0900020270 Kentucky Department of Revenue 2020

Overview of Form 725 Kentucky

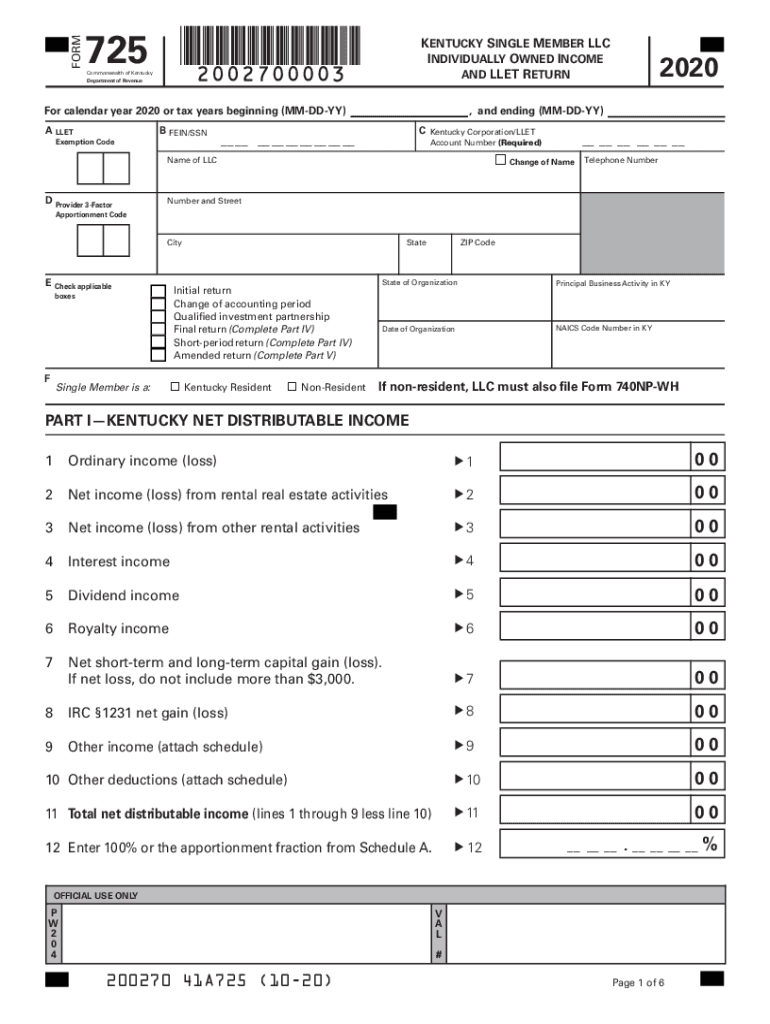

Form 725, also known as the 725 revenue form, is a crucial document issued by the Kentucky Department of Revenue. This form is primarily used for reporting various types of income and calculating tax liabilities for individuals and businesses operating within the state. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax regulations.

Steps to Complete Form 725 Kentucky

Completing the 725 Kentucky form involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including income statements, deductions, and credits applicable to your situation.

- Carefully read the instructions provided with the form to understand the specific requirements.

- Fill out the form with accurate information, ensuring all sections are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the guidelines provided by the Kentucky Department of Revenue.

Legal Use of Form 725 Kentucky

The legal use of Form 725 is governed by state tax laws, which stipulate that the information provided must be accurate and truthful. Misrepresentation or failure to file the form can result in penalties, including fines and interest on unpaid taxes. Utilizing electronic signature solutions, such as signNow, can enhance the legal validity of your submission by ensuring compliance with eSignature regulations.

Filing Deadlines for Form 725 Kentucky

It is important to adhere to filing deadlines to avoid penalties. The typical deadline for submitting Form 725 is April 15th of each year, coinciding with the federal tax filing deadline. However, extensions may be available under certain circumstances, allowing additional time to file the form. Always check the Kentucky Department of Revenue's official guidelines for any updates or changes to deadlines.

Form Submission Methods for Form 725 Kentucky

Form 725 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing and provide immediate confirmation of receipt.

- Mail Submission: If you choose to file by mail, ensure you send the form to the correct address as specified by the Kentucky Department of Revenue.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local revenue office is an option.

Required Documents for Form 725 Kentucky

When completing Form 725, certain documents are necessary to substantiate the information reported. These may include:

- W-2 forms for employees

- 1099 forms for independent contractors

- Receipts for deductible expenses

- Any relevant schedules or additional forms required for specific deductions or credits

Penalties for Non-Compliance with Form 725 Kentucky

Failure to comply with the requirements of Form 725 can lead to significant penalties. These may include:

- Fines for late filing or underreporting income

- Interest on unpaid taxes

- Potential legal action for persistent non-compliance

It is essential to file accurately and on time to avoid these consequences.

Quick guide on how to complete 0900020270 kentucky department of revenue

Prepare 0900020270 Kentucky Department Of Revenue effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage 0900020270 Kentucky Department Of Revenue on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to alter and eSign 0900020270 Kentucky Department Of Revenue without hassle

- Obtain 0900020270 Kentucky Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that task.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 0900020270 Kentucky Department Of Revenue and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 0900020270 kentucky department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 0900020270 kentucky department of revenue

How to create an e-signature for a PDF document in the online mode

How to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is form 725 Kentucky and how can airSlate SignNow help?

Form 725 Kentucky is a document frequently used for various transactions and processes in the state. With airSlate SignNow, you can easily fill out and eSign form 725 Kentucky, streamlining your workflow and ensuring compliance with state requirements.

-

How much does it cost to use airSlate SignNow for form 725 Kentucky?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Depending on your usage, you can choose from monthly or annual subscriptions, allowing you to prepare and manage form 725 Kentucky affordably and efficiently.

-

What features does airSlate SignNow provide for managing form 725 Kentucky?

airSlate SignNow comes with powerful features including drag-and-drop document editing, templates, and digital signature capabilities. This makes it simple to customize form 725 Kentucky, ensuring that it meets all specific requirements and standards necessary for your business.

-

Are there any specific benefits to using airSlate SignNow for form 725 Kentucky?

Using airSlate SignNow for form 725 Kentucky provides enhanced efficiency and reduces the risk of errors. The platform's automated features ensure faster processing times, helping you to quickly achieve your document goals without compromising on compliance.

-

Can I integrate airSlate SignNow with other software for form 725 Kentucky?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to work on form 725 Kentucky alongside your existing tools. This means you can easily export data and manage documents within your preferred platforms for increased productivity.

-

Is the eSigning process for form 725 Kentucky secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all eSignatures related to form 725 Kentucky are protected. With advanced encryption and authentication protocols, you can trust that your documents are safe and legally binding.

-

How can I get started with airSlate SignNow for form 725 Kentucky?

Getting started with airSlate SignNow for form 725 Kentucky is simple. You can sign up for a free trial or choose a subscription plan that suits your needs, and begin uploading, editing, and eSigning your documents right away.

Get more for 0900020270 Kentucky Department Of Revenue

Find out other 0900020270 Kentucky Department Of Revenue

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo