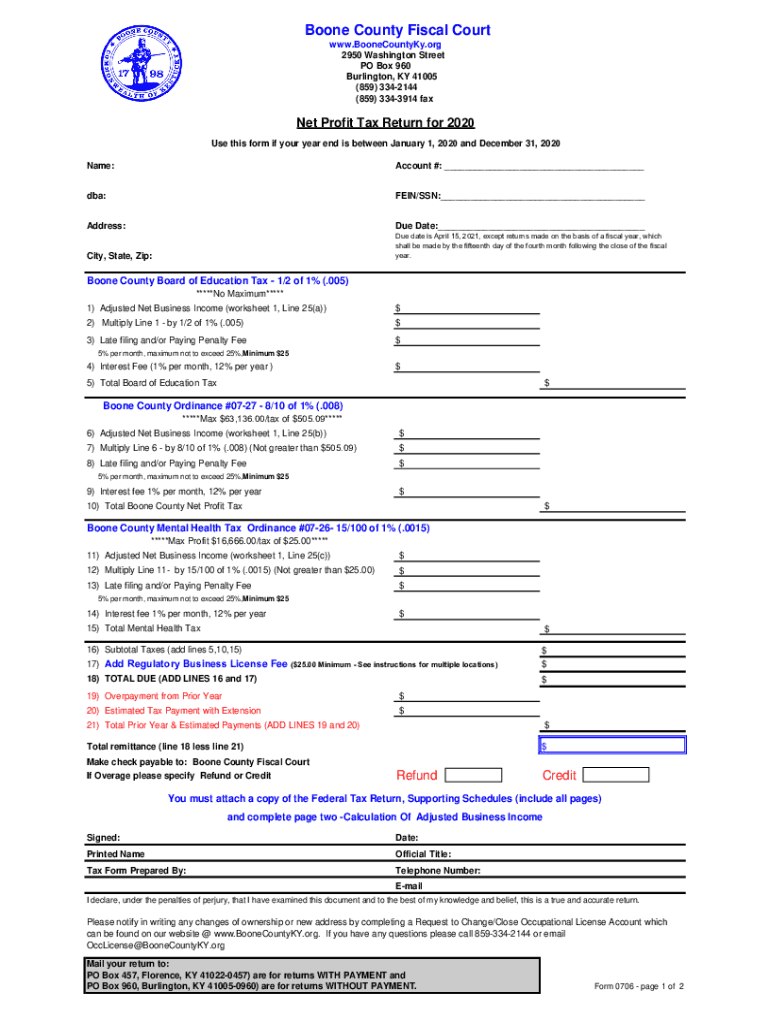

Net Profit Tax Return for 2020

What is the Net Profit Tax Return For

The Boone County Net Profit Tax Return is a specific form used by businesses operating within Boone County to report their net profit for tax purposes. This form is essential for ensuring compliance with local tax regulations and helps determine the amount of tax owed to the county. It is typically required for various business entities, including corporations, partnerships, and limited liability companies (LLCs), allowing them to accurately report their earnings and pay the appropriate taxes.

Steps to Complete the Net Profit Tax Return For

Completing the Boone County Net Profit Tax Return involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Calculate your total net profit by subtracting allowable business expenses from gross income.

- Fill out the Boone County form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated filing deadline, either online or via mail.

Legal Use of the Net Profit Tax Return For

The Boone County Net Profit Tax Return is legally binding when completed and submitted according to local regulations. To ensure its legality, the form must be signed by an authorized representative of the business. Additionally, compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial when submitting electronically. This ensures that the eSignature used is valid and recognized by the county.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Boone County Net Profit Tax Return. Typically, the return is due on the fifteenth day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the return is due by April 15. Late submissions may incur penalties and interest, so timely filing is essential for compliance.

Required Documents

When completing the Boone County Net Profit Tax Return, several documents are necessary:

- Financial statements, including income statements and balance sheets.

- Expense documentation, such as receipts and invoices.

- Prior year tax returns for reference.

- Any additional forms required by Boone County for specific deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

The Boone County Net Profit Tax Return can be submitted through various methods to accommodate different preferences:

- Online Submission: Many businesses opt for electronic filing through the Boone County tax portal, which allows for quicker processing.

- Mail: Completed forms can be printed and mailed to the appropriate county office.

- In-Person: Businesses may also choose to submit their forms in person at the county tax office for immediate confirmation of receipt.

Quick guide on how to complete net profit tax return for 2020

Effortlessly Manage Net Profit Tax Return For on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Net Profit Tax Return For on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Steps to Modify and Electronically Sign Net Profit Tax Return For with Ease

- Obtain Net Profit Tax Return For and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that task.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it directly to your computer.

Eliminate concerns about missing or lost documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Net Profit Tax Return For to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net profit tax return for 2020

Create this form in 5 minutes!

How to create an eSignature for the net profit tax return for 2020

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is a Boone form in airSlate SignNow?

A Boone form in airSlate SignNow refers to a customizable electronic document used for gathering information and obtaining electronic signatures. This form simplifies the process of creating, sending, and signing documents, ensuring efficiency and accuracy in transactions. Utilizing the Boone form enhances the overall workflow for businesses.

-

How can I create a Boone form using airSlate SignNow?

Creating a Boone form with airSlate SignNow is straightforward. Simply log in to your account, navigate to the document creation section, and select 'Create Form' to customize your Boone form according to your needs. You can add various fields for information gathering and integrate signature requests seamlessly.

-

What are the benefits of using a Boone form?

The Boone form offers several benefits, including improved efficiency in document handling and faster turnaround times for obtaining signatures. Additionally, it reduces paperwork and fosters a more sustainable business model. With airSlate SignNow's Boone form, businesses can streamline their workflows and enhance client satisfaction.

-

Is the Boone form feature included in the pricing plans?

Yes, the Boone form feature is included in all airSlate SignNow pricing plans. This means you can access the full functionality of creating and managing Boone forms without any additional costs. The pricing plans are designed to be cost-effective for businesses of all sizes.

-

Can I integrate the Boone form with other applications?

Absolutely! airSlate SignNow allows integration of the Boone form with various applications, such as CRM systems and project management tools. This seamless integration ensures that your document workflows are connected and enhance productivity across platforms.

-

Is it easy to send a Boone form for signature?

Yes, sending a Boone form for signature is incredibly easy with airSlate SignNow. After creating your Boone form, you can simply enter the recipient's email address and hit 'Send.' The recipient will receive an email invitation to sign the form electronically, making the process fast and convenient.

-

How secure is the Boone form when used with airSlate SignNow?

The Boone form is secured with advanced encryption and compliance measures in airSlate SignNow. Your data is protected throughout the sending and signing process, ensuring that sensitive information remains confidential. airSlate SignNow adheres to industry-standard security protocols to keep your Boone forms safe.

Get more for Net Profit Tax Return For

- Depositions in support of divorce from the bond of matrimony virginia form

- Commercial sublease virginia form

- Lease renewal virginia 497428187 form

- Notice to lessor exercising option to purchase virginia form

- Assignment of lease and rent from borrower to lender virginia form

- Assignment of lease from lessor with notice of assignment virginia form

- Virginia tenant property form

- Va complaint with form

Find out other Net Profit Tax Return For

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online