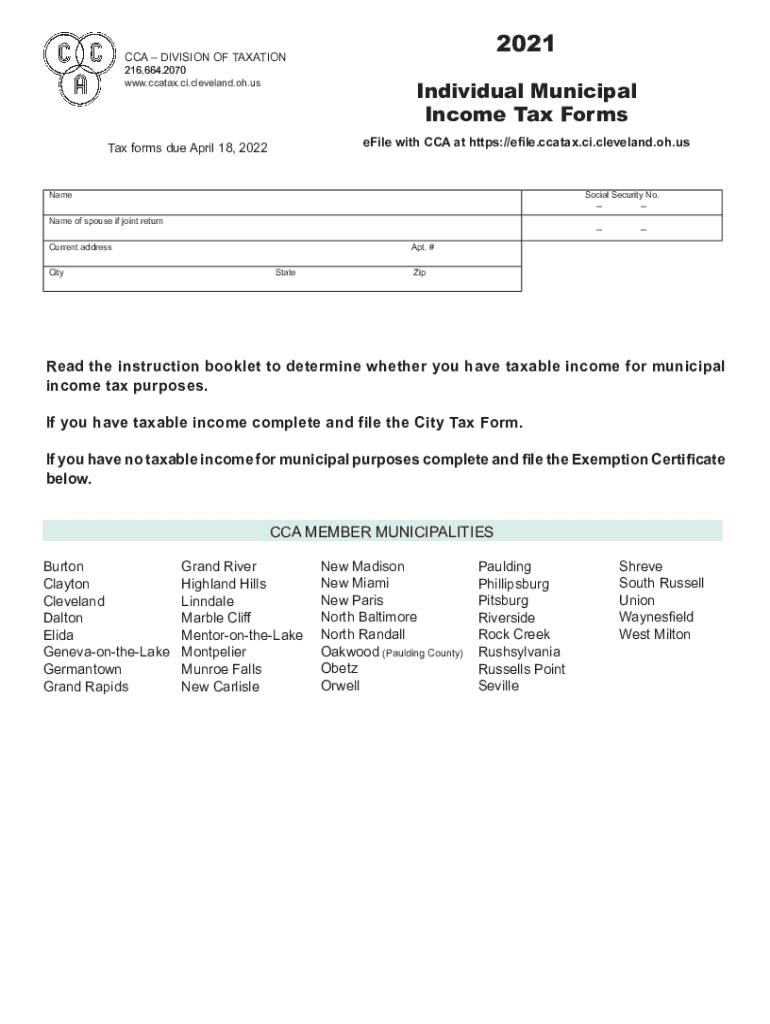

Ccatax Ci Cleveland Oh UsCCA Division of Taxation 2021

Understanding the CCA Division of Taxation

The CCA Division of Taxation is a crucial entity responsible for managing tax compliance and collection in Cleveland, Ohio. This division oversees various tax forms, including the CCA form 120 16 IR, which is essential for residents and businesses to ensure they meet their tax obligations. The division's primary focus is on enforcing local tax laws and providing guidance to taxpayers, making it a vital resource for understanding city tax requirements.

Steps to Complete the CCA Form 120 16 IR

Filling out the CCA form 120 16 IR requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary documents, including income statements and previous tax returns.

- Access the form from the CCA Division of Taxation website or obtain a physical copy.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Calculate your tax liability based on the guidelines provided.

- Review the form for accuracy before submission.

- Submit the completed form online, by mail, or in person as per the instructions.

Legal Use of the CCA Division of Taxation Forms

Forms issued by the CCA Division of Taxation, such as the CCA form 120 16 IR, are legally binding documents. To ensure their validity, it is essential to comply with all local laws and regulations. Properly executed forms can serve as evidence of tax compliance and may be required during audits or legal proceedings. Utilizing a secure eSignature solution can further enhance the legal standing of these documents.

Required Documents for CCA Tax Forms

When preparing to submit a CCA tax form, specific documents are necessary to support your filing. These may include:

- W-2 forms from employers.

