Utah State Business and 2021

What is the Utah State Business And Tax Registration?

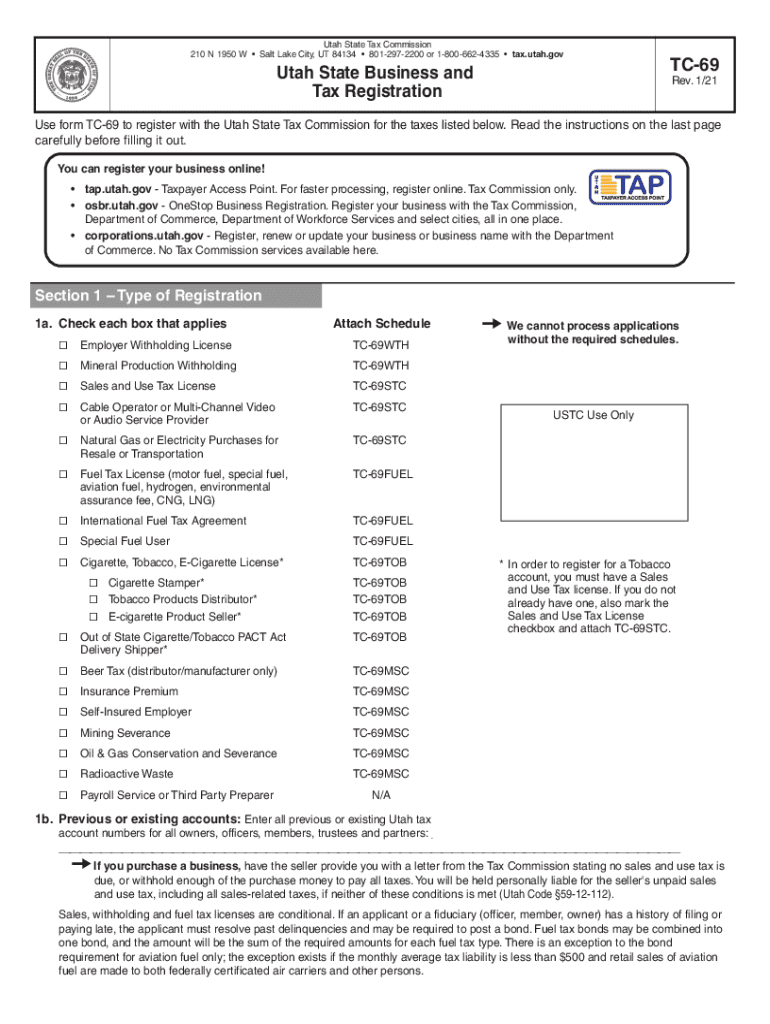

The Utah State Business and Tax Registration process is essential for individuals and entities looking to operate a business within the state. This registration includes obtaining a tax identification number, which is crucial for fulfilling tax obligations. The process ensures that businesses comply with state regulations and helps in the collection of taxes due to the state. The primary form associated with this registration is the TC-69 form, which is specifically designed for businesses in Utah to report their tax information accurately.

Steps to Complete the Utah State Business And Tax Registration

Completing the Utah State Business and Tax Registration involves several key steps. First, gather all necessary information, including your business name, address, and ownership details. Next, fill out the TC-69 form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Once verified, submit the TC-69 form either online or via mail to the appropriate state department. It is important to keep a copy of the submitted form for your records.

Legal Use of the Utah State Business And Tax Registration

The legal use of the Utah State Business and Tax Registration is vital for compliance with state laws. By registering, businesses gain the legal authority to operate within Utah and are recognized by state tax authorities. This registration also allows businesses to collect sales tax, hire employees, and apply for various licenses and permits. Failure to register can lead to penalties and fines, making it essential for all businesses to complete this process legally and promptly.

Required Documents for Utah State Business And Tax Registration

When registering for business and tax purposes in Utah, specific documents are required to ensure a smooth process. These typically include:

- Proof of business name registration

- Identification details of the business owner(s)

- Business address and contact information

- Details regarding the nature of the business

- Any applicable licenses or permits

Having these documents ready will facilitate the completion of the TC-69 form and help avoid delays in the registration process.

Form Submission Methods for the TC-69

The TC-69 form can be submitted through various methods to accommodate different preferences. Businesses can choose to file the form online via the Utah State Tax Commission's website, which is often the quickest option. Alternatively, the form can be mailed to the appropriate address provided by the state. For those who prefer in-person interactions, submitting the form at a local tax office is also an option. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Penalties for Non-Compliance with Utah State Business And Tax Registration

Non-compliance with the Utah State Business and Tax Registration can result in significant penalties. Businesses that fail to register may face fines, interest on unpaid taxes, and potential legal action. Additionally, operating without proper registration can lead to the inability to collect sales tax or obtain necessary permits, hindering business operations. It is crucial for business owners to understand these consequences and ensure timely registration to avoid complications.

Quick guide on how to complete utah state business and

Complete Utah State Business And seamlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed records, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without any holdups. Manage Utah State Business And on any system with airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The easiest method to modify and eSign Utah State Business And effortlessly

- Find Utah State Business And and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to store your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Utah State Business And and ensure exceptional communication at every phase of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utah state business and

Create this form in 5 minutes!

How to create an eSignature for the utah state business and

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is UT TC tax and how does it relate to electronic signatures?

UT TC tax refers to tax regulations in Utah concerning transactions. Understanding UT TC tax is essential for businesses that need to eSign documents, as it ensures compliance and accuracy in your financial dealings when using platforms like airSlate SignNow.

-

How can airSlate SignNow help with managing UT TC tax documentation?

airSlate SignNow provides an efficient way to create, send, and eSign documents related to UT TC tax. Our platform allows for seamless collaboration between parties and ensures that all tax-related documents are secure and comply with Utah regulations.

-

Does airSlate SignNow offer features specifically for UT TC tax compliance?

Yes, airSlate SignNow includes features that assist with UT TC tax compliance, such as audit trails for documents and customizable templates. This ensures that all your electronic signatures meet the necessary legal requirements for UT TC tax filings.

-

What is the pricing structure for airSlate SignNow in relation to UT TC tax services?

airSlate SignNow offers a variety of pricing plans suitable for different business needs, including features that support UT TC tax documentation. Our transparent pricing model helps you budget efficiently without compromising on compliance.

-

Can I integrate airSlate SignNow with other tools for UT TC tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your workflow for managing UT TC tax documents. This integration ensures that all relevant data is synchronized across systems for improved accuracy.

-

What benefits can I expect from using airSlate SignNow for UT TC tax forms?

Using airSlate SignNow for UT TC tax forms simplifies the eSigning process, saving you time and effort. The platform’s security features also ensure that your sensitive tax information is protected throughout the process.

-

Is airSlate SignNow compliant with UT TC tax regulations?

Yes, airSlate SignNow is designed to meet the compliance requirements associated with UT TC tax regulations. Our team continually monitors changes in tax laws to ensure that our eSigning solutions adhere to all necessary compliance standards.

Get more for Utah State Business And

Find out other Utah State Business And

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself