County Net Profit 2018

What is the County Net Profit

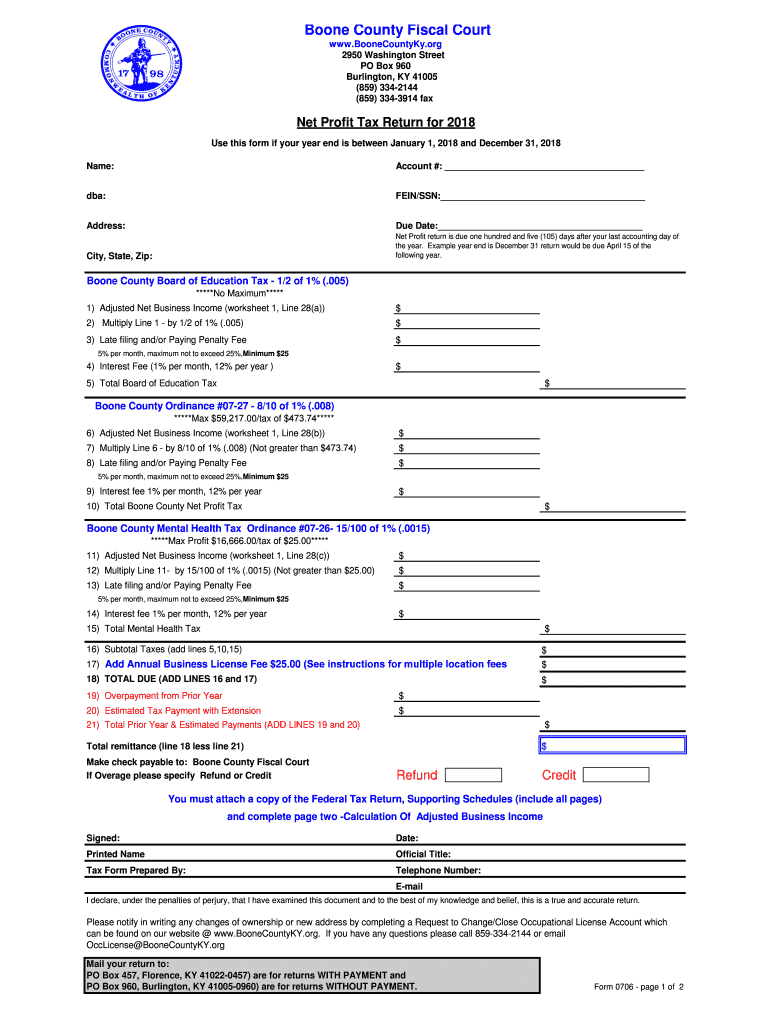

The county net profit tax is a tax imposed on the net profits of businesses operating within a specific county. This tax is designed to generate revenue for local government services and infrastructure. In Kentucky, the county net profit tax applies to various business entities, including corporations and partnerships. Understanding this tax is crucial for compliance and effective financial planning.

How to Complete the County Net Profit Tax Form

Completing the county net profit tax form involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately calculate your net profit by subtracting allowable business expenses from total revenue. Once you have your net profit, fill out the form with the required information, ensuring all figures are correct. Finally, review the form for accuracy before submitting it.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the county net profit tax to avoid penalties. Typically, the tax return is due on the 15th day of the fourth month following the end of your fiscal year. For example, if your fiscal year ends on December 31, your return would be due by April 15. Always check for any local extensions or changes to deadlines that may apply.

Required Documents for Filing

When filing the county net profit tax, certain documents are required to ensure compliance. These documents typically include:

- Income statements

- Expense reports

- Previous year’s tax return

- Supporting documentation for deductions

Having these documents ready will streamline the filing process and help substantiate your reported figures.

Penalties for Non-Compliance

Failure to comply with the county net profit tax regulations can result in various penalties. Common consequences include late fees, interest on unpaid taxes, and potential legal action. It is crucial to file your return on time and ensure accuracy to avoid these penalties. Understanding the implications of non-compliance can motivate timely and correct filing.

Digital vs. Paper Version of the County Net Profit Tax Form

Filing the county net profit tax can be done using either a digital or paper version of the form. The digital version offers advantages such as ease of access, quicker submission, and reduced paperwork. On the other hand, some may prefer the traditional paper method for its tangible nature. Regardless of the method chosen, ensure that the form is filled out accurately and submitted by the deadline.

IRS Guidelines for County Net Profit Tax

While the county net profit tax is a local obligation, it is essential to adhere to IRS guidelines that govern business income reporting. The IRS requires that all income be reported accurately, and any deductions claimed must be substantiated. Familiarizing yourself with these guidelines can help ensure compliance with both local and federal tax laws.

Quick guide on how to complete ky net profit 2018 2019 form

Your assistance manual on how to prepare your County Net Profit

If you're curious about how to finalize and submit your County Net Profit, here are some straightforward instructions to simplify your tax submission process.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, formulate, and finalize your tax papers effortlessly. With its editor, you can alternate between text, check boxes, and electronic signatures and return to modify details when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the following steps to complete your County Net Profit in just a few minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your County Net Profit in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to incorporate your legally-binding electronic signature (if required).

- Review your document and rectify any mistakes.

- Preserve changes, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically using airSlate SignNow. Keep in mind that paper filing can increase return errors and delay refunds. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct ky net profit 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

What is the last date of filling out the application form for the UGC NET 2019?

The registration process for UGC NET June 2019 Exam has been completed on 31st April 2019.Now NTA is all set to release the NTA NET Admit Card on 27th May 2019.The UGC NET June Exam will be conducted from 20th to 28th June 2019.If you missed the opportunity for applying this exam, do not worry.NTA provides a second chance to appear in UGC NET Exam in December month.The registration process for NTA NET Dec 2019 Exam will be started in sept-oct.You should start preparing for the upcoming exam in advance to get good marks.Best of luck!

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the ky net profit 2018 2019 form

How to make an electronic signature for the Ky Net Profit 2018 2019 Form in the online mode

How to generate an eSignature for the Ky Net Profit 2018 2019 Form in Chrome

How to generate an eSignature for signing the Ky Net Profit 2018 2019 Form in Gmail

How to create an eSignature for the Ky Net Profit 2018 2019 Form right from your smart phone

How to generate an eSignature for the Ky Net Profit 2018 2019 Form on iOS

How to make an eSignature for the Ky Net Profit 2018 2019 Form on Android OS

People also ask

-

What is ky net profit tax?

Ky net profit tax refers to the tax levied on the profit earned by businesses operating in Kentucky. Understanding this tax is crucial for compliance, and solutions like airSlate SignNow can help streamline the documentation process for tax-related forms.

-

How can airSlate SignNow assist with managing ky net profit tax?

AirSlate SignNow provides a seamless way to create, send, and eSign tax forms, including those required for ky net profit tax. This simplifies record-keeping and ensures that all documents are complete and properly signed, reducing the risk of errors during tax preparation.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers several pricing plans tailored to different business needs. By utilizing their cost-effective solutions, businesses can efficiently manage documents related to ky net profit tax without overspending on administrative tasks.

-

Can I integrate airSlate SignNow with other tools I use for accounting?

Yes, airSlate SignNow integrates with various popular accounting and business software. This integration allows for streamlined data transfer, ensuring that all information related to ky net profit tax is accurately reflected across platforms.

-

What features does airSlate SignNow offer to simplify tax processes?

AirSlate SignNow includes features like customizable templates, document tracking, and secure electronic signatures. These tools can signNowly enhance the efficiency of handling ky net profit tax documents and improve overall tax compliance.

-

Is airSlate SignNow secure for sensitive tax documents?

Absolutely! AirSlate SignNow prioritizes security, employing robust encryption and authentication measures to protect your sensitive tax documents. This level of security is essential when dealing with critical information such as ky net profit tax filings.

-

How does electronic signing benefit my business with regard to ky net profit tax?

Using electronic signatures through airSlate SignNow can expedite the approval process for tax documents. This efficiency not only saves time but also helps ensure timely submissions for ky net profit tax, minimizing the risk of late fees or penalties.

Get more for County Net Profit

- Contract cancellation option refused or unavailable mikeamp39s auto sales form

- Bank account form sample

- Ar920390z arkansas department of health healthy arkansas form

- Dh1030 statutory declaration housing nsw form

- Carrie winter grant application first national bank in olney form

- E 40 drdp rating record infant toddler e xlsx stancoe form

- Phase 2 full rate speech etsi etsi form

- Learning to surf spillovers in the adoption of the internet michael community oecd form

Find out other County Net Profit

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation