Tc 69 Utah Form 2018

What is the TC 69 Utah Form

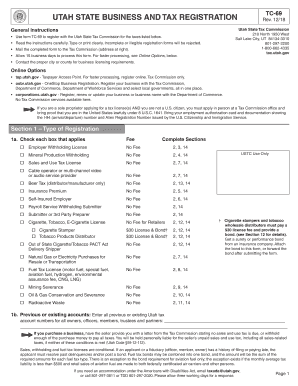

The TC 69 form, also known as the Tax Commission Form TC 69, is a document used by businesses in Utah to register for various tax types. This form is essential for ensuring compliance with state tax regulations and is utilized by entities seeking to establish their tax obligations. It captures crucial information about the business, including its structure, ownership, and tax identification details. Understanding the purpose and requirements of the TC 69 form is vital for any business operating in Utah.

How to Use the TC 69 Utah Form

Using the TC 69 Utah form involves several steps that ensure accurate completion and submission. First, gather all necessary business information, including the legal name, address, and type of business entity. Next, fill out the form carefully, ensuring all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate tax authority as specified in the instructions. Utilizing electronic tools can streamline this process and enhance accuracy.

Steps to Complete the TC 69 Utah Form

Completing the TC 69 form requires careful attention to detail. Follow these steps:

- Gather all required information about your business, including the legal name, address, and entity type.

- Access the TC 69 form through the official Utah tax website or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any mistakes or missing information.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Legal Use of the TC 69 Utah Form

The TC 69 form is legally binding once it is completed and submitted according to the state’s regulations. It serves as a formal declaration of a business’s intent to comply with Utah tax laws. To ensure its legal standing, businesses must adhere to all requirements outlined by the Utah State Tax Commission, including providing accurate information and timely submissions. This form is crucial for establishing a business's tax responsibilities and avoiding potential penalties.

Key Elements of the TC 69 Utah Form

Key elements of the TC 69 form include:

- Business Information: Legal name, address, and contact details.

- Entity Type: Identification of whether the business is a corporation, partnership, sole proprietorship, etc.

- Tax Identification Number: Essential for tax processing and identification.

- Signature: Required to validate the form and affirm the accuracy of the provided information.

Form Submission Methods

The TC 69 form can be submitted through various methods, catering to different preferences. Options include:

- Online Submission: Many businesses opt to submit the form electronically through the Utah State Tax Commission’s website, which can expedite processing.

- Mail: The form can be printed and mailed to the designated address provided in the instructions.

- In-Person: Businesses may also choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete tc69com 2018 2019 form

Complete Tc 69 Utah Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Tc 69 Utah Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Tc 69 Utah Form with ease

- Obtain Tc 69 Utah Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or black out sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tc 69 Utah Form to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc69com 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the tc69com 2018 2019 form

How to generate an electronic signature for the Tc69com 2018 2019 Form in the online mode

How to create an eSignature for your Tc69com 2018 2019 Form in Google Chrome

How to create an electronic signature for signing the Tc69com 2018 2019 Form in Gmail

How to generate an electronic signature for the Tc69com 2018 2019 Form from your mobile device

How to generate an eSignature for the Tc69com 2018 2019 Form on iOS

How to make an electronic signature for the Tc69com 2018 2019 Form on Android OS

People also ask

-

What is the Tc 69 Utah Form used for?

The Tc 69 Utah Form is used for reporting and remitting Utah state income tax withholding for employers. This form is essential for businesses operating in Utah to ensure compliance with state tax regulations. By utilizing the Tc 69 Utah Form, employers can accurately report the amounts withheld from employee wages.

-

How can I complete the Tc 69 Utah Form using airSlate SignNow?

You can easily complete the Tc 69 Utah Form with airSlate SignNow by uploading the form to our platform and filling it out digitally. Our intuitive interface allows you to enter required information quickly and efficiently. Once completed, you can eSign the Tc 69 Utah Form and send it directly to the appropriate state agency.

-

Is there a cost associated with using airSlate SignNow to manage the Tc 69 Utah Form?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our plans provide access to features that simplify the process of completing the Tc 69 Utah Form and other important documents. You can choose a plan that fits your needs, ensuring you have the right tools for efficient document management.

-

What features does airSlate SignNow provide for the Tc 69 Utah Form?

airSlate SignNow offers a variety of features for completing the Tc 69 Utah Form, including customizable templates, secure eSignature options, and real-time tracking. These features streamline the process of filling out and submitting the form, making it easier for businesses to stay compliant with state tax laws. Additionally, our platform ensures that your information is kept secure.

-

Can I integrate airSlate SignNow with other software for the Tc 69 Utah Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enabling you to manage the Tc 69 Utah Form alongside your existing tools. Whether you're using accounting software or customer relationship management (CRM) systems, our integrations help streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Tc 69 Utah Form?

Using airSlate SignNow for the Tc 69 Utah Form provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform minimizes the risk of errors while completing the form and ensures that your sensitive information is protected. Plus, the ability to eSign and send documents electronically accelerates the overall process.

-

How secure is the information I submit on the Tc 69 Utah Form through airSlate SignNow?

Security is a top priority at airSlate SignNow. When you submit the Tc 69 Utah Form through our platform, your data is protected by advanced encryption and compliance with industry standards. You can confidently manage your documents, knowing that your information is kept safe and secure.

Get more for Tc 69 Utah Form

- Cf 285 formpdffillercom

- Patent and breach of contract case sample verdict form tnwd uscourts

- Spd0508 form

- Claim form rev 102012pdf southern california pipe trades scptac

- Backflow test form word

- Memorial bench policy town of falmouth falmouthmass form

- Request for applicants job order form esd wa

- Form 16 36

Find out other Tc 69 Utah Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document