National Association of Tax Professionals Seminar June 24 2024-2026

Understanding the Kentucky Estimated Tax Voucher 2024

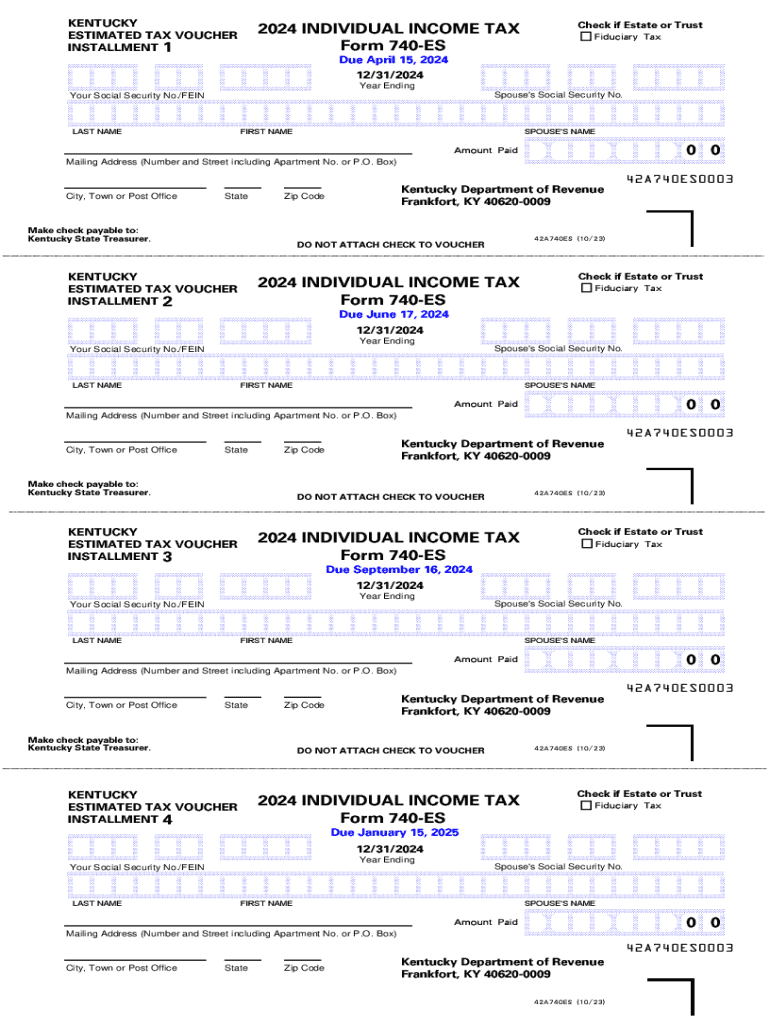

The Kentucky estimated tax voucher 2024, also known as the KY 740 ES 2024, is a crucial document for taxpayers who expect to owe state income tax. This form allows individuals and businesses to make estimated tax payments throughout the year, helping to avoid penalties for underpayment. The voucher is designed to assist taxpayers in calculating and remitting their estimated taxes based on their expected income for the year.

Filing Deadlines and Important Dates

For the year 2024, taxpayers should be aware of key deadlines associated with the Kentucky estimated tax voucher. Payments are typically due on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes. It is essential to stay informed about these dates to ensure compliance and avoid financial repercussions.

Steps to Complete the Kentucky Estimated Tax Voucher 2024

Completing the Kentucky estimated tax voucher involves several steps:

- Gather your financial information, including income sources and deductions.

- Estimate your total income for the year and calculate your expected tax liability using the current tax rates.

- Determine if you need to make estimated payments based on your tax liability and previous year’s tax return.

- Fill out the KY 740 ES 2024 form with the calculated amounts.

- Submit the voucher along with your payment by the due date.

Required Documents for Submission

To accurately complete the Kentucky estimated tax voucher, you will need several documents:

- Your previous year’s tax return, which provides a baseline for estimating your current year’s taxes.

- Income statements, such as W-2s or 1099s, to determine your expected earnings.

- Records of any deductions or credits you plan to claim.

Who Issues the Kentucky Estimated Tax Voucher

The Kentucky Department of Revenue is responsible for issuing the estimated tax voucher. This state agency manages tax collection and ensures compliance with Kentucky tax laws. Taxpayers can access the form and related instructions through the Department of Revenue's official website or through authorized tax professionals.

Penalties for Non-Compliance

Failing to submit the Kentucky estimated tax voucher on time can lead to significant penalties. Taxpayers may incur interest on unpaid amounts, and the state may impose additional fines for late submissions. It is important to adhere to the filing deadlines and make timely payments to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct national association of tax professionals seminar june 24

Create this form in 5 minutes!

How to create an eSignature for the national association of tax professionals seminar june 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky estimated tax voucher 2024?

The Kentucky estimated tax voucher 2024 is a form used by taxpayers in Kentucky to report and pay estimated income taxes. This voucher helps ensure that individuals and businesses meet their tax obligations throughout the year, avoiding penalties for underpayment.

-

How can I obtain the Kentucky estimated tax voucher 2024?

You can obtain the Kentucky estimated tax voucher 2024 from the Kentucky Department of Revenue's website or through tax preparation software. Additionally, airSlate SignNow provides easy access to these forms, allowing you to fill them out and eSign them conveniently.

-

What are the benefits of using airSlate SignNow for the Kentucky estimated tax voucher 2024?

Using airSlate SignNow for the Kentucky estimated tax voucher 2024 streamlines the process of filling out and submitting your tax forms. Our platform offers an easy-to-use interface, secure eSigning capabilities, and the ability to store and manage your documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the Kentucky estimated tax voucher 2024?

Yes, airSlate SignNow offers various pricing plans to suit different needs. While there may be a fee for premium features, the platform is designed to be cost-effective, especially for businesses that frequently handle documents like the Kentucky estimated tax voucher 2024.

-

Can I integrate airSlate SignNow with other software for the Kentucky estimated tax voucher 2024?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Kentucky estimated tax voucher 2024 alongside your other financial documents. This integration helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow offer for managing the Kentucky estimated tax voucher 2024?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for the Kentucky estimated tax voucher 2024. These tools help you manage your tax documents efficiently and ensure that you stay compliant with state regulations.

-

How does airSlate SignNow ensure the security of my Kentucky estimated tax voucher 2024?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Kentucky estimated tax voucher 2024 and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

Get more for National Association Of Tax Professionals Seminar June 24

Find out other National Association Of Tax Professionals Seminar June 24

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free