Ky 42a740 2014

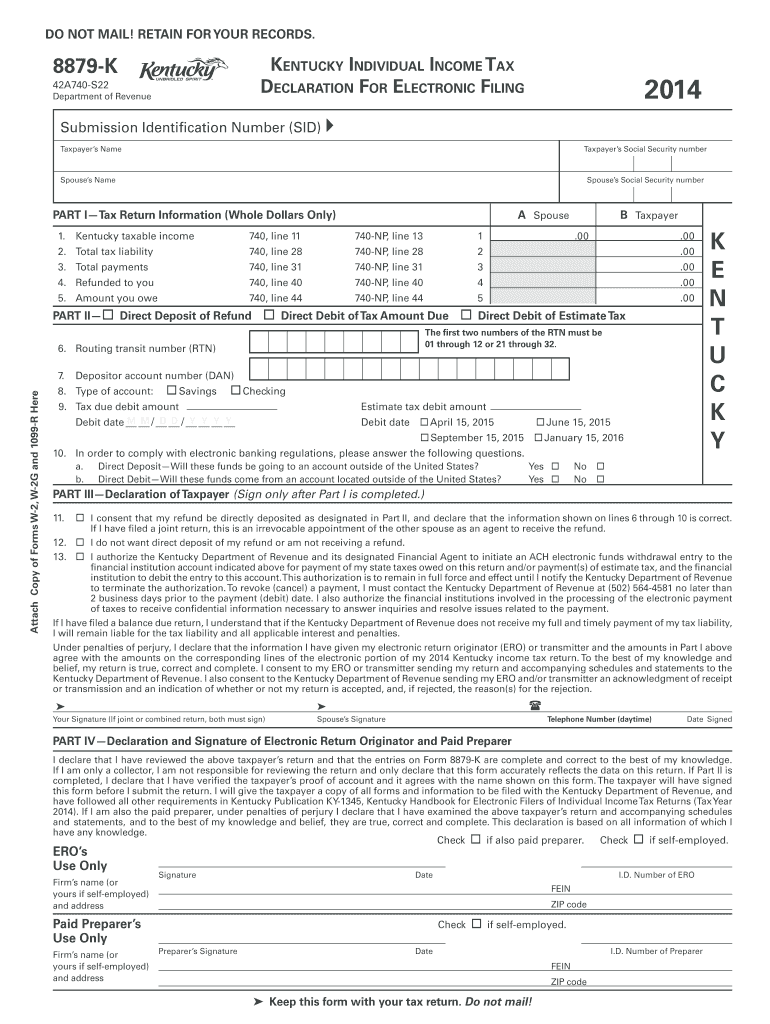

What is the KY 42A740?

The KY 42A740 is a specific form used in the state of Kentucky for electronic filing purposes. This form is typically associated with the state’s tax processes, particularly for individuals or businesses that need to report income or claim deductions electronically. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations.

How to Use the KY 42A740

Using the KY 42A740 involves filling out the required fields accurately to ensure that your electronic submission is processed smoothly. The form typically requires personal identification information, details about income, and any applicable deductions or credits. It is advisable to have all necessary documents on hand to facilitate the completion of the form.

Steps to Complete the KY 42A740

Completing the KY 42A740 can be broken down into several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Access the form through a secure electronic filing platform that supports state tax submissions.

- Fill in your personal information, ensuring accuracy in names, addresses, and Social Security numbers.

- Report your income and any deductions or credits you are eligible for.

- Review the completed form for any errors before submission.

- Submit the form electronically and save a copy for your records.

Legal Use of the KY 42A740

The KY 42A740 is legally binding when completed and submitted according to Kentucky state laws. To ensure its validity, it is important to comply with all relevant eSignature regulations, such as the ESIGN Act and UETA. These laws provide the framework that recognizes electronic signatures and documents as legally acceptable, provided they meet specific criteria.

Required Documents for the KY 42A740

When preparing to complete the KY 42A740, certain documents are essential to ensure accurate reporting. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts and documentation for any deductions or credits claimed.

- Previous tax returns for reference.

Form Submission Methods

The KY 42A740 can be submitted electronically, which is the preferred method for many taxpayers. This process typically involves using a secure online platform that is authorized by the state. Alternatively, the form can also be printed and mailed to the appropriate state tax office, though electronic submission is generally faster and more efficient.

Quick guide on how to complete 8879 k kentucky individual income tax declaration for electronic revenue ky

Effortlessly prepare Ky 42a740 on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Ky 42a740 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Ky 42a740 with ease

- Find Ky 42a740 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes necessitating new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ky 42a740 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8879 k kentucky individual income tax declaration for electronic revenue ky

Create this form in 5 minutes!

How to create an eSignature for the 8879 k kentucky individual income tax declaration for electronic revenue ky

How to create an eSignature for the 8879 K Kentucky Individual Income Tax Declaration For Electronic Revenue Ky in the online mode

How to generate an eSignature for the 8879 K Kentucky Individual Income Tax Declaration For Electronic Revenue Ky in Google Chrome

How to create an eSignature for signing the 8879 K Kentucky Individual Income Tax Declaration For Electronic Revenue Ky in Gmail

How to make an eSignature for the 8879 K Kentucky Individual Income Tax Declaration For Electronic Revenue Ky straight from your mobile device

How to make an eSignature for the 8879 K Kentucky Individual Income Tax Declaration For Electronic Revenue Ky on iOS devices

How to create an electronic signature for the 8879 K Kentucky Individual Income Tax Declaration For Electronic Revenue Ky on Android OS

People also ask

-

What is the ky 42a740 and how does it relate to airSlate SignNow?

The ky 42a740 is a designation for a specific feature within the airSlate SignNow platform. It allows users to streamline their document signing process, enhancing efficiency and compliance. By utilizing this feature, businesses can manage their digital signatures seamlessly.

-

How much does airSlate SignNow cost for features like ky 42a740?

The pricing for airSlate SignNow, including features like ky 42a740, is designed to be cost-effective for businesses of all sizes. Users can choose from various subscription plans that cater to their unique needs and budget. Visit our pricing page for a detailed breakdown of all available options.

-

What are the key features of airSlate SignNow’s ky 42a740?

The ky 42a740 feature of airSlate SignNow includes capabilities such as document templates, automated workflows, and robust security measures. These features facilitate faster document processing and help maintain compliance with industry regulations. Users can take advantage of this to create a more efficient workflow.

-

What benefits does ky 42a740 provide for businesses?

Businesses leveraging the ky 42a740 in airSlate SignNow can signNowly reduce the time spent on manual signatures and paperwork. This acceleration improves productivity and enhances customer satisfaction. Additionally, it enables users to focus on core business activities while ensuring document security.

-

Can ky 42a740 integrate with other software solutions?

Yes, ky 42a740 can integrate seamlessly with various third-party applications, enhancing its functionality within your existing tech stack. This integration ensures that data flows smoothly between platforms, providing a comprehensive solution for document management. Check our integrations page for more information.

-

Is ky 42a740 user-friendly for non-tech-savvy individuals?

Absolutely! The ky 42a740 feature in airSlate SignNow is designed with user experience in mind, making it accessible even for non-tech-savvy individuals. The intuitive interface allows users to easily navigate the platform and utilize the e-signature functionalities without extensive training.

-

How secure is the airSlate SignNow ky 42a740 feature?

Security is a top priority for airSlate SignNow, and the ky 42a740 feature adheres to stringent security protocols. It includes encryption, secure cloud storage, and audit trails to ensure that all documents are protected. Users can trust that their sensitive information remains confidential and secure.

Get more for Ky 42a740

- Texas sales and use tax exemption certificate troop 806 form

- Fundraiser easter lily order form 2010pub st clare

- British army application form download

- Cms 1763 2006 2019 form

- Indiana militia corps application form

- Application for medicare levy exemption certification form

- Asb fastnet classic online form

- Avoximeter 1000e quality control record sheet note form

Find out other Ky 42a740

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template