Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd 2020

Understanding the 740 ES Kentucky Payment Vouchers

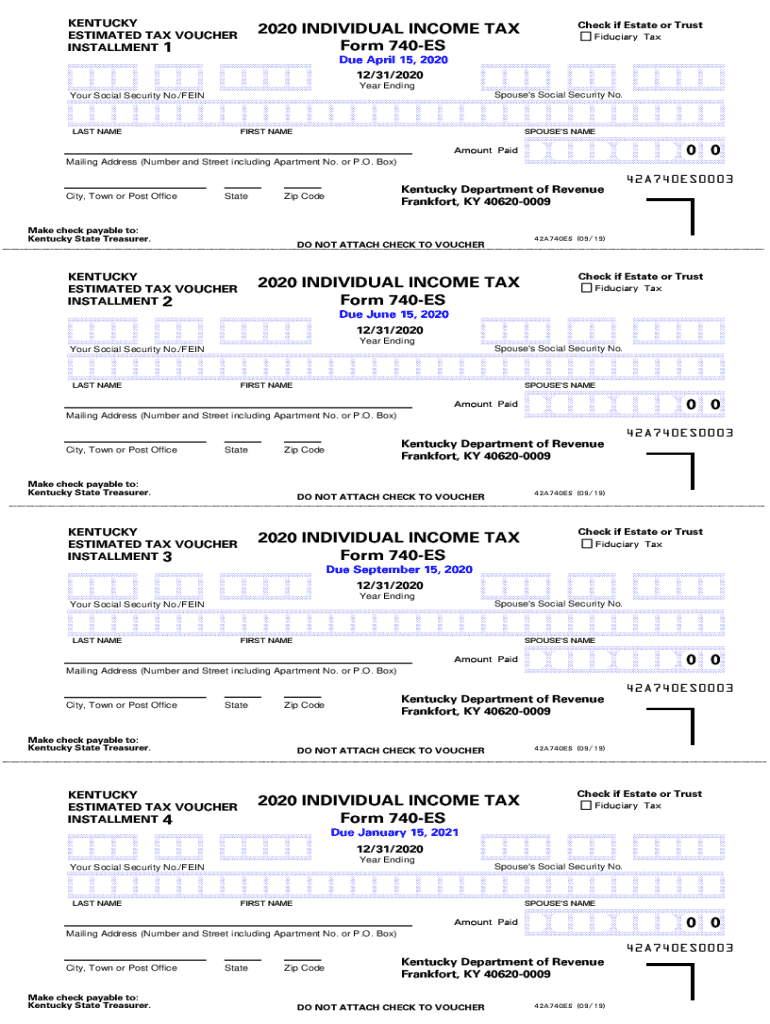

The 740 ES Kentucky payment vouchers are essential for taxpayers who need to make estimated tax payments to the state of Kentucky. These vouchers are used primarily by individuals who expect to owe tax of more than five hundred dollars when filing their annual tax return. The form allows taxpayers to pay their estimated taxes in a structured manner throughout the year, ensuring compliance with state tax laws.

Steps to Complete the 740 ES Kentucky Payment Vouchers

Completing the 740 ES Kentucky payment vouchers involves several key steps:

- Gather necessary financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability using the appropriate tax tables or software.

- Fill out the 740 ES form, ensuring all required fields are completed accurately.

- Submit the voucher along with your payment to the Kentucky Department of Revenue by the specified deadlines.

Legal Use of the 740 ES Kentucky Payment Vouchers

The 740 ES Kentucky payment vouchers are legally binding documents that must be filled out and submitted according to Kentucky tax regulations. It is crucial to ensure that the information provided is accurate and complete to avoid penalties or interest on unpaid taxes. Utilizing electronic tools for submission can enhance the security and efficiency of the process, as long as they comply with legal standards for eSignatures.

Filing Deadlines for the 740 ES Kentucky Payment Vouchers

Filing deadlines for the 740 ES Kentucky payment vouchers are typically aligned with quarterly estimated tax payment schedules. Payments are generally due on the fifteenth day of April, June, September, and January of the following year. It is essential to keep track of these dates to avoid late fees and ensure compliance with state tax obligations.

Required Documents for the 740 ES Kentucky Payment Vouchers

When preparing to fill out the 740 ES Kentucky payment vouchers, taxpayers should gather the following documents:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits that may apply.

Examples of Using the 740 ES Kentucky Payment Vouchers

Taxpayers in various situations may need to use the 740 ES Kentucky payment vouchers. For instance, self-employed individuals often use these vouchers to pay estimated taxes on income that is not subject to withholding. Similarly, retirees with substantial income from pensions or investments may also need to submit these vouchers to cover their tax liabilities.

Quick guide on how to complete aaab aab aaaab aaab aab aaaab cccd ccd ccccd cccd ccd ccccd

Easily Prepare Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd effortlessly

- Find Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd and then click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether it’s via email, SMS, an invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct aaab aab aaaab aaab aab aaaab cccd ccd ccccd cccd ccd ccccd

Create this form in 5 minutes!

How to create an eSignature for the aaab aab aaaab aaab aab aaaab cccd ccd ccccd cccd ccd ccccd

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are 740 es ky payment vouchers?

740 es ky payment vouchers are official documents used in Kentucky to facilitate the payment of taxes or fees. They serve as a means to ensure proper documentation and tracking of payments. Understanding how to use these vouchers can help businesses effectively manage their tax obligations.

-

How can airSlate SignNow help me with 740 es ky payment vouchers?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign your 740 es ky payment vouchers securely. With its intuitive interface, you can ensure that your payment vouchers are completed accurately and submitted on time. This streamlines your payment process, saving you time and reducing errors.

-

Are there any costs associated with using airSlate SignNow for 740 es ky payment vouchers?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Costs depend on the features you choose, but the platform is designed to be cost-effective. Investing in airSlate SignNow can provide signNow savings in time and resources when managing your 740 es ky payment vouchers.

-

What features does airSlate SignNow offer for handling 740 es ky payment vouchers?

airSlate SignNow includes features such as customizable templates, real-time tracking, and mobile signing. These functionalities make it simple to manage your 740 es ky payment vouchers efficiently. By utilizing these tools, you can ensure that all documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with other platforms for managing 740 es ky payment vouchers?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, which can enhance your ability to manage 740 es ky payment vouchers. Integration with software such as CRM systems or accounting tools can help streamline workflows. This allows for better data management and reduces the chances of oversight when processing payment vouchers.

-

What are the benefits of using airSlate SignNow for 740 es ky payment vouchers?

Using airSlate SignNow for your 740 es ky payment vouchers offers numerous benefits, including increased efficiency and reduced turnaround time. The platform simplifies the signing process, making it easy to get approvals promptly. This ensures that your payment vouchers are submitted and processed without unnecessary delays.

-

Is airSlate SignNow secure for handling 740 es ky payment vouchers?

Absolutely! airSlate SignNow prioritizes the security of its users’ documents and data. Implementing robust encryption and compliance with regulations ensures that your 740 es ky payment vouchers remain safe and confidential during the signing and sending process.

Get more for Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497431483 form

- Bill of sale of automobile and odometer statement west virginia form

- Bill of sale for automobile or vehicle including odometer statement and promissory note west virginia form

- Promissory note in connection with sale of vehicle or automobile west virginia form

- Bill of sale for watercraft or boat west virginia form

- Bill of sale of automobile and odometer statement for as is sale west virginia form

- Construction contract cost plus or fixed fee west virginia form

- Painting contract for contractor west virginia form

Find out other Aaab Aab Aaaab Aaab Aab Aaaab Cccd Ccd Ccccd Cccd Ccd Ccccd

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU