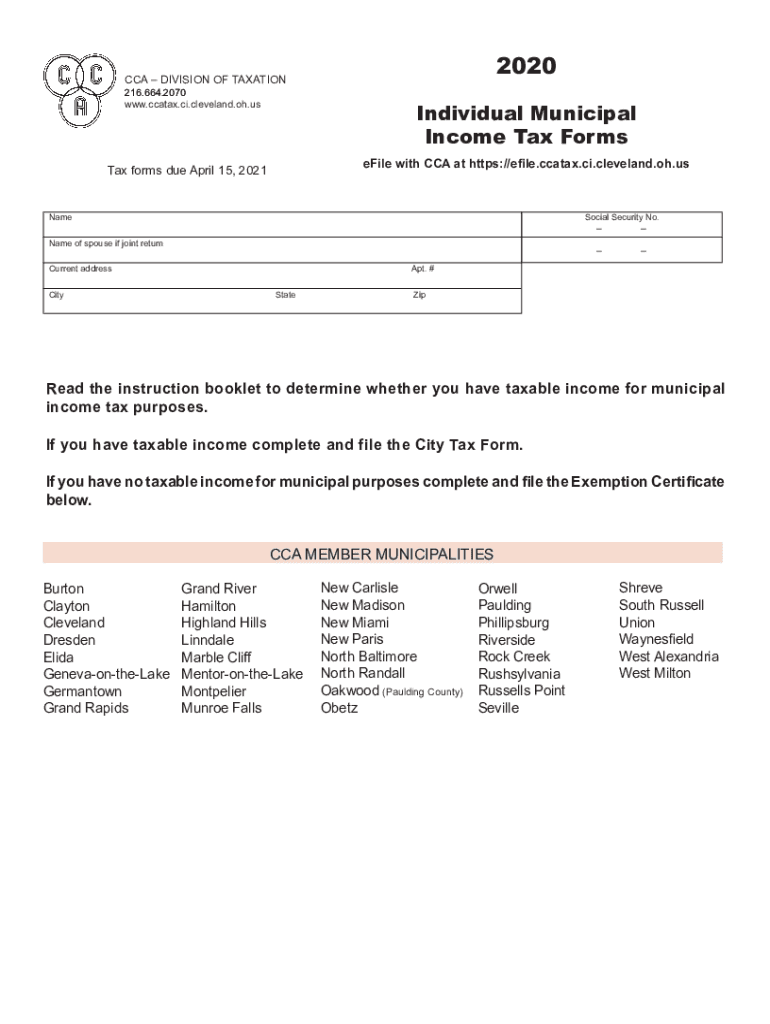

Individual Tax Form 2020

What is the Individual Tax Form

The Individual Tax Form, often referred to as the cca form tax, is a critical document used for reporting income and calculating tax obligations for individuals. This form is essential for residents of Ohio and other states, as it helps taxpayers declare their earnings, deductions, and credits to ensure compliance with state and federal tax laws. The form captures various financial details, including wages, interest income, and any applicable tax credits, ultimately determining the amount owed or refunded.

Steps to complete the Individual Tax Form

Completing the cca tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, follow these steps:

- Fill in personal information, including your name, address, and Social Security number.

- Report your income from various sources, ensuring all figures are accurate and up-to-date.

- Claim deductions and credits applicable to your situation, such as education or healthcare expenses.

- Calculate your total tax liability based on the information provided.

- Review the completed form for any errors or omissions before submission.

Legal use of the Individual Tax Form

The cca form tax is legally binding when completed correctly and submitted to the appropriate tax authority. To ensure its legality, taxpayers must adhere to the guidelines set forth by the IRS and state taxation departments. This includes using accurate information, signing the form, and submitting it by the designated deadlines. Failure to comply with these regulations can result in penalties, including fines or audits.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for avoiding penalties associated with the cca tax form. Typically, individual tax forms must be submitted by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any state-specific deadlines that may differ from federal timelines. It is advisable to plan ahead to ensure timely submission.

Required Documents

To complete the cca form tax accurately, several documents are required. These include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or educational costs.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process and help ensure all income and deductions are accounted for.

Who Issues the Form

The cca form tax is issued by the Ohio Department of Taxation, specifically through the cca division of taxation. This department is responsible for managing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department’s website or through authorized tax preparation services.

Quick guide on how to complete 2020 individual tax form

Complete Individual Tax Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any holdups. Handle Individual Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Individual Tax Form effortlessly

- Obtain Individual Tax Form and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or cover sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and has the same legal validity as a standard handwritten signature.

- Verify all details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device you prefer. Alter and eSign Individual Tax Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 individual tax form

Create this form in 5 minutes!

How to create an eSignature for the 2020 individual tax form

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the cca form tax used for?

The cca form tax is utilized primarily for reporting Capital Cost Allowance claims in Canada. It helps businesses calculate the depreciation of their assets over time, providing potential tax savings. Understanding how to fill out this form can signNowly impact your financial reporting.

-

How can airSlate SignNow help with the cca form tax process?

airSlate SignNow simplifies the process of completing and signing the cca form tax by providing an intuitive, user-friendly platform. You can easily upload, edit, and eSign your documents, ensuring authenticity and compliance. This streamlines your workflow and saves time, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for the cca form tax?

Yes, airSlate SignNow offers a variety of pricing plans to meet your business needs, including options for those focusing on the cca form tax. The plans are designed to be cost-effective, providing great value for the features included. Contact us to find the best plan for your requirements.

-

What features does airSlate SignNow offer for managing the cca form tax?

airSlate SignNow provides several features that benefit users managing the cca form tax, including customizable templates, audit trails, and secure cloud storage. Additionally, features like document sharing and bulk sending enhance collaboration and efficiency. These tools make it easier to handle your tax documents accurately and securely.

-

Can airSlate SignNow integrate with other accounting software for handling the cca form tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing the process of managing your cca form tax. This integration allows for smoother data flow between systems, ensuring that all relevant financial documents are readily accessible and user-friendly. It makes tax preparation effortless.

-

How does eSigning cca form tax documents improve efficiency?

eSigning cca form tax documents through airSlate SignNow signNowly improves efficiency by reducing the need for physical paperwork. The digital signature process is quick and legally binding, allowing for faster turnaround times. It also helps maintain a clear electronic trail for audits or reviews.

-

What are the benefits of using airSlate SignNow for the cca form tax?

Using airSlate SignNow for the cca form tax offers numerous benefits including improved accuracy, time savings, and reduced operational costs. The platform ensures compliance with legal standards while simplifying document management. You also gain access to robust support and resources to help guide you through the tax process.

Get more for Individual Tax Form

Find out other Individual Tax Form

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now