Virginia Form 760Py Instructions ESmart Tax 2020

Understanding the Virginia Form 760PY

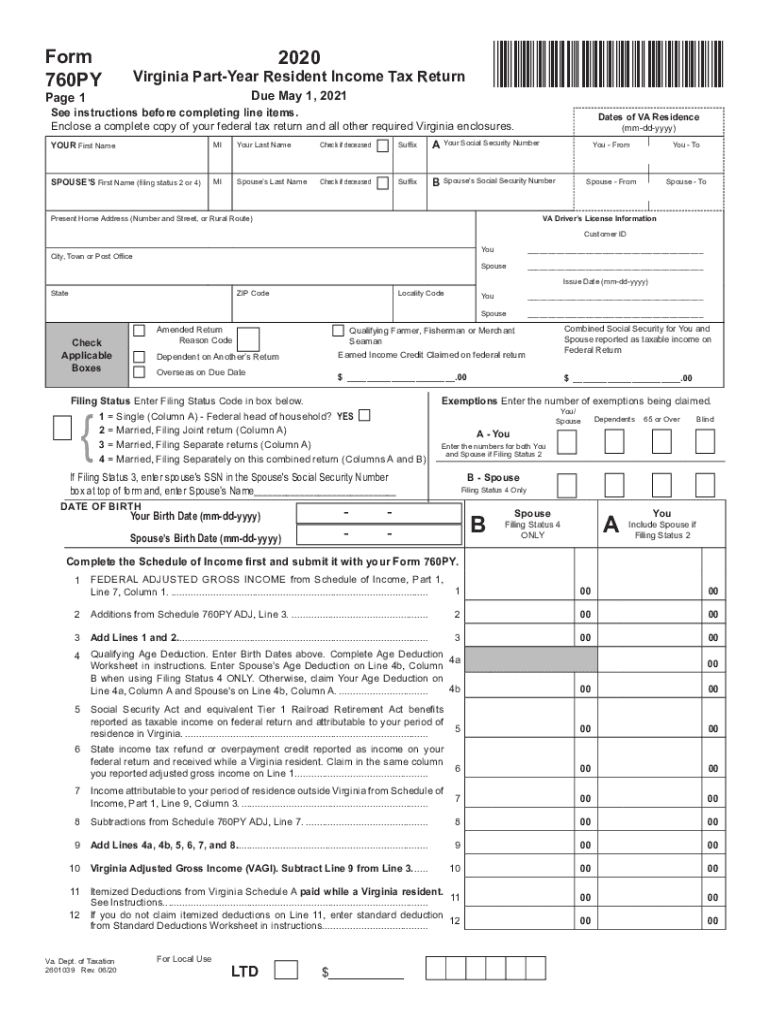

The Virginia Form 760PY is a crucial document for part-year residents who need to report their income and calculate their tax obligations in Virginia. This form allows individuals who have moved into or out of Virginia during the tax year to accurately report their income earned while residing in the state. It is essential to understand the specific requirements and instructions associated with this form to ensure compliance with state tax laws.

Steps to Complete the Virginia Form 760PY

Completing the Virginia Form 760PY involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine Residency Status: Establish the dates of your residency in Virginia to determine what income needs to be reported.

- Fill Out the Form: Accurately enter your income, deductions, and credits as instructed on the form.

- Review and Sign: Ensure all information is correct before signing the form, as inaccuracies can lead to penalties.

Required Documents for Filing

When preparing to file the Virginia Form 760PY, it is important to gather the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any other income sources

- Records of deductions and credits you plan to claim

Filing Deadlines for Virginia Form 760PY

Adhering to filing deadlines is critical to avoid penalties. The Virginia Form 760PY is typically due on May 1st of the year following the tax year. If May 1st falls on a weekend or holiday, the deadline is extended to the next business day. Ensure you are aware of these dates to maintain compliance.

Legal Use of the Virginia Form 760PY

The Virginia Form 760PY is legally recognized for tax reporting purposes. It is important to ensure that all information provided is accurate and complete to avoid legal issues. The form must be filed in accordance with Virginia state tax laws, which include specific guidelines for part-year residents.

Form Submission Methods

The Virginia Form 760PY can be submitted through various methods:

- Online: Many taxpayers choose to file electronically through approved e-filing software.

- Mail: The completed form can be mailed to the appropriate Virginia Department of Taxation address.

- In-Person: Taxpayers may also submit their forms in person at local tax offices.

Quick guide on how to complete virginia form 760py instructions esmart tax

Complete Virginia Form 760Py Instructions ESmart Tax seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Manage Virginia Form 760Py Instructions ESmart Tax on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Steps to modify and eSign Virginia Form 760Py Instructions ESmart Tax effortlessly

- Obtain Virginia Form 760Py Instructions ESmart Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to misplaced or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Virginia Form 760Py Instructions ESmart Tax and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia form 760py instructions esmart tax

Create this form in 5 minutes!

How to create an eSignature for the virginia form 760py instructions esmart tax

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is the tax form for farm rental income?

Form 4835 is used to report farm rental income and expenses for landowners who do not materially participate in the farming process. Income reported on Form 4835 includes crop or livestock shares converted to cash, crop insurance proceeds, federal disaster proceeds, CCC loans, and agricultural program payments.

-

What is the Virginia non resident tax form?

Nonresidents report their income in the same manner as residents, using Virginia Form 763.

-

What is a VA form 760?

Virginia Form 760, also known as Individual Income Tax Return is used to review and confirm the person's tax return. Download Virginia Form 760 to fill out and send it to the Commissioner of Revenue or directly to the Department of Taxation.

-

What is form CT 1040NR PY?

The 2021 Form CT-1040NR/PY, Connecticut Nonresident and Part-Year Resident Income Tax Return Instructions, contains information about the Department of Revenue Services' (DRS) Taxpayer Service Center (TSC).

-

How do I file a nonresident tax return in Virginia?

File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.

-

What is tax form 760PY?

Part-Year Residents of Virginia file a Form 760PY. (A person is considered a part-year resident of Virginia if they lived in VA for less than 183 days AND did not return once they left.

-

How does Virginia pass through entity tax work?

PTET Overview The PTE law effectively allows qualifying pass-through entities, for taxable years 2021 through 2025, to make an annual election to pay an entity level income tax for the period covered by the return at the individual income tax rate of 5.75%.

-

Is Virginia tax rebate taxable?

Do you need to pay taxes on the rebate? If you took the standard deduction, you won't need to take any action on your federal return related to the rebate. If you itemized your deductions, you may be required to report the rebate amount you received as income on your federal return, depending on your circumstances.

Get more for Virginia Form 760Py Instructions ESmart Tax

Find out other Virginia Form 760Py Instructions ESmart Tax

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word