Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax 2021

Understanding the Kansas Business Tax Application

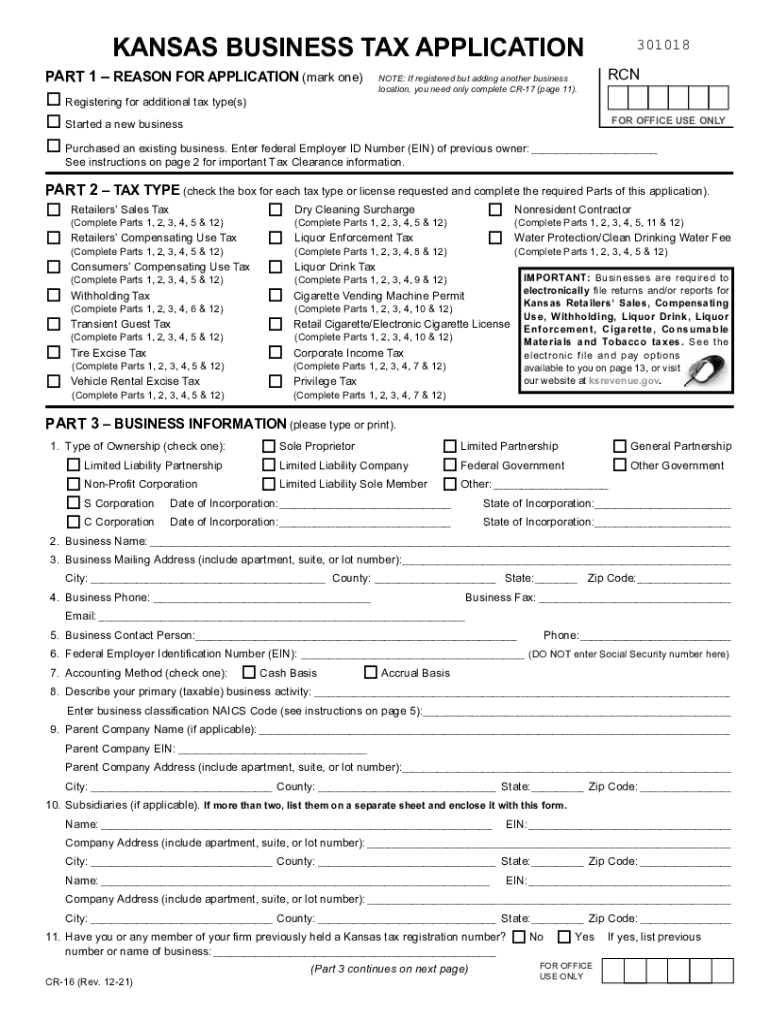

The Kansas Business Tax Application is a crucial document for businesses operating in Kansas. This form is designed to facilitate the registration of various business types, including corporations, partnerships, and sole proprietorships. By completing this application, businesses can obtain a Kansas sales tax ID number, which is essential for collecting and remitting sales tax on taxable sales.

It is important to understand the specific requirements and information needed when filling out this application. This includes details about the business structure, ownership, and the nature of the business activities. Properly completing the application ensures compliance with state regulations and helps avoid potential penalties.

Steps to Complete the Kansas Business Tax Application

Completing the Kansas Business Tax Application involves several key steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary information, including your business name, address, and ownership details.

- Determine the type of business entity you are registering (e.g., LLC, corporation, partnership).

- Access the fillable online version of the application on the Kansas Department of Revenue website.

- Fill out the form, ensuring all information is accurate and complete.

- Review the application for any errors or omissions before submission.

- Submit the application electronically or print it for mailing, depending on your preference.

Following these steps will help streamline the application process and ensure that your business is properly registered with the state.

Required Documents for the Kansas Business Tax Application

When completing the Kansas Business Tax Application, certain documents may be required to support your application. These documents help verify your business identity and structure. Commonly required documents include:

- Proof of business formation, such as Articles of Incorporation or Organization.

- Identification documents for business owners, such as a driver's license or Social Security number.

- Any relevant licenses or permits specific to your business type.

Having these documents ready can expedite the application process and ensure compliance with state regulations.

Filing Deadlines for the Kansas Business Tax Application

Timely submission of the Kansas Business Tax Application is essential to avoid penalties and ensure compliance. Generally, businesses should submit their application before commencing operations or as soon as they decide to establish a presence in Kansas. Specific deadlines may vary based on the business type and local regulations. It is advisable to check with the Kansas Department of Revenue for any updates or changes to filing deadlines.

Legal Use of the Kansas Business Tax Application

The Kansas Business Tax Application serves a legal purpose by formally registering a business with the state. This registration is necessary for compliance with Kansas tax laws and regulations. The completed application, once approved, provides the business with a sales tax ID number, which is legally required for collecting sales tax on taxable goods and services. Proper use of the application helps ensure that businesses operate within the legal framework established by the state.

Digital vs. Paper Version of the Kansas Business Tax Application

Businesses have the option to complete the Kansas Business Tax Application either digitally or on paper. The digital version offers several advantages, including ease of use, faster processing times, and reduced risk of errors. Electronic submissions are typically processed more quickly than paper applications, allowing businesses to receive their sales tax ID number sooner. However, some may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, it is important to ensure that the application is filled out accurately and submitted in a timely manner.

Quick guide on how to complete fillable online kansas business tax application part 1 fax

Easily Prepare Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax on Any Device

Web-based document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the suitable form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without unnecessary delays. Manage Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax across any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The simplest way to modify and eSign Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax effortlessly

- Obtain Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details with the tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tiresome form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax to ensure smooth communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online kansas business tax application part 1 fax

Create this form in 5 minutes!

How to create an eSignature for the fillable online kansas business tax application part 1 fax

The way to create an e-signature for a PDF file in the online mode

The way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is a business tax application and how does it work?

A business tax application helps companies manage and streamline their tax-related processes efficiently. It allows users to prepare, file, and track their business taxes digitally, reducing the likelihood of errors. Using a business tax application can signNowly simplify tax preparation and ensure compliance with tax regulations.

-

How much does the airSlate SignNow business tax application cost?

The airSlate SignNow business tax application is offered through various pricing plans that cater to different business sizes and needs. Each plan includes essential features designed to optimize your tax management process. By choosing the right plan, you can ensure you get the best value for your investment in a business tax application.

-

What features are included in the business tax application?

The business tax application includes features such as eSigning, document management, and real-time collaboration tools. These features enhance productivity and streamline the tax filing process. Additionally, the application will help businesses maintain organized records and ensure that all required documentation is efficiently managed.

-

How can a business tax application benefit my company?

A business tax application can save your company time and reduce costs by automating tax processes. It helps ensure compliance with tax regulations while minimizing human error. By using a reliable business tax application, you can focus more on core operations rather than getting bogged down by tax paperwork.

-

Is the airSlate SignNow business tax application secure?

Yes, the airSlate SignNow business tax application prioritizes security through advanced encryption and data protection measures. Your sensitive tax information is securely stored and managed, ensuring that only authorized individuals have access. This commitment to security helps businesses feel confident in using the application.

-

Can the business tax application integrate with other software?

Absolutely! The airSlate SignNow business tax application offers integrations with popular accounting and financial software. This allows users to seamlessly synchronize their financial data, enhancing overall operational efficiency. Integrating with other systems helps streamline your business tax processes even further.

-

Is there customer support available for the business tax application?

Yes, airSlate SignNow provides dedicated customer support for users of the business tax application. Whether you have questions about features, pricing, or technical issues, their support team is ready to assist you promptly. Comprehensive resources are also available, ensuring you get the most out of your business tax application.

Get more for Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax

- Mississippi affidavit form

- Change venue form

- Separate answer and defenses to plaintiffs amended complaint mississippi form

- Plaintiffs first set of requests for admissions to defendant mississippi form

- Interrogatories requests document form

- Complaint mississippi 497314533 form

- Recusal 497314534 form

- Affidavit mississippi form

Find out other Fillable Online KANSAS BUSINESS TAX APPLICATION PART 1 Fax

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online