Pub KS 1216 Business Tax Application Rev 5 20 an Important Step in Starting a Business is to Select the Type of Business Structu 2020-2026

Understanding the Kansas Business Tax Application (Pub KS 1216)

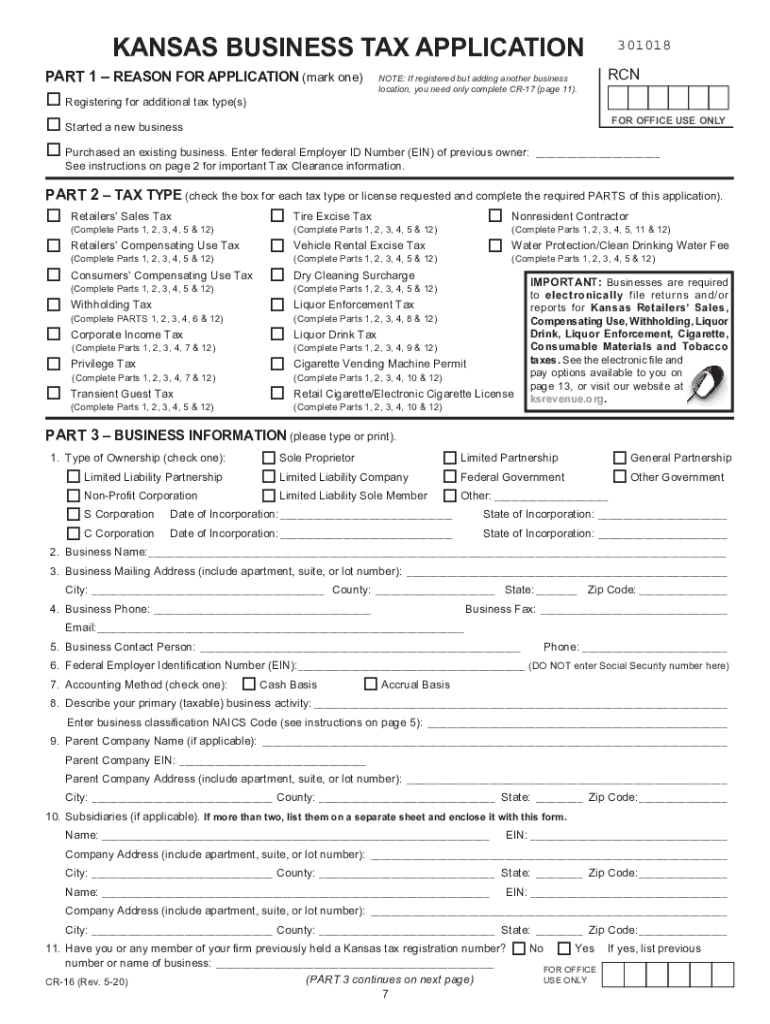

The Kansas Business Tax Application, also known as Pub KS 1216, is a crucial document for businesses operating in Kansas. This form is essential for registering your business with the Kansas Department of Revenue and is a vital step in ensuring compliance with state tax regulations. The application collects necessary information about the business structure, ownership, and tax obligations. Understanding this form is fundamental for anyone looking to start or maintain a business in Kansas.

Steps to Complete the Kansas Business Tax Application

Filling out the Kansas Business Tax Application involves several key steps:

- Gather necessary information about your business, including the legal name, address, and type of business entity (e.g., LLC, corporation, partnership).

- Provide details about the owners or partners, including Social Security numbers and contact information.

- Indicate the nature of your business activities and any applicable tax classifications.

- Review the form for accuracy before submission to avoid delays or penalties.

Completing these steps carefully will help ensure that your application is processed smoothly.

Required Documents for the Kansas Business Tax Application

When submitting the Kansas Business Tax Application, it is important to have the following documents ready:

- Proof of business registration (if applicable).

- Identification documents for all business owners or partners.

- Any previous tax documents related to the business.

- Supporting documents that clarify the business structure and operations.

