SC Withholding File Number 2020

What is the SC Withholding File Number

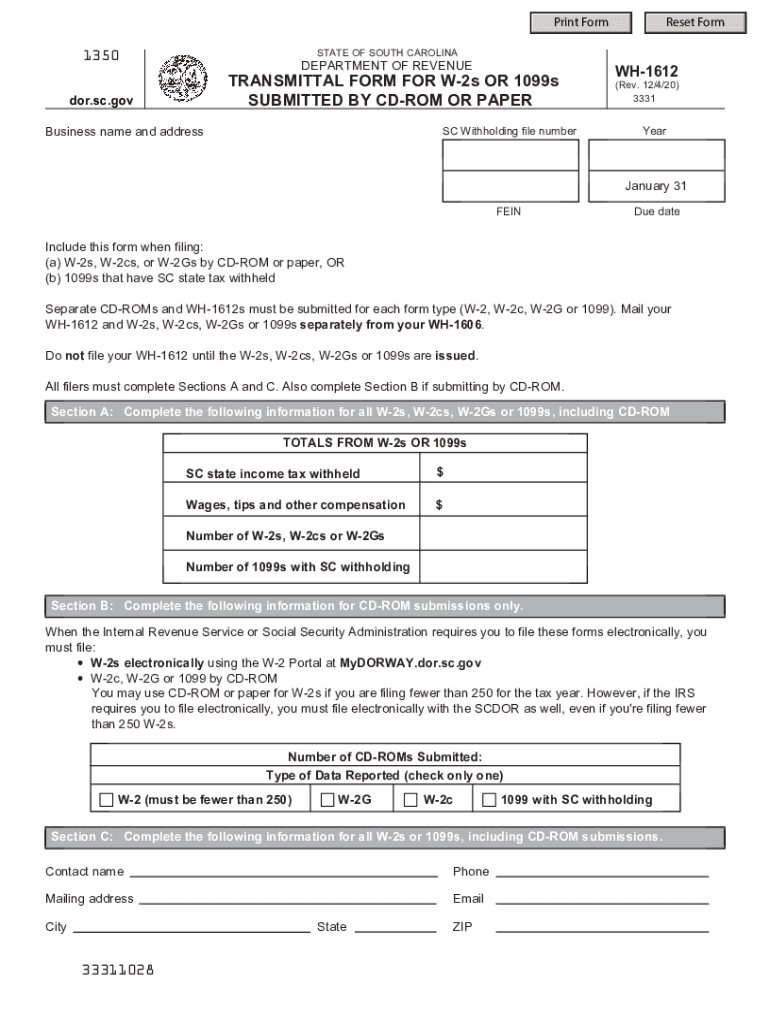

The SC Withholding File Number is a unique identifier assigned to businesses and employers in South Carolina for the purpose of reporting and remitting state income taxes withheld from employees' wages. This number is essential for ensuring compliance with state tax regulations and is used when filing the SC withholding paper form. It helps streamline the process of tax reporting and ensures that the state can accurately track withholding amounts from various employers.

How to Obtain the SC Withholding File Number

To obtain the SC Withholding File Number, businesses must register with the South Carolina Department of Revenue. This process typically involves completing a registration form, which can be done online or via mail. Employers will need to provide information such as their business name, address, and federal Employer Identification Number (EIN). Once the application is processed, the Department of Revenue will issue the SC Withholding File Number, which should be used in all future tax filings.

Key Elements of the SC Withholding File Number

The SC Withholding File Number consists of a series of digits that uniquely identify an employer within the state's tax system. Key elements include:

- Identification: Distinguishes each employer for tax purposes.

- Compliance: Ensures accurate reporting of withheld taxes.

- Tracking: Aids the state in monitoring tax collections from various sources.

Employers must ensure that this number is included on all relevant tax documents to avoid delays or issues with their filings.

Steps to Complete the SC Withholding File Number

Completing the SC Withholding File Number involves several key steps:

- Register with the South Carolina Department of Revenue: Fill out the required registration form.

- Provide necessary information: Include your business name, address, and EIN.

- Submit the application: Send the completed form online or via mail to the appropriate department.

- Receive your file number: Wait for the Department of Revenue to process your application and issue your SC Withholding File Number.

Following these steps ensures that your business is properly registered for withholding tax purposes.

Form Submission Methods (Online / Mail / In-Person)

Employers can submit the SC withholding paper form through various methods, ensuring flexibility based on their preferences:

- Online: Utilize the South Carolina Department of Revenue's online portal for electronic submission.

- Mail: Print and send the completed form to the designated address provided by the Department of Revenue.

- In-Person: Visit local Department of Revenue offices to submit the form directly.

Each method has its own processing times, so employers should choose the option that best fits their needs.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance with South Carolina tax regulations. Employers must be aware of the following important dates:

- Quarterly Filings: Employers are typically required to file withholding taxes quarterly, with deadlines falling on the last day of the month following the end of each quarter.

- Annual Reconciliation: An annual reconciliation of withheld taxes must be submitted by January thirty-first of the following year.

Staying informed about these deadlines helps avoid penalties and ensures timely compliance with state tax laws.

Quick guide on how to complete sc withholding file number

Complete SC Withholding File Number effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage SC Withholding File Number on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and eSign SC Withholding File Number without difficulty

- Obtain SC Withholding File Number and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Alter and eSign SC Withholding File Number and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc withholding file number

Create this form in 5 minutes!

How to create an eSignature for the sc withholding file number

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the filers sc withholding form, and why is it important?

The filers sc withholding form is a crucial document for businesses and employees in South Carolina to properly report and withhold state taxes. Understanding this form ensures compliance with state tax laws, helping filers avoid potential penalties and fines. Proper completion aids in accurate tax reporting and financial management.

-

How can airSlate SignNow help me with the filers sc withholding form?

airSlate SignNow offers a streamlined process for completing and eSigning the filers sc withholding form. Our platform allows you to fill out the form electronically, ensuring accuracy and speed. Additionally, you can securely send and receive the form, making tax filing easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for the filers sc withholding form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including the use of the filers sc withholding form. Our plans are cost-effective and designed to provide maximum value for document management and eSigning. You can choose a plan that suits your volume of forms and user requirements.

-

What features does airSlate SignNow provide for managing documents like the filers sc withholding form?

airSlate SignNow provides numerous features to enhance document management, including templates, automated workflows, and secure storage. You can easily create and customize the filers sc withholding form using our intuitive interface. Additionally, eSigning functionality ensures that your documents are legally binding and compliant.

-

Can I integrate airSlate SignNow with other tools for my filers sc withholding form needs?

Absolutely! airSlate SignNow offers integration with various business tools to enhance your workflow while managing forms like the filers sc withholding form. You can connect our platform with applications like Google Drive, Salesforce, and many others to centralize your document handling. This makes managing your tax documents more efficient.

-

Are there any benefits to using electronic signatures for the filers sc withholding form?

Using electronic signatures for the filers sc withholding form provides several benefits, including increased efficiency and reduced paperwork. With airSlate SignNow, you can sign documents from anywhere, saving time and resources. Electronic signatures are also legally binding, ensuring that your filings are valid and secure.

-

How secure is airSlate SignNow when handling the filers sc withholding form?

security is a top priority at airSlate SignNow. Our platform employs robust encryption and security measures to protect your sensitive data, including the filers sc withholding form. You can trust that your documents are safe, and your information stays confidential throughout the eSigning process.

Get more for SC Withholding File Number

- Chart foot print form

- Claimant workers compensation form

- Report workers compensation 497427887 form

- Supplementary report form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497427889 form

- Virginia workers compensation form

- Bill of sale of automobile and odometer statement virginia form

- Bill of sale for automobile or vehicle including odometer statement and promissory note virginia form

Find out other SC Withholding File Number

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free