Ks 2022-2026 Form

Understanding the Kansas Business Tax Application

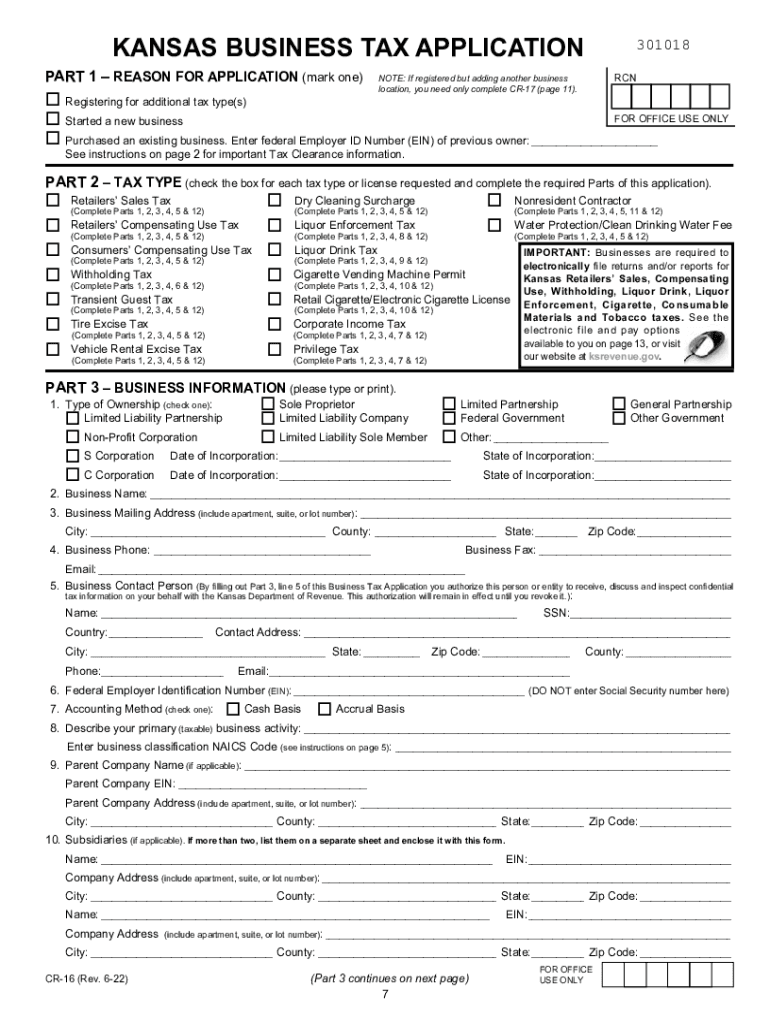

The Kansas Business Tax Application is a crucial document for businesses operating in the state. This application, often referred to as the KS 1216, is used to register a business with the Kansas Department of Revenue. It collects essential information about the business, including its name, address, and type of business entity. Proper completion of this form ensures that businesses comply with state tax regulations and can operate legally within Kansas.

Steps to Complete the Kansas Business Tax Application

Completing the Kansas Business Tax Application involves several key steps:

- Gather necessary information about your business, including the legal name, address, and federal Employer Identification Number (EIN).

- Determine the type of business entity you are registering, such as a corporation, partnership, or sole proprietorship.

- Fill out the KS 1216 form accurately, ensuring all sections are completed to avoid delays.

- Review the completed application for accuracy and completeness.

- Submit the application either online, by mail, or in person at your local Department of Revenue office.

Legal Use of the Kansas Business Tax Application

The Kansas Business Tax Application is legally binding once submitted. It serves as an official record of your business registration with the state. To ensure its legal validity, the application must be completed in accordance with state regulations. This includes providing accurate information and adhering to deadlines for submission. Compliance with these legal requirements protects your business from potential penalties and ensures your ability to operate within Kansas.

Important Filing Deadlines for the Kansas Business Tax Application

Filing deadlines for the Kansas Business Tax Application vary based on the type of business entity and the specific tax obligations. Generally, new businesses should submit their application before commencing operations to avoid late fees. It is advisable to check the Kansas Department of Revenue's official website for the most current deadlines and any additional requirements that may apply.

Required Documents for the Kansas Business Tax Application

When completing the Kansas Business Tax Application, certain documents may be required to support your submission. These documents typically include:

- Federal Employer Identification Number (EIN) confirmation letter from the IRS.

- Operating agreements or articles of incorporation for corporations and LLCs.

- Identification documents for business owners or partners.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods for the Kansas Business Tax Application

The Kansas Business Tax Application can be submitted through various methods, providing flexibility for business owners:

- Online: Submit the application through the Kansas Department of Revenue's online portal for immediate processing.

- By Mail: Send the completed form to the appropriate address listed on the application.

- In-Person: Visit your local Department of Revenue office to submit the application directly.

Quick guide on how to complete ks 1216

Complete ks 1216 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly option to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents rapidly without any hold-ups. Manage ks form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign kansas business tax application with ease

- Obtain kansas ks cr and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign kansas business application and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas tax application

Related searches to you kansas business

Create this form in 5 minutes!

People also ask publication ks 1216

-

What is the Kansas business tax application and how does it work?

The Kansas business tax application is a streamlined platform that allows businesses to manage their tax filings and payments efficiently. By utilizing airSlate SignNow, businesses can easily eSign documents related to their tax applications, ensuring compliance and accuracy. This solution also helps users track deadlines and stay organized throughout the filing process.

-

How much does the Kansas business tax application cost?

The Kansas business tax application offered through airSlate SignNow is priced competitively to provide cost-effective solutions for businesses. Pricing plans vary based on the features and volume of documents you need to manage. Reviewing the various subscription options will help you find the plan that best suits your business needs.

-

What features are included in the Kansas business tax application?

The Kansas business tax application includes features such as eSigning, document templates, and real-time collaboration. Users can upload tax documents, invite colleagues for review, and ensure all necessary signatures are obtained quickly. These features help streamline the tax filing process and enhance overall productivity.

-

What are the benefits of using the Kansas business tax application?

Using the Kansas business tax application can signNowly reduce the time and effort needed to file taxes. With its intuitive interface and electronic signing capabilities, businesses can eliminate paperwork and minimize errors. Additionally, this efficient solution provides better tracking of submissions and deadlines.

-

Can the Kansas business tax application integrate with other software?

Yes, the Kansas business tax application from airSlate SignNow offers integrations with popular accounting and business management software. This ensures that users can sync their tax information across platforms, which simplifies financial reporting and management processes. Check our integration list for specific compatibility.

-

Is the Kansas business tax application secure?

Absolutely. The Kansas business tax application prioritizes data security by employing advanced encryption protocols and compliance with legal regulations. Users can trust that their sensitive tax documents are protected while sharing and storing them in the airSlate SignNow system.

-

How can businesses get started with the Kansas business tax application?

Getting started with the Kansas business tax application is easy. Simply sign up for an airSlate SignNow account, choose the appropriate subscription plan, and begin uploading your tax documents. The user-friendly interface guides you through the process of eSigning and submitting your applications.

Get more for ks form

Find out other kansas business tax application

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure