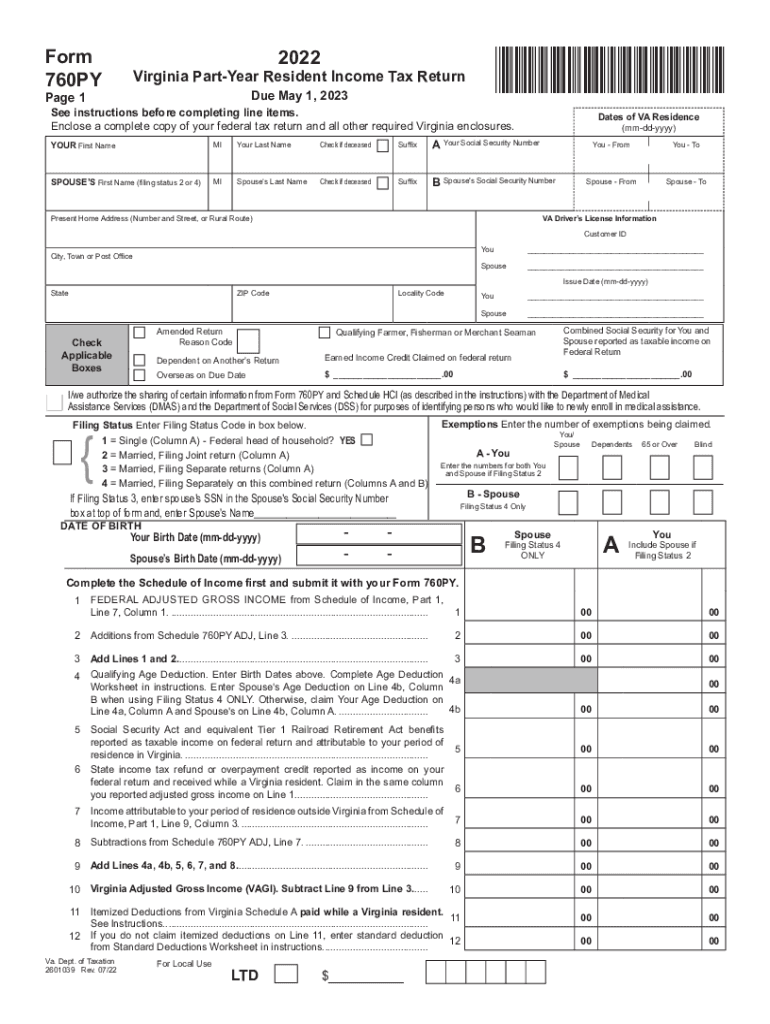

Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return 2022

What is the Virginia Form 760PY?

The Virginia Form 760PY is the Part-Year Resident Income Tax Return used by individuals who have moved into or out of Virginia during the tax year. This form allows taxpayers to report income earned while they were residents of Virginia, as well as any income earned while they were residents of another state. Understanding this form is essential for accurately calculating state income tax obligations.

Taxpayers must provide details about their residency status, income sources, and any deductions or credits they may qualify for. The form is specifically designed for those who have not been residents for the entire year, ensuring that they only pay taxes on income earned while living in Virginia.

Steps to Complete the Virginia Form 760PY

Completing the Virginia Form 760PY involves several key steps to ensure accuracy and compliance with state tax laws. Follow these steps to fill out the form correctly:

- Gather Required Documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine Residency Status: Clearly identify the periods during which you were a resident of Virginia and when you were a resident of another state.

- Report Income: Fill in the income section of the form, including all sources of income earned during your residency in Virginia.

- Calculate Deductions: Identify any deductions you may qualify for, such as those for dependents or specific expenses.

- Review and Sign: Carefully review the completed form for accuracy and sign it before submission.

How to Obtain the Virginia Form 760PY

The Virginia Form 760PY can be obtained through multiple channels to ensure accessibility for all taxpayers. Here are the ways to access the form:

- Virginia Department of Taxation Website: The form is available for download in PDF format from the official state tax website.

- Local Tax Offices: Taxpayers can visit local tax offices or public libraries to obtain physical copies of the form.

- Tax Preparation Software: Many tax preparation software programs include the Form 760PY, allowing users to complete it electronically.

State-Specific Rules for the Virginia Form 760PY

When filing the Virginia Form 760PY, it is crucial to be aware of state-specific rules that may affect your tax return. These rules include:

- Tax Rates: Virginia has a progressive income tax rate, which means that the tax rate increases with higher income levels.

- Residency Definitions: Understanding how Virginia defines residency is essential for accurate reporting. Part-year residents must clearly delineate their time spent in and out of the state.

- Filing Deadlines: The deadline for filing the Form 760PY typically aligns with the federal tax filing deadline, but it is important to verify specific dates each year.

Legal Use of the Virginia Form 760PY

The legal use of the Virginia Form 760PY is governed by state tax laws, which require accurate reporting of income and adherence to filing deadlines. This form serves as a legal document that taxpayers submit to the Virginia Department of Taxation, and it must be completed truthfully to avoid penalties.

Taxpayers should be aware that submitting false information can lead to legal consequences, including fines or audits. Therefore, it is advisable to maintain thorough records and consult with a tax professional if there are uncertainties regarding the form or tax obligations.

Quick guide on how to complete 2022 form 760py virginia part year resident income tax return virginia part year resident income tax return 2022

Prepare Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return effortlessly on any device

Online document management has gained tremendous popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to update and eSign Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return with ease

- Obtain Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and possesses the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 760py virginia part year resident income tax return virginia part year resident income tax return 2022

Create this form in 5 minutes!

People also ask

-

Does Virginia have state income tax for residents?

Yes, Virginia does have a state income tax for residents. The income tax rates vary depending on your income level, ranging from 2% to 5.75%. It’s important to understand your tax obligations and how they may affect your financial decisions.

-

How does airSlate SignNow help with document management in Virginia?

airSlate SignNow streamlines document management by allowing users to create, send, and eSign paperwork online efficiently. This is crucial for Virginia residents who need to manage tax documents and other important paperwork that may relate to state income tax.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to meet diverse business needs. Whether you're an individual or a business, you can select a plan that best fits your requirements, ensuring cost-effectiveness, especially when managing documents related to state income tax in Virginia.

-

Are there any specific features of airSlate SignNow that assist with taxation documents?

Yes, airSlate SignNow includes features that provide templates for tax documents, secure eSigning, and easy sharing options. These features are particularly helpful for Virginia residents who need to prepare and submit documents related to their state income tax responsibilities.

-

How does using airSlate SignNow benefit Virginia businesses?

For Virginia businesses, using airSlate SignNow can lead to increased efficiency and reduced turnaround times. By simplifying the eSigning process, businesses can focus on their operations rather than getting bogged down with paperwork, including aspects related to state income tax.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates with various platforms like Google Drive, Dropbox, and Microsoft Office. These integrations help Virginia residents and businesses manage their documents seamlessly, particularly when dealing with files that may relate to state income tax.

-

Can airSlate SignNow help me file my Virginia state income tax online?

While airSlate SignNow does not file taxes, it can help you organize and prepare your required documents for submission. This allows users to efficiently handle their state income tax filings in Virginia, ensuring all paperwork is in order.

Get more for Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return

- Ohio executor form

- Classification form for estates ohio

- Oh name form

- Ohio name change instructions and forms package for a minor ohio

- Name change instructions and forms package for a family ohio

- Information name change 497322506

- Ohio cost change form

- Authorization to release confidential information for name change ohio

Find out other Form 760PY Virginia Part Year Resident Income Tax Return Virginia Part Year Resident Income Tax Return

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now