- 1099 forms for independent contractors.

- Proof of any deductions or credits claimed.

- Previous year’s tax return for reference.

- Identification documents, such as a driver’s license or Social Security card.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for avoiding penalties. The CCA Division of Taxation typically sets annual deadlines for tax submissions. It is advisable to mark these dates on your calendar and prepare your forms well in advance. Key dates include:

- Annual filing deadline for individual returns.

- Quarterly estimated tax payment deadlines.

- Extensions for filing and payment, if applicable.

Form Submission Methods

Taxpayers have several options for submitting their CCA forms. Understanding these methods can facilitate a smoother filing process:

- Online submission through the CCA Division of Taxation website, which is often the fastest method.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, which may offer additional assistance.

Quick guide on how to complete ccataxciclevelandohuscca division of taxation

Complete Ccatax ci cleveland oh usCCA Division Of Taxation with ease on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage Ccatax ci cleveland oh usCCA Division Of Taxation on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Ccatax ci cleveland oh usCCA Division Of Taxation effortlessly

- Obtain Ccatax ci cleveland oh usCCA Division Of Taxation and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the specialized tools airSlate SignNow offers for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ccatax ci cleveland oh usCCA Division Of Taxation and ensure efficient communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ccataxciclevelandohuscca division of taxation

Create this form in 5 minutes!

People also ask

-

What are cca division of taxation photos?

CCA division of taxation photos refer to images or documents related to tax compliance and authority verification. These photos are critical for businesses needing to fulfill their tax obligations and ensure accurate reporting. Utilizing airSlate SignNow, you can easily manage these documents and streamline your tax processes.

-

How can airSlate SignNow help with cca division of taxation photos?

AirSlate SignNow simplifies the process of managing cca division of taxation photos by allowing you to easily upload, sign, and share your documents securely. The platform’s user-friendly interface ensures that you can quickly access and organize your tax-related files, saving you time and effort when preparing for audits or compliance checks.

-

What pricing options does airSlate SignNow offer for managing cca division of taxation photos?

AirSlate SignNow offers flexible pricing plans that cater to various business needs when it comes to managing cca division of taxation photos. Whether you're a small business or a large enterprise, you can select a plan that fits your budget and ensures you have all the necessary features for efficient document management.

-

Are there any specific features for handling cca division of taxation photos?

Yes, airSlate SignNow includes specific features such as document templates, automated workflows, and secure cloud storage that make handling cca division of taxation photos easier. These features ensure that your taxation documents are not only well organized but also accessible whenever you need them, enhancing your efficiency.

-

Can I integrate airSlate SignNow with other tools? How does this benefit my cca division of taxation photos management?

AirSlate SignNow integrates seamlessly with various productivity tools, allowing for smooth workflows when managing cca division of taxation photos. By connecting with platforms like Google Drive, Dropbox, or CRM systems, you can ensure that all your documents are interconnected, enhancing collaboration within your organization.

-

What are the security measures in place for cca division of taxation photos on airSlate SignNow?

AirSlate SignNow prioritizes security by implementing robust encryption and secure access controls for your cca division of taxation photos. This means your sensitive tax documents are protected from unauthorized access, giving you peace of mind while managing your tax compliance electronically.

-

How does electronic signing of cca division of taxation photos work with airSlate SignNow?

With airSlate SignNow, electronic signing of cca division of taxation photos is straightforward and compliant with industry regulations. Users can sign documents digitally, providing a legal signature that speeds up the process and reduces the need for physical paperwork, all while maintaining a secure transaction.

Get more for Ccatax ci cleveland oh usCCA Division Of Taxation

- Essential legal life documents for new parents new york form

- New york custody 497321792 form

- New york small form

- New york procedures form

- Revocation of power of attorney for care of child or children new york form

- Newly divorced individuals package new york form

- Contractors forms package new york

- Power of attorney for sale of motor vehicle new york form

Find out other Ccatax ci cleveland oh usCCA Division Of Taxation

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF