Kentucky Form 740 ES Estimated Income Tax Return 2022

What is the Kentucky Form 740 ES Estimated Income Tax Return

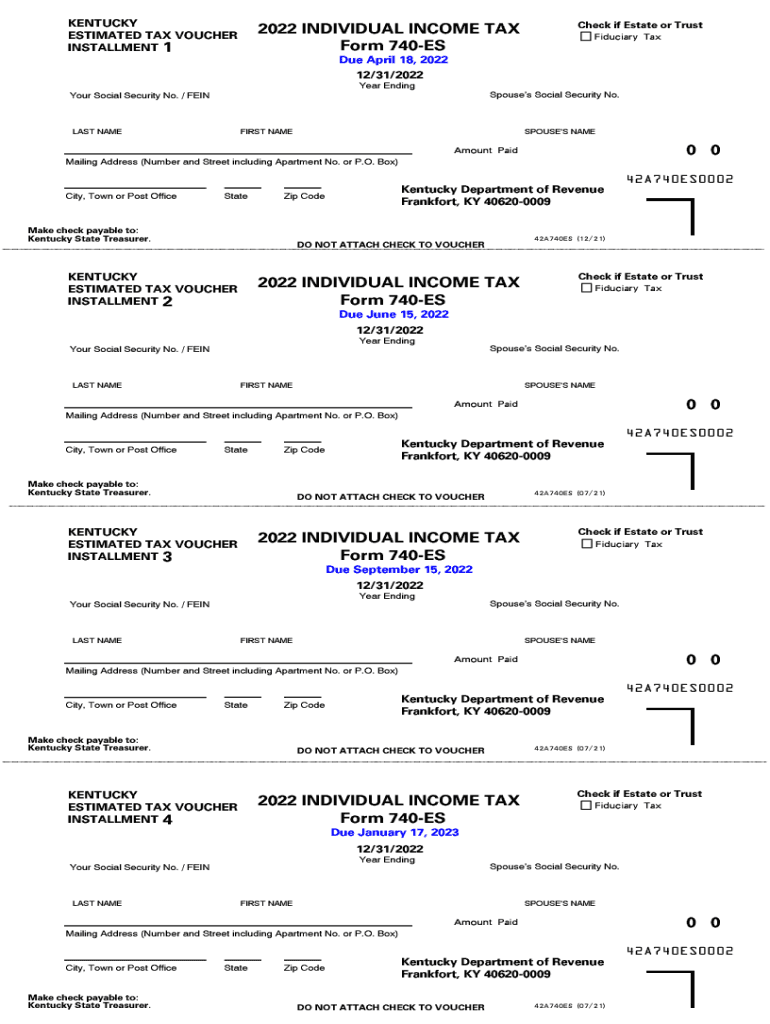

The Kentucky Form 740 ES is an estimated income tax return used by individuals and businesses to report their expected income tax obligations for the year. This form is essential for taxpayers who anticipate owing tax at the end of the year, allowing them to make estimated payments throughout the year. By submitting this form, taxpayers can avoid penalties for underpayment and ensure they meet their tax obligations in a timely manner.

How to use the Kentucky Form 740 ES Estimated Income Tax Return

Using the Kentucky Form 740 ES involves several steps. First, taxpayers need to estimate their total income for the year, considering all sources such as wages, dividends, and business income. Next, they calculate their expected tax liability based on current tax rates and deductions. Once the estimated tax amount is determined, taxpayers can fill out the form with their personal information, including name, address, and Social Security number. After completing the form, they can submit it along with their estimated payment to the Kentucky Department of Revenue.

Steps to complete the Kentucky Form 740 ES Estimated Income Tax Return

Completing the Kentucky Form 740 ES requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including previous tax returns and income statements.

- Estimate your total income for the current tax year.

- Determine your expected tax liability using the appropriate tax rates.

- Fill out the Kentucky Form 740 ES with accurate information.

- Review the form for any errors or omissions.

- Submit the form along with your estimated payment by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Form 740 ES are crucial to avoid penalties. Typically, estimated tax payments are due on the 15th of April, June, September, and January of the following year. It is essential for taxpayers to mark these dates on their calendars to ensure timely submissions. Missing a deadline may result in interest charges and penalties, impacting overall tax liability.

Required Documents

To accurately complete the Kentucky Form 740 ES, taxpayers should prepare several documents, including:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any additional income sources.

- Documentation of deductions and credits that may apply.

Penalties for Non-Compliance

Failing to file the Kentucky Form 740 ES or underpaying estimated taxes can lead to significant penalties. Taxpayers may incur interest on unpaid amounts and face a penalty of up to 25% of the unpaid tax. It is vital to comply with all filing requirements to avoid these financial repercussions.

Quick guide on how to complete kentucky form 740 es estimated income tax return

Easily prepare Kentucky Form 740 ES Estimated Income Tax Return on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Kentucky Form 740 ES Estimated Income Tax Return on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Kentucky Form 740 ES Estimated Income Tax Return with ease

- Find Kentucky Form 740 ES Estimated Income Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Kentucky Form 740 ES Estimated Income Tax Return to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky form 740 es estimated income tax return

Create this form in 5 minutes!

People also ask

-

What is the ky form 740 es 2023?

The ky form 740 es 2023 is a state income tax estimate form used by Kentucky residents to project their tax liabilities. This form helps taxpayers estimate their payments for the upcoming tax year and ensures they comply with state tax regulations.

-

How can airSlate SignNow assist with the ky form 740 es 2023?

airSlate SignNow streamlines the process of completing and signing the ky form 740 es 2023. With our easy-to-use platform, users can fill out, sign, and send the form securely, eliminating the hassle of traditional paper-based methods.

-

Is there a cost associated with using airSlate SignNow for the ky form 740 es 2023?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for managing documents. Pricing plans are designed to cater to various business needs, making it affordable for individuals and organizations to handle the ky form 740 es 2023 efficiently.

-

What features does airSlate SignNow provide for handling the ky form 740 es 2023?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure cloud storage, tailored for documents like the ky form 740 es 2023. These features ensure that users can easily manage their documents while maintaining compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools while working on the ky form 740 es 2023?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing users to enhance their workflow when preparing the ky form 740 es 2023. Popular integrations include CRM systems, accounting software, and cloud storage services.

-

What are the benefits of using airSlate SignNow for the ky form 740 es 2023?

Using airSlate SignNow for the ky form 740 es 2023 saves time and reduces errors associated with manual forms. The digital solution provides instant access to signed documents, improves organization, and helps ensure timely submissions, which is crucial for tax compliance.

-

Is airSlate SignNow compliant with state and federal regulations for the ky form 740 es 2023?

Yes, airSlate SignNow is compliant with relevant state and federal regulations, ensuring that the ky form 740 es 2023 is handled according to legal standards. This compliance is essential for users who want to guarantee that their electronic signatures are valid.

Get more for Kentucky Form 740 ES Estimated Income Tax Return

- Buyers request for accounting from seller under contract for deed oregon form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed oregon form

- General notice of default for contract for deed oregon form

- Oregon forfeiture form

- Seller disclosure property form

- Oregon annual form

- Notice of default for past due payments in connection with contract for deed oregon form

- Final notice of default for past due payments in connection with contract for deed oregon form

Find out other Kentucky Form 740 ES Estimated Income Tax Return

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself