Form 8862 Rev December Information to Claim Certain Credits After Disallowance 2022

What is the form 8862?

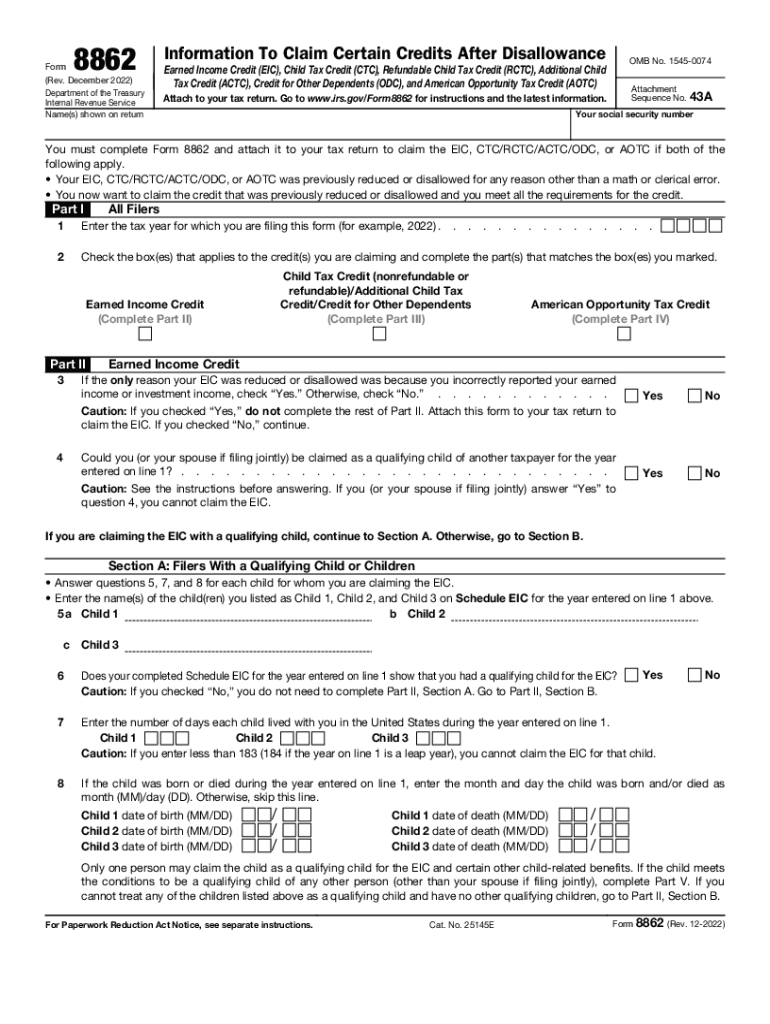

The form 8862, officially titled "Information to Claim Certain Credits After Disallowance," is a tax form used by individuals who have previously had certain tax credits disallowed. This form allows taxpayers to provide necessary information to the IRS to claim credits such as the Earned Income Tax Credit (EITC) or the Child Tax Credit after they have been denied in prior years. Understanding the purpose of this form is crucial for taxpayers seeking to reclaim these benefits.

How to use the form 8862

Using the form 8862 involves several steps to ensure that all required information is accurately provided. Taxpayers must fill out the form with their personal details, including Social Security numbers and the specific credits they are claiming. It is essential to carefully review the eligibility criteria for each credit and provide any additional documentation that may be requested by the IRS. Once completed, the form should be submitted along with the taxpayer's tax return.

Steps to complete the form 8862

Completing the form 8862 requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including Social Security numbers for yourself and any dependents.

- Review the instructions provided with the form to understand eligibility requirements.

- Fill out the form, ensuring that all sections are completed accurately.

- Attach any required documentation that supports your claim for the credits.

- Submit the form along with your tax return, either electronically or by mail.

Legal use of the form 8862

The legal use of the form 8862 is governed by IRS regulations. Taxpayers must ensure that they are eligible to claim the credits and that they have complied with all IRS guidelines regarding previous disallowances. Failing to provide accurate information or attempting to claim credits without eligibility can result in penalties or further disallowance of credits. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of using this form.

Eligibility criteria for the form 8862

To use the form 8862, taxpayers must meet specific eligibility criteria. Generally, this includes having previously claimed a credit that was disallowed and being able to demonstrate eligibility for that credit in the current tax year. Factors such as income level, filing status, and the number of qualifying children may also affect eligibility. It is important for taxpayers to review these criteria carefully to ensure compliance before submitting the form.

IRS guidelines for the form 8862

The IRS provides detailed guidelines for completing and submitting the form 8862. These guidelines outline the necessary information required, the process for submission, and the importance of accuracy in reporting. Taxpayers are encouraged to consult the IRS website or the instructions accompanying the form for the most current information and updates regarding any changes in requirements or procedures.

Quick guide on how to complete form 8862 rev december 2022 information to claim certain credits after disallowance

Complete Form 8862 Rev December Information To Claim Certain Credits After Disallowance effortlessly on any device

Online document management has gained traction among companies and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8862 Rev December Information To Claim Certain Credits After Disallowance on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form 8862 Rev December Information To Claim Certain Credits After Disallowance without stress

- Locate Form 8862 Rev December Information To Claim Certain Credits After Disallowance and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8862 Rev December Information To Claim Certain Credits After Disallowance and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8862 rev december 2022 information to claim certain credits after disallowance

Create this form in 5 minutes!

People also ask

-

What is Form 8862 and why is it important?

Form 8862 is used by taxpayers who have previously lost their eligibility for the Earned Income Tax Credit (EITC) to reclaim their eligibility. Completing Form 8862 correctly can help you receive tax refunds that you may otherwise miss out on. Understanding how to fill out Form 8862 is crucial for ensuring compliance with IRS rules.

-

How does airSlate SignNow simplify filling out Form 8862?

AirSlate SignNow provides an intuitive platform that allows users to fill out Form 8862 electronically, streamlining the entire process. With features like template management and easy document sharing, you can complete Form 8862 quickly and accurately. This reduces the risk of errors that can lead to processing delays or rejections.

-

Is there a cost associated with accessing Form 8862 through airSlate SignNow?

While airSlate SignNow offers a variety of pricing plans, accessing Form 8862 is included in the subscription at no additional cost. The platform is designed to provide cost-effective solutions, allowing users to manage all their essential documents, including Form 8862, without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 8862?

AirSlate SignNow offers features such as eSignature capabilities, automated workflows, and customizable templates that streamline the process of completing Form 8862. These tools not only enhance efficiency but also ensure your documents are secure and compliant. You’ll find it easier to manage your tax documents with these robust functionalities.

-

Can I integrate airSlate SignNow with other software for filing Form 8862?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software solutions, making it easy to file Form 8862 alongside your other tax documents. This feature allows for streamlined data transfer and reduces the time spent on manual entry, ensuring your submissions are both quick and accurate.

-

What are the benefits of using airSlate SignNow for Form 8862?

Using airSlate SignNow for Form 8862 offers several benefits, including a user-friendly interface, secure storage, and the ability to track the status of your document. This ensures you remain organized during tax season. Moreover, electronic signatures on Form 8862 help expedite the approval process with the IRS.

-

How secure is my information when using airSlate SignNow for Form 8862?

AirSlate SignNow prioritizes security, employing encryption and robust authentication methods to protect your information when filling out Form 8862. All data is stored securely to prevent unauthorized access, ensuring your sensitive tax information remains confidential throughout the process.

Get more for Form 8862 Rev December Information To Claim Certain Credits After Disallowance

- Special warranty deed limited liability company to limited liability company oklahoma form

- Transfer of deed on death oklahoma form

- Child support in oklahoma form

- Quitclaim deed trust to an individual oklahoma form

- Warranty deed with form

- Oklahoma affidavit form

- Oklahoma quitclaim deed form

- Special warranty deed corporation to individual oklahoma form

Find out other Form 8862 Rev December Information To Claim Certain Credits After Disallowance

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online