Having these documents prepared will facilitate a more efficient application process.

Legal Use of the Kansas Business Tax Application

The Kansas Business Tax Application must be completed in accordance with state laws to ensure its legal validity. This includes providing accurate information and adhering to all requirements set forth by the Kansas Department of Revenue. An eSignature can be used to sign the application electronically, provided it meets the standards set by the ESIGN Act and UETA. This legal framework ensures that electronic signatures are recognized and enforceable in the same manner as traditional handwritten signatures.

Form Submission Methods for the Kansas Business Tax Application

You can submit the Kansas Business Tax Application in several ways:

- Online through the Kansas Department of Revenue's website, which allows for quick processing.

- By mail, sending the completed form to the appropriate department address.

- In-person at designated state offices, where assistance may be available.

Choosing the right submission method can impact the speed and efficiency of your application processing.

Eligibility Criteria for the Kansas Business Tax Application

Eligibility to file the Kansas Business Tax Application generally includes:

- Any individual or entity planning to conduct business within Kansas.

- Businesses that meet the state’s revenue thresholds for tax registration.

- Entities that require a tax identification number for compliance with state tax laws.

Understanding these criteria can help ensure that your business is properly registered and compliant with state regulations.

Quick guide on how to complete pub ks 1216 business tax application rev 5 20 an important step in starting a business is to select the type of business

Complete Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu effortlessly on any gadget

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without any holdups. Manage Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu without stress

- Find Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu and ensure excellent communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pub ks 1216 business tax application rev 5 20 an important step in starting a business is to select the type of business

Create this form in 5 minutes!

How to create an eSignature for the pub ks 1216 business tax application rev 5 20 an important step in starting a business is to select the type of business

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the kansas business tax application?

The kansas business tax application is a streamlined system designed to simplify the filing and management of business taxes in Kansas. It allows businesses to apply for various tax types electronically, making the process more efficient and less prone to errors.

-

How can airSlate SignNow help with the kansas business tax application?

airSlate SignNow empowers businesses by facilitating the electronic signing and sending of documents related to the kansas business tax application. This digital solution minimizes paperwork and speeds up the filing process, ensuring that businesses can easily manage their tax obligations.

-

Are there any costs associated with using airSlate SignNow for the kansas business tax application?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. Each plan provides access to essential features that facilitate the kansas business tax application process, ensuring you get valuable tools at a competitive price.

-

What features does airSlate SignNow offer to assist with the kansas business tax application?

Key features of airSlate SignNow include eSignature capabilities, document templates, and secure cloud storage. These features simplify compliance with the kansas business tax application process, allowing businesses to manage their documents more effectively.

-

What are the benefits of using airSlate SignNow for the kansas business tax application?

Using airSlate SignNow for the kansas business tax application can lead to signNow time savings and improved accuracy. With its user-friendly interface and electronic signing features, businesses can complete their tax forms quicker and reduce the risk of mailing delays or lost documents.

-

Can airSlate SignNow integrate with other tools for the kansas business tax application?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Microsoft Office, and various accounting software. This interoperability allows users to enhance their workflow when managing their kansas business tax application.

-

Is the kansas business tax application secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes security by implementing industry-standard encryption protocols and compliance measures. This ensures that all information related to your kansas business tax application is kept safe and confidential throughout the process.

Get more for Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu

- Legal last will and testament form for divorced and remarried person with mine yours and ours children wisconsin

- Legal last will and testament form with all property to trust called a pour over will wisconsin

- Written revocation of will wisconsin form

- Last will and testament for other persons wisconsin form

- Notice to beneficiaries of being named in will wisconsin form

- Estate planning questionnaire and worksheets wisconsin form

- Document locator and personal information package including burial information form wisconsin

- Demand to produce copy of will from heir to executor or person in possession of will wisconsin form

Find out other Pub KS 1216 Business Tax Application Rev 5 20 An Important Step In Starting A Business Is To Select The Type Of Business Structu

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself