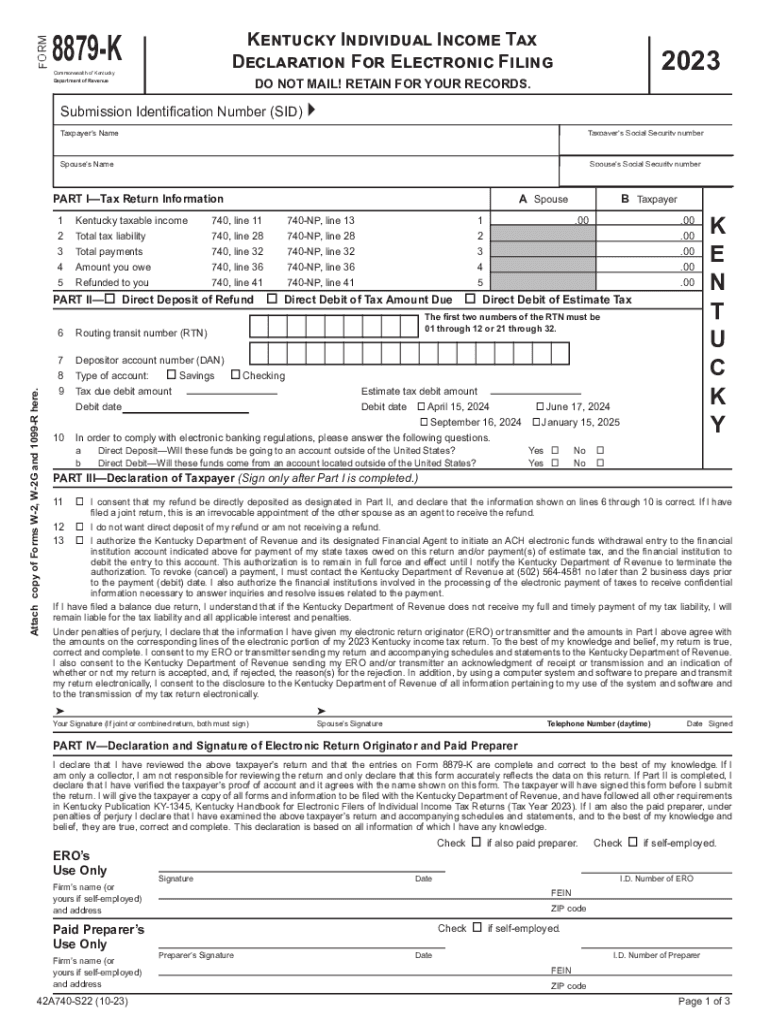

Instructions for Form 8879 K Kentucky Individual Income Tax 2023-2026

What is form 8879 tax?

Form 8879 is a declaration used by taxpayers in Kentucky to authorize an electronic return originator (ERO) to file their individual income tax returns electronically. This form is crucial for ensuring that the taxpayer's information is accurately submitted to the Kentucky Department of Revenue. By signing this form, the taxpayer confirms that all information provided is correct and grants permission for the ERO to file the return on their behalf.

Steps to complete form 8879 tax

Completing form 8879 involves several important steps:

- Gather necessary documents, including your income statements and any relevant deductions.

- Fill in your personal information, such as your name, Social Security number, and address.

- Review your tax return to ensure all details are accurate before authorizing the electronic filing.

- Sign and date the form to confirm your consent for electronic submission.

- Provide the completed form to your ERO, who will then file your tax return electronically.

Legal use of form 8879 tax

The legal use of form 8879 is to serve as a formal declaration that allows for the electronic filing of individual income tax returns in Kentucky. This form must be signed by the taxpayer to validate the information submitted. It is important to understand that any discrepancies or inaccuracies in the information provided may lead to penalties or delays in processing your tax return.

Filing deadlines for form 8879 tax

Taxpayers should be aware of the filing deadlines associated with form 8879. Typically, individual income tax returns must be filed by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid any last-minute issues.

Required documents for form 8879 tax

To complete form 8879, you will need several documents, including:

- Your previous year's tax return for reference.

- W-2 forms from employers for income verification.

- 1099 forms for any additional income sources.

- Records of deductions and credits you plan to claim.

Who issues form 8879 tax?

Form 8879 is issued by the Kentucky Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's website or through their ERO when preparing their tax returns.

Quick guide on how to complete instructions for form 8879 k kentucky individual income tax

Complete Instructions For Form 8879 K Kentucky Individual Income Tax effortlessly on any device

Online document management has become widely adopted by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without hold-ups. Handle Instructions For Form 8879 K Kentucky Individual Income Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Instructions For Form 8879 K Kentucky Individual Income Tax with ease

- Locate Instructions For Form 8879 K Kentucky Individual Income Tax and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 8879 K Kentucky Individual Income Tax and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8879 k kentucky individual income tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8879 k kentucky individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 8879 k and how does it relate to airSlate SignNow?

8879 k refers to a specific pricing tier within the airSlate SignNow platform. This tier offers businesses access to advanced eSignature features, document management capabilities, and enhanced security. With 8879 k, users can streamline their document workflows efficiently.

-

What are the key features included in the 8879 k pricing plan?

The 8879 k pricing plan includes comprehensive features such as unlimited document signing, customizable templates, and advanced compliance options. Users can also benefit from API access, making integrations with existing business applications seamless. Overall, the 8879 k plan is designed to enhance productivity and efficiency in document handling.

-

How does airSlate SignNow ensure the security of documents signed under 8879 k?

airSlate SignNow employs robust security measures to protect documents signed under 8879 k. This includes encryption of data in transit and at rest, multi-factor authentication, and compliance with industry standards. Clients can have peace of mind knowing their sensitive information is well-protected.

-

Is there a trial period available for the 8879 k plan?

Yes, airSlate SignNow offers a free trial period for the 8879 k plan, allowing potential customers to explore its features and benefits risk-free. This trial provides an opportunity to test the platform's capabilities and see how it can meet your business needs before committing to a subscription.

-

Can I integrate airSlate SignNow with other applications while using the 8879 k plan?

Absolutely! The 8879 k plan includes API access, enabling seamless integration with various business applications such as CRM systems and document storage solutions. This enhances workflow efficiency and streamlines processes across different platforms.

-

What types of businesses benefit from the 8879 k plan?

The 8879 k plan is ideal for businesses of all sizes that require efficient document signing and management solutions. Companies that deal with contracts, client agreements, or sensitive information will find signNow value in the security and features offered by airSlate SignNow at this pricing tier.

-

What are the benefits of using airSlate SignNow compared to other eSignature solutions at the 8879 k level?

airSlate SignNow stands out at the 8879 k level due to its user-friendly interface, comprehensive feature set, and competitive pricing. It offers unmatched flexibility in document handling and superior customer support. Businesses can enjoy a cost-effective solution that simplifies the eSigning process.

Get more for Instructions For Form 8879 K Kentucky Individual Income Tax

- Photographer order form

- Plumbers amp drainlayers supervision manukau building consultants form

- Countdown job application form online

- Additional assistance in examinations and alternative examination arrangements supporting medical documentation additional form

- Philippine business registry form

- Bmbe form

- Pnu online application form

- Philippine sinter corporation application form

Find out other Instructions For Form 8879 K Kentucky Individual Income Tax

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document