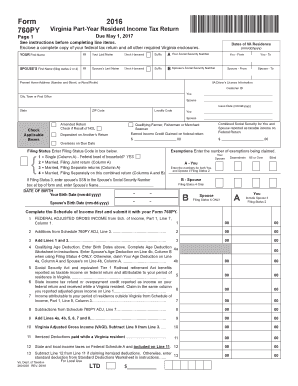

Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return 2016

What is the Virginia Form 760PY Part Year Resident Income Tax Return?

The Virginia Form 760PY is specifically designed for individuals who are considered part-year residents of Virginia. This form allows taxpayers to report their income earned while residing in Virginia during the tax year. It is essential for those who have moved into or out of the state, ensuring that they pay taxes only on the income earned while a resident. The form captures various income sources and deductions applicable to part-year residents, aligning with state tax regulations.

Steps to Complete the Virginia Form 760PY Part Year Resident Income Tax Return

Completing the Virginia Form 760PY involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine residency periods: Identify the dates you were a resident of Virginia during the tax year.

- Fill out the form: Input your income, deductions, and credits based on the time spent as a Virginia resident.

- Review for accuracy: Double-check all entries for completeness and correctness to avoid errors.

- Sign and date the form: Ensure that you sign the form, as an unsigned return may be considered invalid.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

How to Obtain the Virginia Form 760PY Part Year Resident Income Tax Return

The Virginia Form 760PY can be easily obtained through various channels. It is available on the official Virginia Department of Taxation website, where taxpayers can download the form directly. Additionally, physical copies may be available at local tax offices or public libraries. Ensure that you are using the most current version of the form to comply with state regulations.

Key Elements of the Virginia Form 760PY Part Year Resident Income Tax Return

Understanding the key elements of the Virginia Form 760PY is crucial for accurate filing. The form typically includes sections for:

- Personal information: Name, address, Social Security number, and residency dates.

- Income reporting: Total income earned during the residency period, including wages, interest, and dividends.

- Deductions and credits: Applicable deductions that can reduce taxable income, such as standard or itemized deductions.

- Tax calculation: A section to calculate the total tax owed based on the reported income and deductions.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Virginia Form 760PY. Generally, the deadline for submission aligns with the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions they may apply for if they cannot meet the initial deadline.

Form Submission Methods

Taxpayers have several options for submitting the Virginia Form 760PY. The form can be filed electronically through the Virginia Department of Taxation's online portal, which is a convenient option for many. Alternatively, individuals may choose to mail their completed form to the appropriate address provided in the instructions. In-person submissions may also be accepted at local tax offices, allowing for direct assistance if needed.

Quick guide on how to complete 2016 virginia form 760py part year resident income tax return 2016 form 760py virginia part year resident income tax return

Your assistance manual on how to prepare your Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return

If you wish to learn how to complete and submit your Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return, below are a few concise directions to simplify the tax processing experience.

To begin, you just need to sign up for your airSlate SignNow account to change how you manage documentation online. airSlate SignNow is a highly user-friendly and efficient document solution that allows you to modify, create, and finalize your income tax forms without hassle. With its editor, you can toggle between text, check boxes, and electronic signatures and go back to adjust details as necessary. Optimize your tax handling with advanced PDF editing, electronic signing, and user-friendly sharing.

Follow the instructions below to complete your Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return in moments:

- Establish your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding electronic signature (if applicable).

- Review your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and postpone reimbursements. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 virginia form 760py part year resident income tax return 2016 form 760py virginia part year resident income tax return

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Is it possible for an Indian resident to claim tax refund retroactively for the last 5 years where he has been paying excess taxes as part of TDS but never filed tax returns with income below tax limit?

Circular No. 9/2015 dated 9–6–2015 of Income Tax answers your question.The circular speaks about the instruction to subordinate Income Tax authorities for condondation of delay in filing of refund claim.The condonation application for refund should be made within six years from the end of assessment year for which refund application is being made. The Principal Commissioners of Income-tax/Commissioners of Income-tax (Pr.CsIT/CsIT) shall be vested with the powers of acceptance/rejection of such applications/claims if the amount of such claims is not more than Rs.10 lakhs for any one assessment year.As per the aforesaid circular, the condonation application should be disposed of within six months from the end of the month in which the application is received by the competent authority, as far as possible.Following further conditions need to be fulfilled:i. The income of the assessee is not assessable in the hands of any other person under any of the provisions of the Act.ii.No interest will be admissible on belated claim of refunds.iii.The refund has arisen as a result of excess tax deducted/collected at source and/or excess advance tax payment and/or excess payment of self-assessment tax as per the provisions of the Act.

Create this form in 5 minutes!

How to create an eSignature for the 2016 virginia form 760py part year resident income tax return 2016 form 760py virginia part year resident income tax return

How to create an electronic signature for the 2016 Virginia Form 760py Part Year Resident Income Tax Return 2016 Form 760py Virginia Part Year Resident Income Tax Return online

How to create an electronic signature for the 2016 Virginia Form 760py Part Year Resident Income Tax Return 2016 Form 760py Virginia Part Year Resident Income Tax Return in Chrome

How to make an electronic signature for signing the 2016 Virginia Form 760py Part Year Resident Income Tax Return 2016 Form 760py Virginia Part Year Resident Income Tax Return in Gmail

How to create an electronic signature for the 2016 Virginia Form 760py Part Year Resident Income Tax Return 2016 Form 760py Virginia Part Year Resident Income Tax Return from your smartphone

How to make an electronic signature for the 2016 Virginia Form 760py Part Year Resident Income Tax Return 2016 Form 760py Virginia Part Year Resident Income Tax Return on iOS

How to make an electronic signature for the 2016 Virginia Form 760py Part Year Resident Income Tax Return 2016 Form 760py Virginia Part Year Resident Income Tax Return on Android OS

People also ask

-

What is the Virginia Form 760PY Part Year Resident Income Tax Return?

The Virginia Form 760PY Part Year Resident Income Tax Return is a tax form designed for individuals who were residents of Virginia for part of the tax year. This form allows taxpayers to report their income accurately while considering the period of residency. Completing this form accurately is crucial to ensure compliance with Virginia tax regulations.

-

How can airSlate SignNow help with submitting the Virginia Form 760PY Part Year Resident Income Tax Return?

airSlate SignNow streamlines the process of completing and submitting the Virginia Form 760PY Part Year Resident Income Tax Return. Our platform allows you to easily fill out the form, eSign, and send it securely. This eliminates the hassle of paper forms and reduces the chances of errors in your submission.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a variety of features tailored for tax document management, including easy eSigning, document storage, real-time collaboration, and secure cloud access. These features ensure that you can manage your Virginia Form 760PY Part Year Resident Income Tax Return efficiently. This makes tax filing a seamless part of your workflow.

-

Is airSlate SignNow cost-effective for managing the Virginia Form 760PY Part Year Resident Income Tax Return?

Yes, airSlate SignNow is a cost-effective solution for managing the Virginia Form 760PY Part Year Resident Income Tax Return. Our pricing plans are designed to fit various needs, allowing you to save money while ensuring you have all the tools necessary for smooth tax filings. You benefit from a comprehensive solution without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow offers integration capabilities with various tax software and tools. This enables you to synchronize your data effortlessly and enhance the process of completing your Virginia Form 760PY Part Year Resident Income Tax Return. Integration helps in maintaining a smooth flow of information for all your tax-related tasks.

-

What are the benefits of using airSlate SignNow for my Virginia Form 760PY Part Year Resident Income Tax Return?

Using airSlate SignNow for your Virginia Form 760PY Part Year Resident Income Tax Return ensures a quick, efficient, and error-free submission process. The platform's user-friendly interface and robust features save time and reduce stress. Additionally, you can track your documents easily, providing peace of mind during tax season.

-

Is my data secure when using airSlate SignNow for my tax documents?

Yes, airSlate SignNow prioritizes data security, utilizing advanced encryption methods to safeguard your documents, including the Virginia Form 760PY Part Year Resident Income Tax Return. Our platform complies with industry standards to ensure your personal and financial information remains confidential. You can trust us to keep your data safe.

Get more for Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return

Find out other Virginia Form 760PY Part Year Resident Income Tax Return Form 760PY Virginia Part Year Resident Income Tax Return

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement