New York Form it 213 Claim for Empire State Child Credit 2019

What is the New York Form IT-213 Claim For Empire State Child Credit

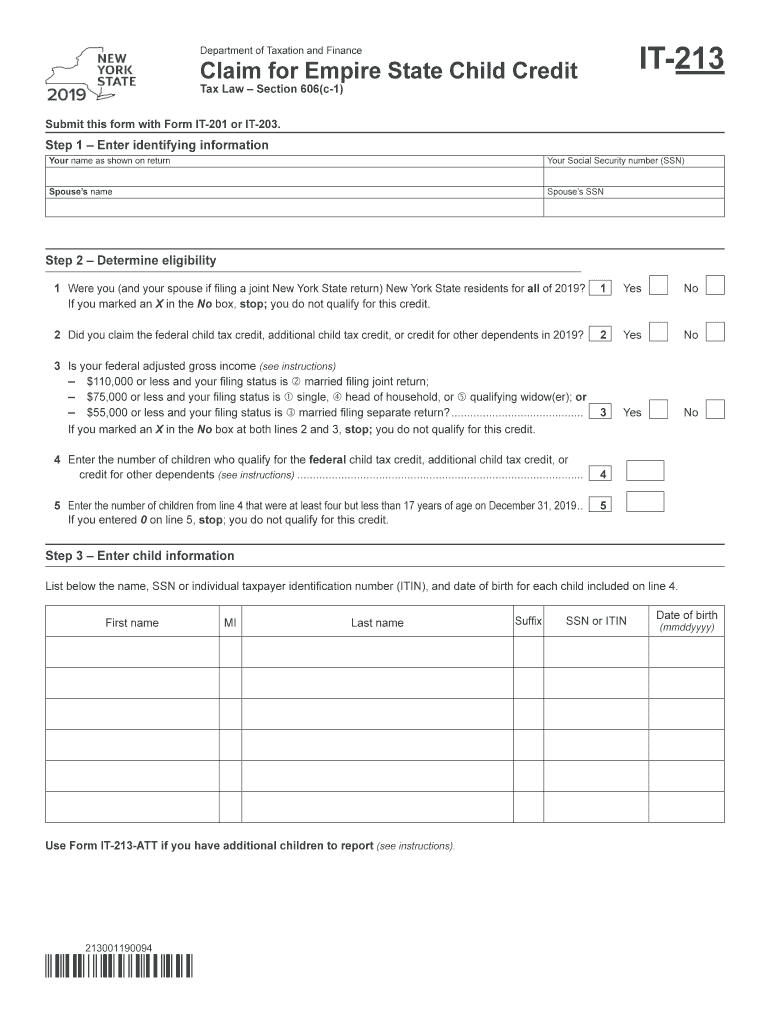

The New York Form IT-213 is a tax form used by residents to claim the Empire State Child Credit. This credit is designed to provide financial relief to families with qualifying children, helping to reduce the overall tax burden. Eligible taxpayers can receive a credit based on their income and the number of qualifying children, which can significantly impact their tax refund or liability. Understanding the purpose and benefits of this form is essential for maximizing potential savings during tax season.

Steps to Complete the New York Form IT-213 Claim For Empire State Child Credit

Completing the New York Form IT-213 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including Social Security numbers for each qualifying child and income information. Next, fill out the form by providing personal details, such as your name, address, and filing status. Then, calculate the credit amount based on the guidelines provided in the form instructions. Finally, review the completed form for any errors before submitting it to the New York State Department of Taxation and Finance.

Eligibility Criteria for the New York Form IT-213 Claim For Empire State Child Credit

To qualify for the Empire State Child Credit, taxpayers must meet specific eligibility criteria. This includes being a resident of New York State for the tax year in question, having a qualifying child under the age of 17, and meeting certain income thresholds. The credit is phased out for higher-income earners, so it is vital to review the income limits outlined in the form instructions. Additionally, taxpayers must have filed a New York State personal income tax return to claim the credit.

Required Documents for the New York Form IT-213 Claim For Empire State Child Credit

When preparing to file the New York Form IT-213, several documents are necessary to support your claim. These include:

- Social Security cards or numbers for each qualifying child

- Proof of residency in New York State

- Income documentation, such as W-2 forms or 1099 forms

- Any previous tax returns if applicable

Having these documents on hand will streamline the filing process and help ensure that your claim is processed efficiently.

Form Submission Methods for the New York Form IT-213 Claim For Empire State Child Credit

The New York Form IT-213 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the New York State Department of Taxation and Finance website

- Mailing the completed form to the designated address provided in the form instructions

- In-person submission at local tax offices, if available

Choosing the right submission method can help ensure timely processing of your claim.

Legal Use of the New York Form IT-213 Claim For Empire State Child Credit

The legal use of the New York Form IT-213 is governed by state tax laws. This form must be filled out accurately and truthfully to comply with legal requirements. Misrepresentation or errors can lead to penalties or delays in processing. It is essential to follow all instructions provided with the form and to maintain records of all submitted documents for future reference. Adhering to these legal guidelines ensures that taxpayers can confidently claim their credits without issues.

Quick guide on how to complete new york form it 213 claim for empire state child credit

Complete New York Form IT 213 Claim For Empire State Child Credit seamlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle New York Form IT 213 Claim For Empire State Child Credit on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to alter and eSign New York Form IT 213 Claim For Empire State Child Credit effortlessly

- Find New York Form IT 213 Claim For Empire State Child Credit and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and eSign New York Form IT 213 Claim For Empire State Child Credit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 213 claim for empire state child credit

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the New York Empire State?

airSlate SignNow is a digital signature platform that helps businesses streamline their document workflows. For companies operating in the New York Empire State, it provides a user-friendly solution to manage eSigning and document management efficiently.

-

How much does airSlate SignNow cost for businesses in the New York Empire State?

airSlate SignNow offers flexible pricing plans that cater to various business sizes in the New York Empire State. You can choose from monthly or annual subscriptions, making it a cost-effective solution for companies looking to optimize their document signing processes.

-

What features does airSlate SignNow offer for New York Empire State companies?

airSlate SignNow provides a robust set of features including template creation, document tracking, and team collaboration tools. These features are designed to streamline operations for businesses in the New York Empire State and enhance productivity.

-

Are there any specific benefits of using airSlate SignNow in the New York Empire State?

Using airSlate SignNow in the New York Empire State enables businesses to save time and reduce paper usage. Its intuitive interface allows users to quickly send and sign documents, improving efficiency and client satisfaction.

-

What integrations does airSlate SignNow support for users in the New York Empire State?

airSlate SignNow integrates seamlessly with many popular applications like Google Drive, Salesforce, and Dropbox. This allows businesses in the New York Empire State to enhance their existing workflows without disruption.

-

Is airSlate SignNow compliant with regulations for eSigning in the New York Empire State?

Yes, airSlate SignNow complies with federal and state regulations, ensuring that eSignatures are legally binding in the New York Empire State. This compliance provides businesses peace of mind when managing their digital document processes.

-

How can businesses in the New York Empire State get started with airSlate SignNow?

Getting started with airSlate SignNow is simple. Businesses in the New York Empire State can sign up for a free trial on the website, allowing them to explore its features and see how it can enhance their document management.

Get more for New York Form IT 213 Claim For Empire State Child Credit

Find out other New York Form IT 213 Claim For Empire State Child Credit

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure