Kentucky Estimated Tax Form 740 Es 2023

What is the Kentucky Estimated Tax Form 740 ES

The Kentucky Estimated Tax Form 740 ES is a document used by individuals and businesses in Kentucky to report and pay estimated state income taxes. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual return. By submitting the 740 ES, taxpayers can make quarterly payments to avoid penalties for underpayment of taxes. The form is specifically designed to help manage tax obligations throughout the year rather than in a lump sum at tax time.

How to use the Kentucky Estimated Tax Form 740 ES

Using the Kentucky Estimated Tax Form 740 ES involves several key steps. First, taxpayers need to estimate their total income for the year, including wages, self-employment income, and other sources. Next, they calculate the expected tax liability based on the current tax rates. Once the estimated tax amount is determined, taxpayers can fill out the 740 ES form, specifying the amounts they plan to pay each quarter. It is important to keep track of payment deadlines to ensure timely submissions and avoid penalties.

Steps to complete the Kentucky Estimated Tax Form 740 ES

Completing the Kentucky Estimated Tax Form 740 ES requires careful attention to detail. Here are the steps involved:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Estimate your total income for the year and calculate your expected tax liability.

- Fill out the 740 ES form, entering your estimated income and tax amounts.

- Decide on the payment schedule, typically quarterly, and indicate the amounts on the form.

- Review the completed form for accuracy before submission.

- Submit the form by the appropriate deadlines to avoid penalties.

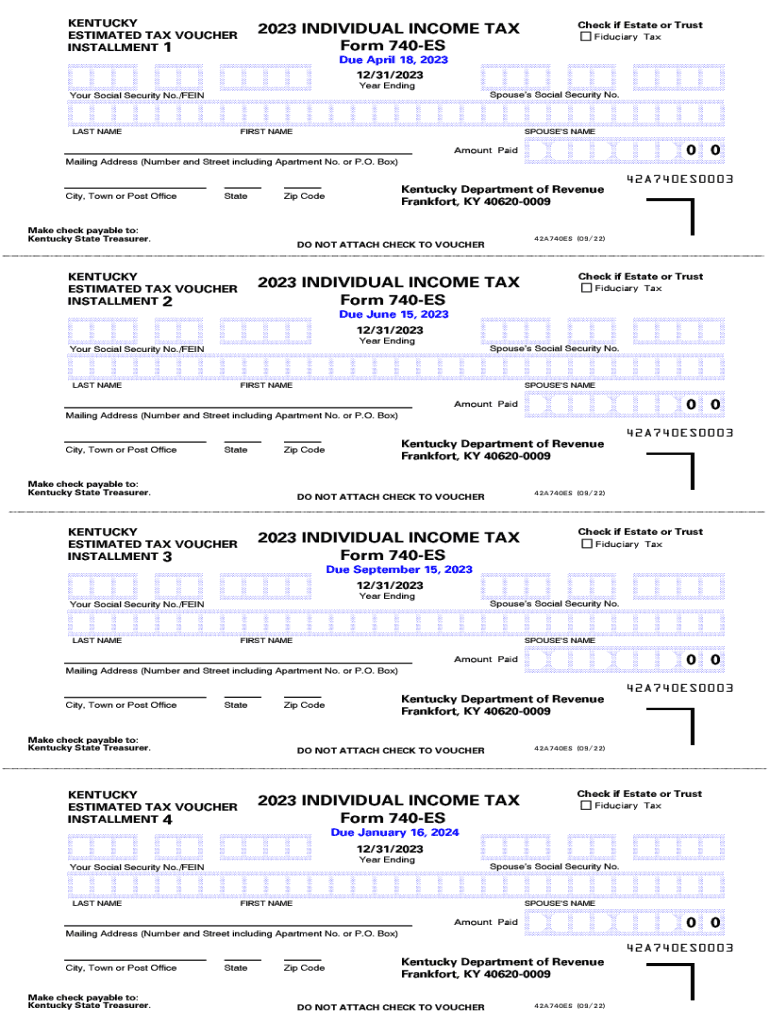

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Kentucky Estimated Tax Form 740 ES is crucial for compliance. Generally, estimated tax payments are due on the following dates:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Taxpayers should mark these dates on their calendars to ensure timely payments and avoid any penalties for late submissions.

Key elements of the Kentucky Estimated Tax Form 740 ES

The Kentucky Estimated Tax Form 740 ES includes several key elements that taxpayers must complete accurately. These elements typically include:

- Taxpayer identification information, such as name, address, and Social Security number.

- Estimated income for the year, broken down by source.

- Calculation of the estimated tax liability based on current tax rates.

- Payment amounts for each quarter, including any adjustments from previous payments.

Completing these elements correctly is essential to ensure that the estimated tax payments are accurate and reflect the taxpayer's financial situation.

How to obtain the Kentucky Estimated Tax Form 740 ES

The Kentucky Estimated Tax Form 740 ES can be obtained through several convenient methods. Taxpayers can download the form directly from the Kentucky Department of Revenue's website. Additionally, physical copies may be available at local tax offices or public libraries. It is important to ensure that the most current version of the form is used, as tax laws and forms may change from year to year.

Quick guide on how to complete kentucky estimated tax form 740 es

Effortlessly Prepare Kentucky Estimated Tax Form 740 Es on Any Device

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Kentucky Estimated Tax Form 740 Es on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Kentucky Estimated Tax Form 740 Es with Ease

- Obtain Kentucky Estimated Tax Form 740 Es and then click Get Form to begin.

- Leverage the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that aim.

- Create your signature with the Sign function, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Kentucky Estimated Tax Form 740 Es to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky estimated tax form 740 es

Create this form in 5 minutes!

How to create an eSignature for the kentucky estimated tax form 740 es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky estimated tax voucher 2024?

The Kentucky estimated tax voucher 2024 is a form used by taxpayers to calculate and pay their estimated income taxes for the year. It's essential for individuals who expect to owe tax of $500 or more to ensure compliance with state tax regulations.

-

How do I obtain the Kentucky estimated tax voucher 2024?

You can obtain the Kentucky estimated tax voucher 2024 from the Kentucky Department of Revenue's website or through tax preparation software that provides the latest tax forms. Additionally, you can access it through airSlate SignNow, which simplifies the process of filling and sending tax documents.

-

Are there any fees associated with using the Kentucky estimated tax voucher 2024?

While there is no fee to fill out the Kentucky estimated tax voucher 2024, you may incur costs if you use a professional tax service or software. However, employing airSlate SignNow can keep costs low by providing an efficient and economical eSigning solution.

-

What features does airSlate SignNow offer for the Kentucky estimated tax voucher 2024?

airSlate SignNow offers features like secure eSignature, document templates, and automated reminders to enhance your experience with the Kentucky estimated tax voucher 2024. This ensures that your documents are signed and sent quickly and securely, streamlining your tax process.

-

Can I integrate airSlate SignNow with other accounting software for my Kentucky estimated tax voucher 2024?

Yes, airSlate SignNow can integrate seamlessly with various accounting and financial software, making it easier to manage your Kentucky estimated tax voucher 2024 alongside your other financial documents. This helps maintain organization and efficiency in your tax preparations.

-

What are the benefits of using airSlate SignNow for the Kentucky estimated tax voucher 2024?

Using airSlate SignNow for the Kentucky estimated tax voucher 2024 provides a simple and efficient way to prepare, sign, and send your tax documents. Its user-friendly interface and cost-effective solution empower you to handle your tax obligations with confidence and ease.

-

Is airSlate SignNow legally compliant for signing the Kentucky estimated tax voucher 2024?

Yes, airSlate SignNow is legally compliant and adheres to regulations regarding electronic signatures and document management. This ensures that using the platform for your Kentucky estimated tax voucher 2024 meets all legal requirements.

Get more for Kentucky Estimated Tax Form 740 Es

- Lead safe work practices waiver form thermal windows inc

- Annex a tender and contract award acknowledge certificate this drc form

- Forms kela

- Diamante poems super teacher worksheets form

- Worldyouthday comworldyouthday comworld youth day news stories and more form

- Dusty construction activities form

- Agency info to update your address please attach a copy of your license and surety bond reflecting the new address form

- Yogi haris ashram sampoorna yoga application form

Find out other Kentucky Estimated Tax Form 740 Es

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free