Boone County Fiscal Court Tax Forms Fill and SignBoone County Fiscal CourtPVA of Boone County, KYOccupational 2022

Key elements of the county net profit return

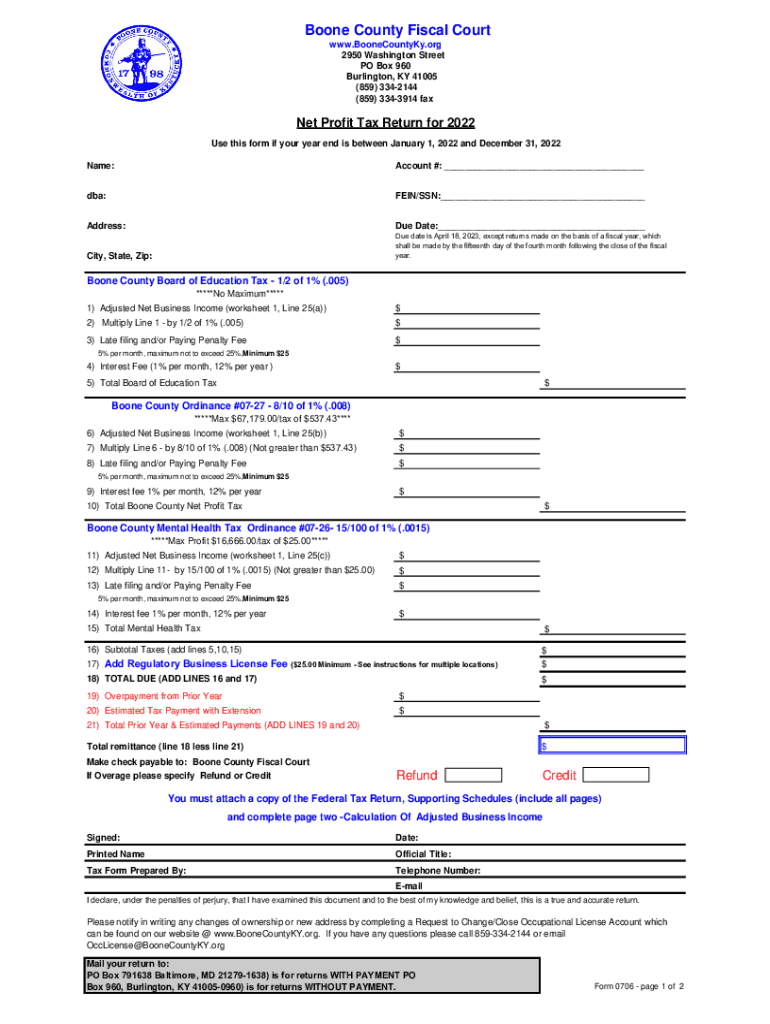

The county net profit return is a crucial document for businesses operating within Boone County and other jurisdictions in Kentucky. This form captures essential financial information, including gross receipts, allowable deductions, and net profits. Accurate completion of the return is vital for determining tax obligations. Key elements include:

- Gross Receipts: Total income generated from business operations before any deductions.

- Allowable Deductions: Expenses that can be subtracted from gross receipts, such as operating costs and salaries.

- Net Profit: The final amount after deductions, which is subject to taxation.

- Signature: A valid signature is required to authenticate the form, ensuring compliance with legal standards.

Steps to complete the county net profit return

Filling out the county net profit return involves several steps to ensure accuracy and compliance. Follow these steps for a smooth process:

- Gather financial records, including income statements and expense reports.

- Calculate gross receipts by summing all business income.

- List all allowable deductions based on IRS guidelines and local regulations.

- Subtract total deductions from gross receipts to determine net profit.

- Complete the return form, ensuring all sections are filled out accurately.

- Sign the form electronically or physically, depending on submission method.

- Submit the completed form by the designated deadline.

Filing deadlines and important dates

Understanding the filing deadlines for the county net profit return is essential for compliance. Typically, the return is due on:

- The fifteenth day of the fourth month following the end of the tax year.

- Extensions may be available, but must be requested in advance.

- Penalties may apply for late submissions, so timely filing is crucial.

Form submission methods

Businesses have several options for submitting the county net profit return, which include:

- Online Submission: Utilizing secure e-filing systems that ensure quick processing.

- Mail: Sending a printed copy of the completed form to the appropriate county office.

- In-Person: Delivering the form directly to the county tax office for immediate processing.

Legal use of the county net profit return

The county net profit return serves as a legally binding document once properly completed and submitted. To ensure its legal standing:

- All information must be accurate and truthful to avoid penalties.

- Electronic signatures must comply with eSignature laws, ensuring authenticity.

- Maintain records of submission for future reference and potential audits.

IRS guidelines for the county net profit return

Compliance with IRS guidelines is essential when completing the county net profit return. Key considerations include:

- Understanding the tax implications of net profits and allowable deductions.

- Staying updated on any changes in tax law that may affect the return.

- Utilizing IRS resources for guidance on specific tax scenarios related to business operations.

Quick guide on how to complete boone county fiscal court tax forms fill and signboone county fiscal courtpva of boone county kyoccupational

Prepare Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational effortlessly on any device

Online document management has become more prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational without effort

- Locate Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational and click Get Form to start.

- Use the tools we provide to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to missing or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct boone county fiscal court tax forms fill and signboone county fiscal courtpva of boone county kyoccupational

Create this form in 5 minutes!

People also ask

-

What is a county net profit return?

A county net profit return is a financial document submitted to local government authorities to report the profits earned within a specific county. This return helps in determining the appropriate tax obligations for businesses operating in that area. Understanding your county net profit return is essential for compliance and accurate tax reporting.

-

How does airSlate SignNow help with submitting a county net profit return?

airSlate SignNow streamlines the process of preparing and submitting your county net profit return by providing easy access to electronic signatures and document management. With our platform, you can securely sign and send documents, ensuring that your returns are filed accurately and on time. This efficiency reduces the risk of errors and enhances compliance with local regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit the needs of businesses of all sizes. Our pricing is competitive and includes comprehensive features that make managing your county net profit return and other documents easy. Subscribing to a plan means you get value-added tools without breaking the bank.

-

What features does airSlate SignNow provide for county net profit return management?

airSlate SignNow includes several essential features for managing your county net profit return. Key functionalities include eSignature capabilities, document templates, and secure cloud storage. These features facilitate a smooth workflow, ensuring your returns are prepared and submitted effortlessly.

-

Can I integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance your workflow. Whether you use accounting software or project management tools, our integrations support efficient management of your county net profit return alongside other essential business processes. This compatibility ensures a more cohesive experience across your systems.

-

How does airSlate SignNow improve the efficiency of filing a county net profit return?

airSlate SignNow signNowly boosts the efficiency of filing your county net profit return by offering automation features and centralized document storage. This allows for quick access to necessary forms and faster turnaround times for signatures, minimizing delays. Ultimately, this streamlined approach helps you meet deadlines more effectively.

-

Is airSlate SignNow secure for submitting important documents like a county net profit return?

Absolutely! Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption protocols and secure data storage practices, ensuring that your county net profit return and other sensitive documents are safely handled and protected from unauthorized access.

Get more for Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational

- Oregon lease form

- Oregon prenuptial premarital agreement uniform premarital agreement act with financial statements oregon

- Oregon prenuptial premarital agreement without financial statements oregon form

- Amendment to prenuptial or premarital agreement oregon form

- Financial statements only in connection with prenuptial premarital agreement oregon form

- Revocation of premarital or prenuptial agreement oregon form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children oregon form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497323528 form

Find out other Boone County Fiscal Court Tax Forms Fill And SignBoone County Fiscal CourtPVA Of Boone County, KYOccupational

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF