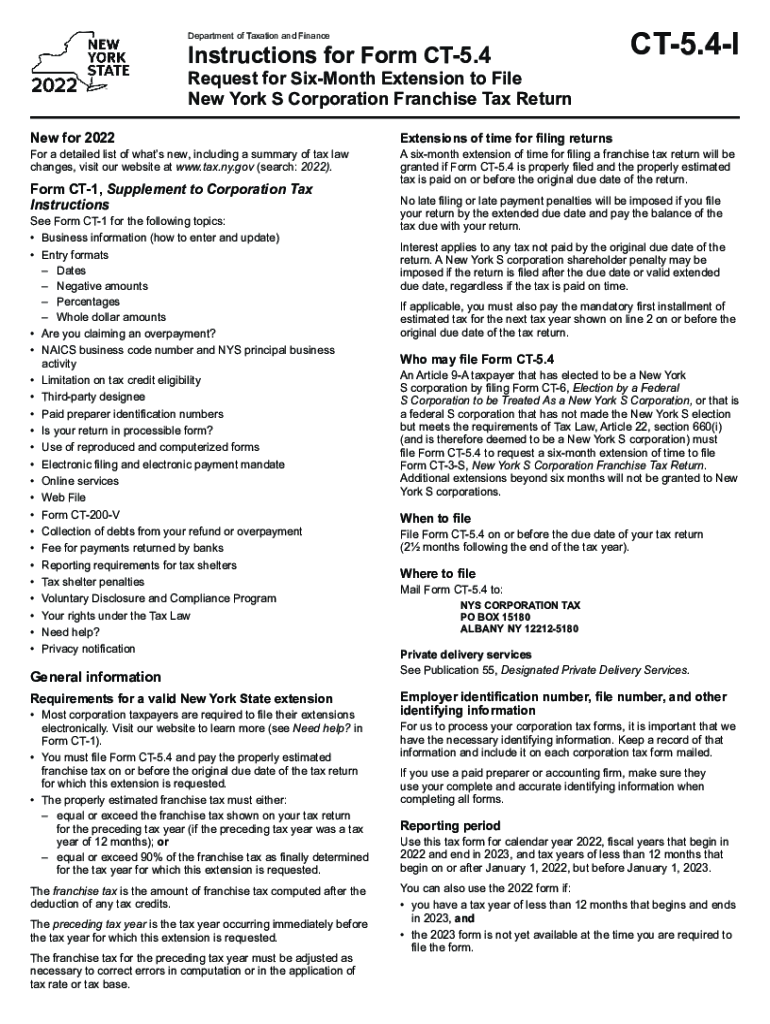

Department of Taxation and Finance Instructions for Form CT 5 CT 5 I 2022

What is the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I

The Department of Taxation and Finance Instructions for Form CT 5 CT 5 I provide essential guidance for taxpayers in New York State who are required to file this specific form. This form is primarily used for claiming a refund of overpaid New York State corporation tax. The instructions outline the necessary steps, eligibility criteria, and specific information needed to ensure accurate completion and submission of the form. Understanding these instructions is crucial for taxpayers to navigate the filing process effectively and to comply with state tax regulations.

Steps to complete the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I

Completing the Department of Taxation and Finance Instructions for Form CT 5 CT 5 I involves several key steps:

- Gather all relevant financial documents, including previous tax returns and records of payments made.

- Review the eligibility criteria outlined in the instructions to ensure you qualify for a refund.

- Fill out the form accurately, following the detailed instructions for each section.

- Double-check all entries for accuracy to avoid delays in processing.

- Sign and date the form as required, ensuring that all necessary signatures are included.

- Submit the completed form either electronically or via mail, depending on your preference and the guidelines provided.

Legal use of the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I

The legal use of the Department of Taxation and Finance Instructions for Form CT 5 CT 5 I is governed by New York State tax laws. The instructions serve as a legal framework for taxpayers to follow when submitting their claims for refunds. Proper adherence to these instructions ensures that the form is executed correctly, which is essential for the form to be considered valid and legally binding. It is important for taxpayers to understand their rights and responsibilities under state law when using this form.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Department of Taxation and Finance Instructions for Form CT 5 CT 5 I. The submission methods include:

- Online Submission: Taxpayers can file electronically through the New York State Department of Taxation and Finance website, which may offer faster processing times.

- Mail Submission: Completed forms can be mailed to the designated address provided in the instructions. It is advisable to use certified mail for tracking purposes.

- In-Person Submission: Taxpayers may also choose to submit the form in person at local tax offices, although this option may be limited based on current health guidelines.

Required Documents

When completing the Department of Taxation and Finance Instructions for Form CT 5 CT 5 I, certain documents are required to support your claim. These may include:

- Copies of prior tax returns.

- Documentation of payments made to New York State.

- Any correspondence from the Department of Taxation and Finance related to your tax account.

- Proof of eligibility for the refund being claimed.

Eligibility Criteria

To successfully file the Department of Taxation and Finance Instructions for Form CT 5 CT 5 I, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Having overpaid New York State corporation tax in the prior tax year.

- Filing the form within the designated time frame as stipulated in the instructions.

- Providing accurate and complete information on the form to support the refund claim.

Quick guide on how to complete department of taxation and finance instructions for form ct 5 ct 5 i

Optimize Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without issues. Administer Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I with ease

- Locate Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to confirm your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Edit and eSign Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance instructions for form ct 5 ct 5 i

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow related to Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

airSlate SignNow offers features that simplify the process of completing forms, including the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. With its intuitive interface, users can easily access templates, add signatures, and collaborate in real-time. This streamlines the workflow, ensuring compliance and accuracy in document management.

-

How does airSlate SignNow ensure compliance with Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

Our platform adheres to the latest regulations, ensuring that all documents comply with the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. This means that your eSigned documents will be legally binding and recognized by tax authorities. We regularly update our features to remain in line with evolving compliance standards.

-

Can I integrate airSlate SignNow with other applications while using Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

Yes, airSlate SignNow provides seamless integrations with various applications, enhancing your workflow when handling the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. Whether you use CRM systems, cloud storage solutions, or project management tools, our platform complements them effectively. This integration helps you automate the document signing process.

-

What pricing options are available for using airSlate SignNow with Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

airSlate SignNow offers flexible pricing plans to accommodate different business needs while working with the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. From basic plans for small businesses to premium options for larger organizations, you can choose the one that fits your company’s requirements. Additionally, trial options may be available so you can test the service before committing.

-

How does airSlate SignNow benefit users who frequently need to complete the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

Using airSlate SignNow signNowly reduces the time and effort required to complete the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. With our easy-to-use electronic signature feature, users can expedite the signing process and ensure that all stakeholders can collaborate smoothly. This efficiency not only saves time but also enhances accuracy in form completion.

-

Is airSlate SignNow suitable for individuals needing to fill out Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

Absolutely! airSlate SignNow is designed to cater to both businesses and individuals needing to fill out the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. Our user-friendly interface allows anyone to easily complete and eSign documents, making it a great solution for personal tax needs as well as business requirements.

-

What support options are available for users of airSlate SignNow dealing with Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I?

airSlate SignNow provides a variety of support options for users working on the Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I. This includes live chat, email support, and an extensive knowledge base with tutorials and FAQs. Our goal is to ensure that you have all the assistance you need to effectively utilize our platform.

Get more for Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I

- Residential lease or rental agreement for month to month oklahoma form

- Residential rental lease agreement oklahoma form

- Tenant welcome letter oklahoma form

- Warning of default on commercial lease oklahoma form

- Warning of default on residential lease oklahoma form

- Landlord tenant closing statement to reconcile security deposit oklahoma form

- Name change notification package for brides court ordered name change divorced marriage for oklahoma oklahoma form

- Name change notification form oklahoma

Find out other Department Of Taxation And Finance Instructions For Form CT 5 CT 5 I

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself