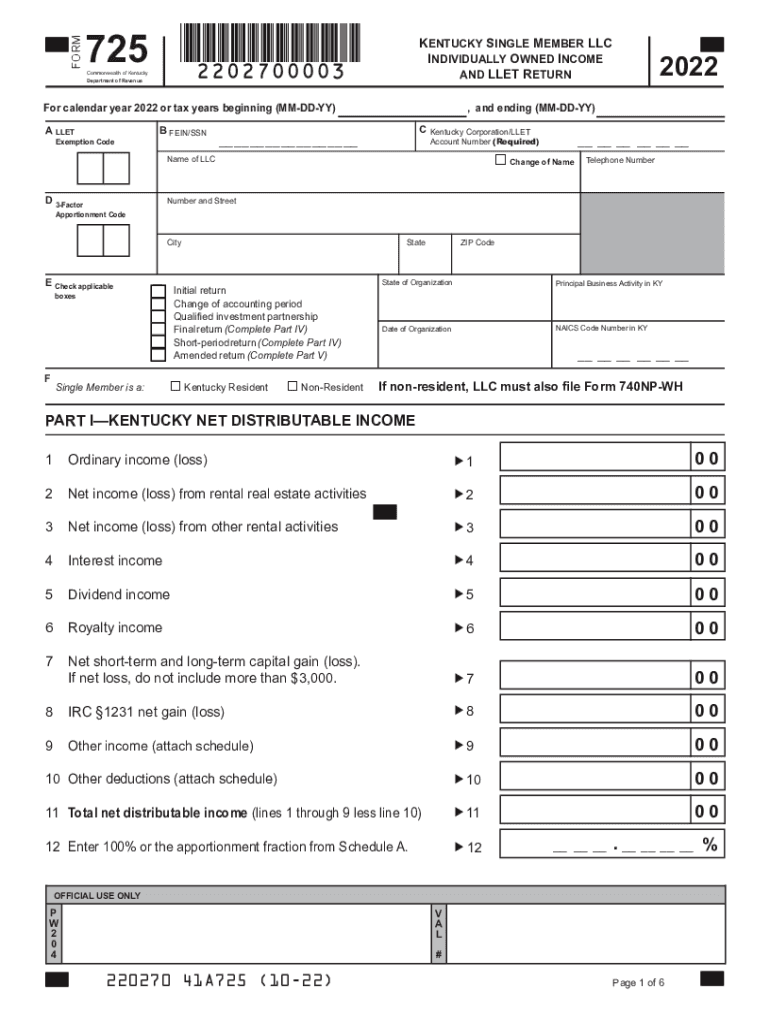

Form 725 PDF Department of Revenue 2022

What is the Form 725?

The Form 725, also known as the Kentucky Form 725, is a tax document used by individuals and businesses in Kentucky to report certain types of income and calculate tax liabilities. This form is specifically designed for the Department of Revenue in Kentucky and plays a crucial role in ensuring compliance with state tax regulations. It is essential for taxpayers to understand the purpose and requirements of this form to avoid potential penalties and ensure accurate filing.

Steps to Complete the Form 725

Completing the Form 725 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download the Form 725 from the Kentucky Department of Revenue website or access it through authorized tax software.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections of the form.

- Calculate your total tax liability based on the instructions provided.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the Form 725

The Form 725 is legally binding when completed and submitted according to Kentucky state laws. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal consequences. The form must be signed by the taxpayer or an authorized representative to validate its authenticity. Compliance with eSignature laws also applies if the form is submitted electronically, ensuring that digital signatures meet the necessary legal standards.

Key Elements of the Form 725

Understanding the key elements of the Form 725 is vital for accurate completion. The form typically includes:

- Personal identification information of the taxpayer.

- Sections for reporting various types of income, including wages, dividends, and business income.

- Calculations for deductions and credits applicable to the taxpayer.

- Final tax liability calculation and payment instructions.

Filing Deadlines / Important Dates

Timely filing of the Form 725 is crucial to avoid penalties. The standard deadline for submitting the form is typically April fifteenth of each year. However, taxpayers should verify specific deadlines for the current tax year, as extensions or changes may occur. It is advisable to keep track of these dates to ensure compliance and avoid late fees.

Form Submission Methods

The Form 725 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Kentucky Department of Revenue’s e-filing system.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local Department of Revenue offices.

Quick guide on how to complete form 725pdf department of revenue

Complete Form 725 pdf Department Of Revenue effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, edit, and electronically sign your documents quickly and efficiently. Manage Form 725 pdf Department Of Revenue on any system with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Form 725 pdf Department Of Revenue effortlessly

- Obtain Form 725 pdf Department Of Revenue and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 725 pdf Department Of Revenue to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 725pdf department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form 725pdf department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 725 Kentucky?

The form 725 Kentucky is a specific document used for tax administration in the state of Kentucky. It is primarily utilized for claiming certain tax credits and reporting income. Understanding how to correctly fill out the form 725 Kentucky can help businesses maximize their tax benefits.

-

How can airSlate SignNow help with filling out form 725 Kentucky?

AirSlate SignNow provides an intuitive platform that simplifies the process of completing the form 725 Kentucky. With our electronic signature capabilities, users can easily fill, sign, and send this form securely. This ensures that you meet compliance requirements while streamlining your workflow.

-

Is there a cost associated with using airSlate SignNow for form 725 Kentucky?

AirSlate SignNow offers various pricing plans tailored to meet your business needs, including options for handling the form 725 Kentucky. Our affordable rates ensure that businesses of all sizes can access cost-effective solutions for document management. You can choose from monthly or annual subscriptions to get started.

-

Can I integrate airSlate SignNow with other software for managing form 725 Kentucky?

Yes, airSlate SignNow supports integrations with various third-party applications that enhance your experience with the form 725 Kentucky. By connecting with other tools, you can automate workflows and manage documents more effectively. Check our integrations page to see the available options.

-

What features does airSlate SignNow offer for managing form 725 Kentucky?

AirSlate SignNow includes a range of features specifically designed for managing documents like form 725 Kentucky. These features include easy electronic signatures, real-time tracking, and customizable templates. This allows you to ensure that your form is correctly completed and submitted without hassle.

-

How secure is the process of signing form 725 Kentucky with airSlate SignNow?

The security of your documents, including the form 725 Kentucky, is a top priority at airSlate SignNow. We use industry-standard encryption and secure servers to protect your sensitive information. You can rest assured that your signed documents are safe and compliant with legal standards.

-

Can I access form 725 Kentucky on mobile devices using airSlate SignNow?

Absolutely! AirSlate SignNow provides mobile-friendly access, allowing you to manage the form 725 Kentucky from anywhere. Whether you're in the office or on the go, you can fill out, sign, and send your documents seamlessly from your smartphone or tablet.

Get more for Form 725 pdf Department Of Revenue

- Verification of creditors matrix texas 497327704 form

- Correction statement and agreement texas form

- Texas statement form

- Flood zone statement and authorization texas form

- Name affidavit of buyer texas form

- Name affidavit of seller texas form

- Non foreign affidavit under irc 1445 texas form

- Owners or sellers affidavit of no liens texas form

Find out other Form 725 pdf Department Of Revenue

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free