Read the Instructions on the Last Page 2021

Understanding the Utah TC Tax Form

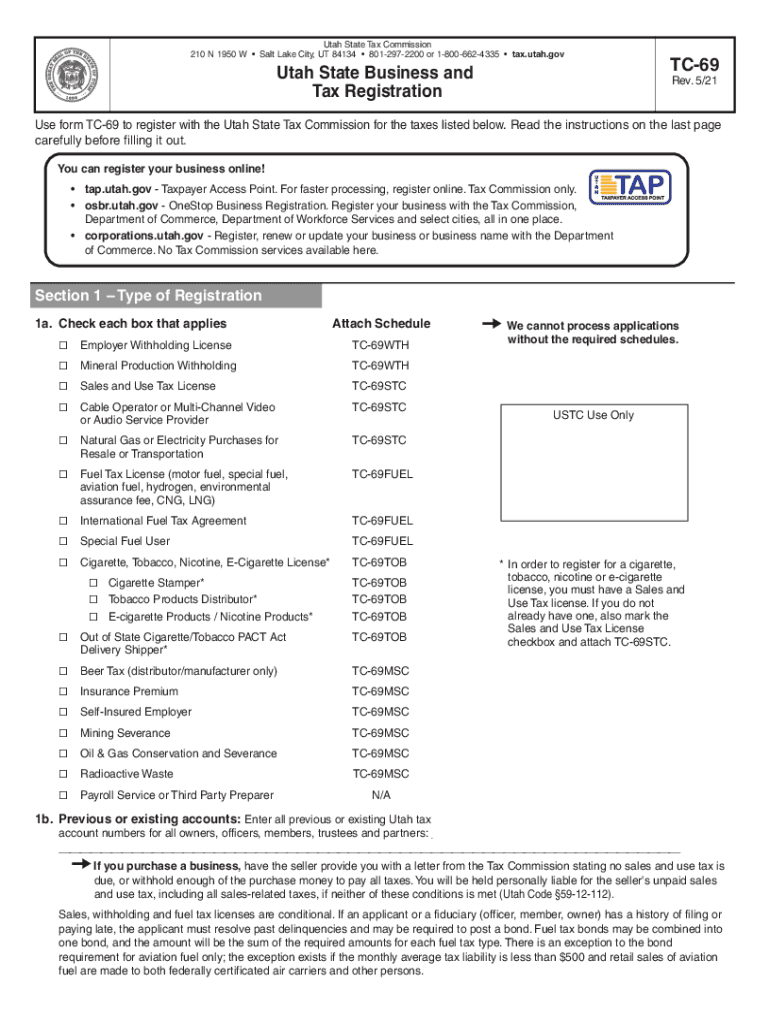

The Utah TC tax form, also known as the TC-69, is essential for businesses operating in Utah to register for state taxes. This form collects necessary information about the business entity, including its name, address, and type of business. Understanding the details required on this form is crucial for compliance with state tax laws.

Steps to Complete the Utah TC Tax Form

Completing the Utah TC tax form involves several steps to ensure accuracy and compliance. First, gather all necessary information about your business, including your Employer Identification Number (EIN) and the nature of your business activities. Next, fill out the form carefully, ensuring that all sections are completed. Double-check your entries for accuracy before submitting the form. Finally, submit the form either online or by mail, depending on your preference.

Filing Deadlines for the Utah TC Tax Form

It is important to be aware of the filing deadlines for the Utah TC tax form to avoid penalties. Typically, the form must be submitted by the due date of your first tax payment. For most businesses, this is within the first quarter of the tax year. Keeping track of these deadlines can help ensure that your business remains in good standing with the state.

Required Documents for Filing the Utah TC Tax Form

When filing the Utah TC tax form, certain documents may be required to support your application. These documents can include your business formation documents, identification numbers, and any previous tax returns if applicable. Having these documents ready will streamline the filing process and help avoid delays.

Legal Use of the Utah TC Tax Form

The Utah TC tax form is legally binding once completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or legal issues. Understanding the legal implications of this form can help protect your business from potential complications.

Form Submission Methods

The Utah TC tax form can be submitted through various methods to accommodate different preferences. Businesses can choose to file online through the Utah State Tax Commission's website, which offers a streamlined process. Alternatively, the form can be mailed directly to the appropriate tax office or submitted in person at designated locations. Each method has its own advantages, so consider the one that best fits your needs.

Quick guide on how to complete read the instructions on the last page

Effortlessly Prepare Read The Instructions On The Last Page on Any Device

Online document management has gained signNow traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Read The Instructions On The Last Page on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Modify and eSign Read The Instructions On The Last Page with Ease

- Obtain Read The Instructions On The Last Page and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this function.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Read The Instructions On The Last Page and ensure seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct read the instructions on the last page

Create this form in 5 minutes!

How to create an eSignature for the read the instructions on the last page

How to create an e-signature for a PDF document online

How to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is UT TC tax, and how does it apply to document signing?

UT TC tax refers to the tax implications that may arise during the electronic signing of documents in Utah. Understanding UT TC tax is crucial for businesses that operate in the state and utilize document signing platforms like airSlate SignNow. By ensuring compliance, companies can avoid legal issues and streamline their signing processes.

-

How does airSlate SignNow handle UT TC tax for clients?

airSlate SignNow provides users with resources and tools to help understand UT TC tax requirements associated with electronic signatures. This ensures that businesses are compliant when signing documents digitally. Our platform emphasizes transparency and user support in navigating these tax implications.

-

What features of airSlate SignNow help manage UT TC tax documentation?

With airSlate SignNow, features such as customizable templates, audit trails, and automatic compliance notifications assist businesses in managing UT TC tax documentation efficiently. These tools ensure that all required information is accurately captured during the signing process, making tax reporting easier for users.

-

Is airSlate SignNow a cost-effective solution for handling UT TC tax documents?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to handle UT TC tax documents. With competitive pricing plans and a range of features designed for efficiency and compliance, companies can save time and resources while ensuring their tax obligations are met.

-

Can I integrate airSlate SignNow with other platforms to manage UT TC tax information?

Absolutely! airSlate SignNow easily integrates with various platforms, allowing businesses to synchronize their UT TC tax information and documents. Through seamless integrations, users can streamline data flow and maintain accurate records across different applications related to tax compliance and document management.

-

What benefits do businesses gain by using airSlate SignNow for UT TC tax-related documents?

Utilizing airSlate SignNow provides several benefits for managing UT TC tax-related documents, including enhanced security, efficient workflows, and digital compliance. Businesses can expedite their document signing processes while ensuring they meet all legal tax obligations, ultimately improving their operational efficiency.

-

Does airSlate SignNow offer customer support for questions regarding UT TC tax?

Yes, airSlate SignNow provides dedicated customer support to assist users with questions regarding UT TC tax and electronic signatures. Our support team is knowledgeable about tax requirements and can guide businesses through compliance and effective document management strategies.

Get more for Read The Instructions On The Last Page

- Wy stat29 10 101 29 10 101 preliminary notice of right form

- Wyoming statutes title 29 liens29 10 101findlaw form

- Wyoming preliminary notice guide all you need to know form

- On this the day of 20 the undersigned does form

- Grantor does hereby convey and warrant unto a corporation form

- On this the day of 20 the undersigned form

- 29 10 106 form for notice of satisfaction of lien 2013

- Grantor does hereby convey and warrant unto a limited form

Find out other Read The Instructions On The Last Page

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure