Ksrevenue Govpdfpub1216Pub KS 1216 Business Tax Application and Instructions Rev 6 22 2022-2026

Understanding the Kansas Business Tax Application

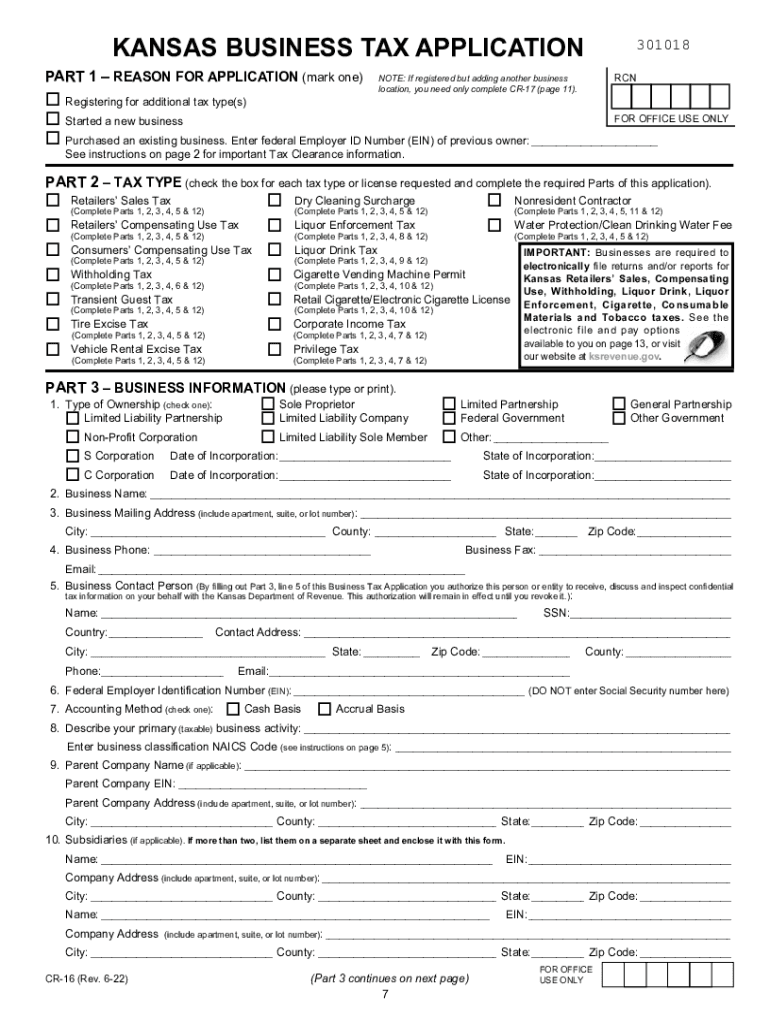

The Kansas Business Tax Application, specifically the form CR 16 2012, is essential for businesses operating in Kansas. This form allows businesses to register for various tax types, including sales tax and withholding tax. It is important for ensuring compliance with state tax regulations. The application provides detailed instructions that guide businesses through the registration process, ensuring that all necessary information is accurately submitted.

Steps to Complete the Kansas Business Tax Application

Completing the Kansas Business Tax Application involves several key steps:

- Gather necessary information, including your business structure, federal Employer Identification Number (EIN), and contact details.

- Access the form CR 16 2012 from the Kansas Department of Revenue website.

- Fill out the form with accurate and complete information, ensuring all required fields are addressed.

- Review the form for any errors or omissions before submission.

- Submit the application either online, by mail, or in person, depending on your preference.

Required Documents for Submission

When submitting the Kansas Business Tax Application, certain documents may be required to support your application. These typically include:

- Federal Employer Identification Number (EIN) confirmation.

- Proof of business registration with the state.

- Any relevant licenses specific to your business type.

Having these documents ready can facilitate a smoother application process.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines to avoid penalties. The Kansas Department of Revenue typically sets specific deadlines for tax registration and submissions. Businesses should check the official website for the most current deadlines, as these can vary based on the type of tax and business structure.

Penalties for Non-Compliance

Failing to complete the Kansas Business Tax Application or submitting inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to stay compliant with state tax laws to avoid these consequences.

Digital Submission of the Kansas Business Tax Application

Businesses can submit the Kansas Business Tax Application electronically, which offers several advantages. Digital submissions are typically processed faster than paper submissions, allowing for quicker registration. Additionally, electronic filing often provides confirmation of submission, enhancing the reliability of the application process.

Quick guide on how to complete ksrevenuegovpdfpub1216pub ks 1216 business tax application and instructions rev 6 22

Prepare Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22 effortlessly

- Find Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiresome document searches, or errors that necessitate new printed copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ksrevenuegovpdfpub1216pub ks 1216 business tax application and instructions rev 6 22

Create this form in 5 minutes!

People also ask

-

What documents can I eSign related to my 2012 Kansas tax filings?

With airSlate SignNow, you can eSign a variety of documents required for your 2012 Kansas tax filings, including W-2s, 1099s, and state tax forms. Our platform ensures that all necessary documents are securely signed and stored, making the tax submission process seamless.

-

How does airSlate SignNow help with 2012 Kansas tax compliance?

airSlate SignNow provides features that facilitate compliance with 2012 Kansas tax regulations. By using our platform, you can maintain proper documentation and easily access your signed forms, making audits and compliance reviews straightforward.

-

What are the pricing options for using airSlate SignNow for 2012 Kansas tax documents?

airSlate SignNow offers several affordable pricing plans tailored to your needs, with options suitable for individuals to large businesses. Our pricing structure ensures you can manage your 2012 Kansas tax documents efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing my 2012 Kansas tax documents?

Yes, airSlate SignNow seamlessly integrates with a variety of accounting and tax preparation software, helping you manage your 2012 Kansas tax documents effectively. This integration streamlines your workflow, making it easier to eSign and submit necessary forms.

-

Is airSlate SignNow secure for handling sensitive 2012 Kansas tax information?

Absolutely! airSlate SignNow prioritizes your security with industry-leading encryption protocols. When handling your 2012 Kansas tax information, you can trust that your data will be kept safe and confidential.

-

Can I use airSlate SignNow on mobile devices for my 2012 Kansas tax needs?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to eSign documents related to your 2012 Kansas tax filings from anywhere. This on-the-go functionality means you can manage your tax paperwork at your convenience.

-

What benefits does airSlate SignNow offer for individuals handling their 2012 Kansas tax returns?

Using airSlate SignNow for your 2012 Kansas tax returns streamlines the eSigning process, saving you time and reducing stress. The platform's user-friendly interface allows you to focus more on your finances and less on paperwork.

Get more for Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22

Find out other Ksrevenue govpdfpub1216Pub KS 1216 Business Tax Application And Instructions Rev 6 22

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form