Kansas Department of Revenue Pub KS 1216 Business Tax 2020

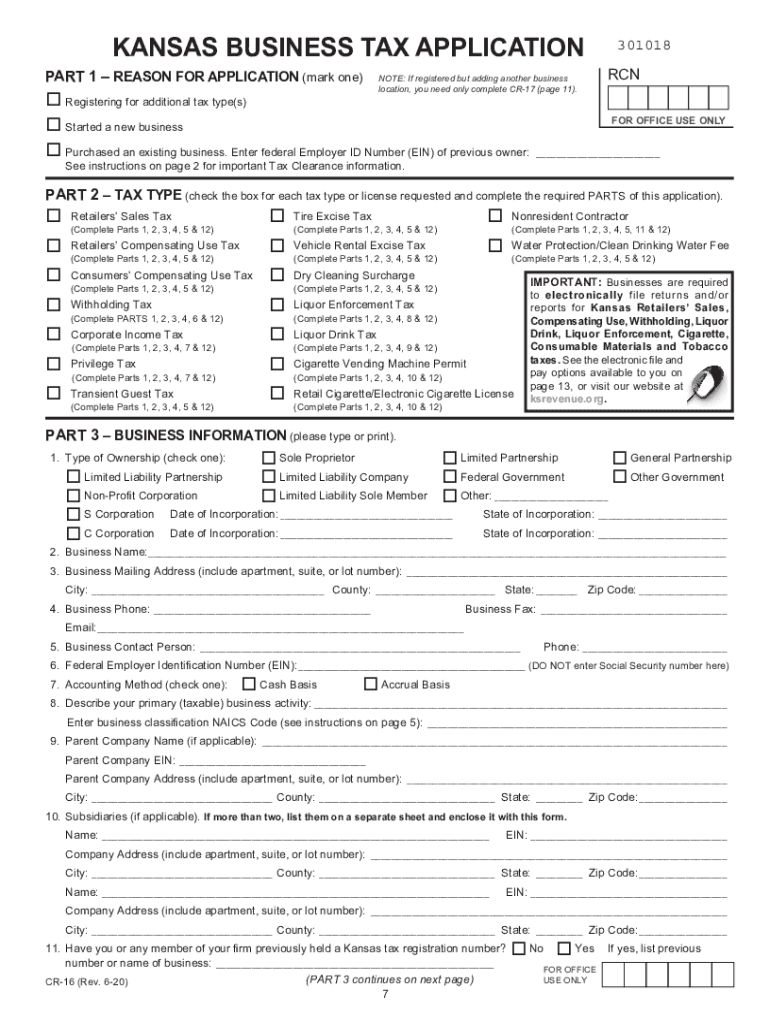

What is the Kansas Department Of Revenue Pub KS 1216 Business Tax?

The Kansas Department of Revenue Pub KS 1216 Business Tax is a crucial document for businesses operating in Kansas. This form is designed to assist businesses in reporting their tax obligations accurately. It provides guidelines on how to calculate and submit the appropriate business taxes, ensuring compliance with state regulations. Understanding this form is essential for maintaining good standing with the Kansas Department of Revenue.

Steps to complete the Kansas Department Of Revenue Pub KS 1216 Business Tax

Completing the Kansas Department of Revenue Pub KS 1216 Business Tax involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check calculations to avoid errors that could lead to penalties.

- Submit the completed form by the designated deadline, either online or via mail.

Legal use of the Kansas Department Of Revenue Pub KS 1216 Business Tax

The legal use of the Kansas Department of Revenue Pub KS 1216 Business Tax is governed by state tax laws. This form must be filled out in accordance with the regulations set forth by the Kansas Department of Revenue. Proper use of this form ensures that businesses meet their tax obligations and avoid potential legal issues. It is important to keep records of submitted forms for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Department of Revenue Pub KS 1216 Business Tax vary based on the business's tax structure. Generally, businesses must file this form annually, with specific deadlines typically falling on the 15th day of the fourth month following the end of the tax year. It is crucial for businesses to stay informed about these dates to ensure timely submissions and avoid penalties.

Required Documents

When preparing to complete the Kansas Department of Revenue Pub KS 1216 Business Tax, certain documents are required:

- Income statements detailing revenue generated during the tax year.

- Expense records to substantiate deductions claimed.

- Previous tax returns for reference and consistency.

- Any additional documentation specified in the form instructions.

Form Submission Methods

The Kansas Department of Revenue Pub KS 1216 Business Tax can be submitted through various methods. Businesses have the option to file online through the Kansas Department of Revenue's website, which is often the most efficient method. Alternatively, forms can be mailed directly to the department or submitted in person at designated offices. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Quick guide on how to complete kansas department of revenue pub ks 1216 business tax

Effortlessly Prepare Kansas Department Of Revenue Pub KS 1216 Business Tax on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly and without delays. Handle Kansas Department Of Revenue Pub KS 1216 Business Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Edit and eSign Kansas Department Of Revenue Pub KS 1216 Business Tax Easily

- Find Kansas Department Of Revenue Pub KS 1216 Business Tax and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or out-of-place documents, tedious form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Kansas Department Of Revenue Pub KS 1216 Business Tax and ensure excellent communication throughout any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas department of revenue pub ks 1216 business tax

Create this form in 5 minutes!

How to create an eSignature for the kansas department of revenue pub ks 1216 business tax

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Kansas Form CR 16 and how can airSlate SignNow help?

The Kansas Form CR 16 is a crucial document for businesses in Kansas that simplifies the process of electronic signatures. With airSlate SignNow, you can easily complete, sign, and send the Kansas Form CR 16 electronically, ensuring compliance and efficiency. Our platform provides a secure environment for managing important documents and enhances productivity.

-

How does airSlate SignNow ensure the security of the Kansas Form CR 16?

airSlate SignNow prioritizes security for all documents, including the Kansas Form CR 16. Our platform uses advanced encryption protocols to safeguard your data and ensure that only authorized users can access the documents. Additionally, we provide audit trails to track document activity and maintain accountability.

-

What are the costs associated with using airSlate SignNow for the Kansas Form CR 16?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes looking to manage documents like the Kansas Form CR 16 efficiently. You can choose from various subscription tiers that suit your budget and needs, ensuring you get the best value for electronic signature solutions. Free trials are also available to test the service before commitment.

-

Can I customize the Kansas Form CR 16 templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Kansas Form CR 16 templates according to their specific requirements. You can easily add your branding, logos, and adjust fields to suit your organization's needs. This flexibility helps maintain professionalism while streamlining the signing process.

-

What features does airSlate SignNow offer for managing the Kansas Form CR 16?

AirSlate SignNow provides a range of features for managing the Kansas Form CR 16, including team collaboration tools, real-time notifications, and mobile capabilities. Users can quickly send, sign, and receive documents, ensuring efficiency from anywhere at any time. These features enhance workflow and save valuable time.

-

What integrations are available for airSlate SignNow when using the Kansas Form CR 16?

AirSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and more, enabling users to manage the Kansas Form CR 16 effortlessly. These integrations allow you to streamline your workflow and keep all your documents organized in one place. Simplifying processes is key to enhancing productivity.

-

Is there customer support available for issues related to the Kansas Form CR 16?

Absolutely! airSlate SignNow provides dedicated customer support to assist with any issues related to the Kansas Form CR 16. Our support team is available via chat, email, or phone and is ready to help you troubleshoot problems, answer questions, and ensure a smooth experience with our platform.

Get more for Kansas Department Of Revenue Pub KS 1216 Business Tax

- Quitclaim deed from husband to himself and wife west virginia form

- Quitclaim deed from husband and wife to husband and wife west virginia form

- Wv husband form

- West virginia revocation form

- Postnuptial property agreement west virginia west virginia form

- West virginia postnuptial agreement form

- Quitclaim deed from husband and wife to an individual west virginia form

- West virginia wife form

Find out other Kansas Department Of Revenue Pub KS 1216 Business Tax

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free