Form it 213 Claim for Empire State Child Credit Tax Year 2022

What is the Form IT 213 Claim For Empire State Child Credit Tax Year

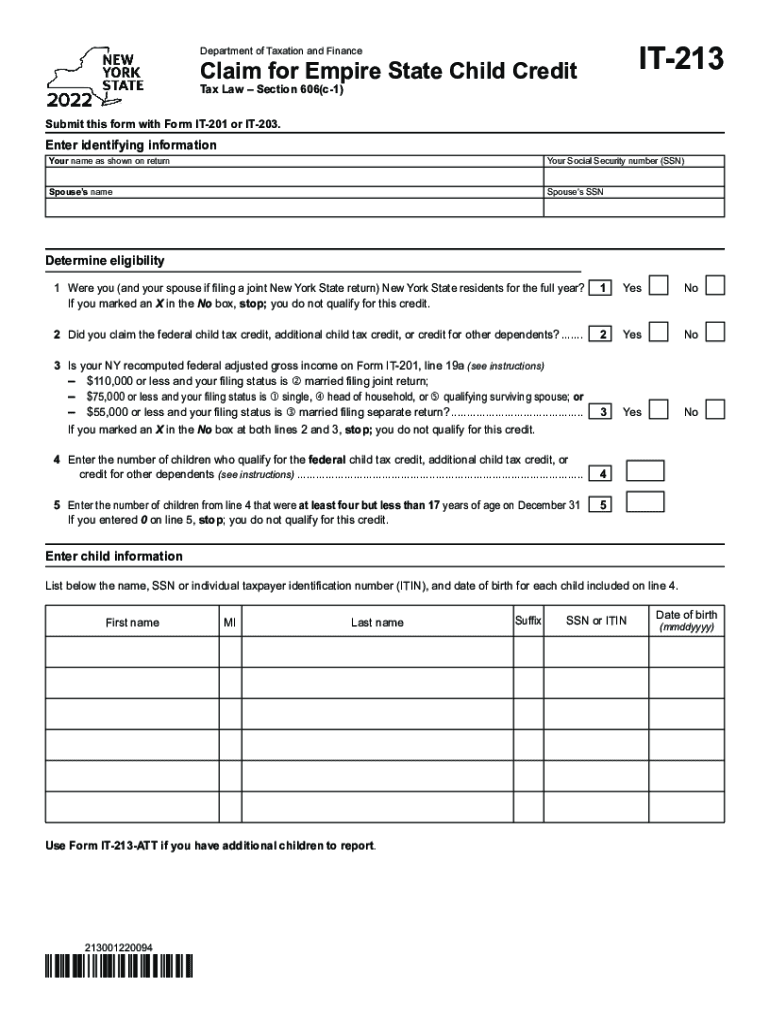

The Form IT 213 is a tax form used by residents of New York to claim the Empire State Child Credit for the tax year. This credit is designed to provide financial relief to families with children, helping to offset the costs associated with raising children. The form allows eligible taxpayers to receive a credit against their New York State income tax liability based on the number of qualifying children they have. Understanding the purpose and benefits of this form is crucial for families looking to maximize their tax benefits.

Steps to complete the Form IT 213 Claim For Empire State Child Credit Tax Year

Completing the Form IT 213 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your Social Security number, the Social Security numbers of your children, and any relevant income documentation. Next, fill out the personal information section accurately. Then, report your qualifying children in the designated section, ensuring that you meet the eligibility criteria outlined by New York State. Finally, review the form for completeness and accuracy before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the Empire State Child Credit using Form IT 213, certain eligibility criteria must be met. Taxpayers must have a qualifying child, defined as a dependent under the age of 17 at the end of the tax year. Additionally, the taxpayer's adjusted gross income must fall within specified limits to receive the full credit. It is important to review these criteria carefully to determine eligibility, as failure to meet them may result in denial of the credit.

How to obtain the Form IT 213 Claim For Empire State Child Credit Tax Year

The Form IT 213 can be obtained through various channels to ensure easy access for taxpayers. It is available for download directly from the New York State Department of Taxation and Finance website. Additionally, physical copies can be requested from local tax offices or public libraries. Ensuring you have the correct and most current version of the form is essential for accurate filing.

Required Documents

When completing the Form IT 213, certain documents are required to substantiate your claim. These include proof of income, such as W-2 forms or tax returns, and documentation supporting the relationship to the qualifying child, like birth certificates. Having these documents ready will facilitate a smoother filing process and help ensure that your claim is valid and complete.

Form Submission Methods

The Form IT 213 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the New York State Department of Taxation and Finance's e-filing system. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own timelines and requirements, so it is advisable to choose the one that best suits your situation.

Quick guide on how to complete form it 213 claim for empire state child credit tax year 2022

Complete Form IT 213 Claim For Empire State Child Credit Tax Year effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form IT 213 Claim For Empire State Child Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign Form IT 213 Claim For Empire State Child Credit Tax Year with ease

- Locate Form IT 213 Claim For Empire State Child Credit Tax Year and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your updates.

- Select how you would prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 213 Claim For Empire State Child Credit Tax Year to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 213 claim for empire state child credit tax year 2022

Create this form in 5 minutes!

People also ask

-

What are the IT 213 instructions for using airSlate SignNow?

The IT 213 instructions for using airSlate SignNow outline the steps needed to effectively send and eSign documents. These instructions provide guidance on setting up your account, navigating the user interface, and utilizing key features to streamline the signing process.

-

Are there any costs associated with obtaining IT 213 instructions?

There are no additional costs for obtaining the IT 213 instructions. As part of the airSlate SignNow service, users can access comprehensive guidance and support for free, ensuring that everyone can easily utilize the platform’s features without any hidden fees.

-

What features are included in the airSlate SignNow IT 213 instructions?

The IT 213 instructions include details on various features such as document templates, team collaboration tools, and customizable fields. These features are designed to enhance the signing experience and improve workflow efficiency for all users.

-

How can IT 213 instructions benefit my business?

Following the IT 213 instructions can signNowly boost your business's document management efficiency. By streamlining the signing process and providing clear guidance, these instructions help reduce turnaround times and increase overall productivity.

-

Can I integrate airSlate SignNow with other applications using IT 213 instructions?

Yes, the IT 213 instructions provide insights into how to integrate airSlate SignNow with various applications such as CRM systems, cloud storage, and productivity tools. This integration capability ensures that you can maintain a seamless workflow across your business applications.

-

Where can I find the most up-to-date IT 213 instructions?

The most up-to-date IT 213 instructions can be found on the official airSlate SignNow website. Regular updates ensure that users receive the latest guidance tailored to accommodate new features and enhancements that may roll out.

-

Is technical support available if I have questions about the IT 213 instructions?

Yes, airSlate SignNow offers technical support for users with questions about the IT 213 instructions. You can signNow out to our support team via chat, email, or phone, ensuring you receive the help you need to fully utilize the platform.

Get more for Form IT 213 Claim For Empire State Child Credit Tax Year

Find out other Form IT 213 Claim For Empire State Child Credit Tax Year

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later