S Corporation Tax Forms Current Year Government of New York 2022

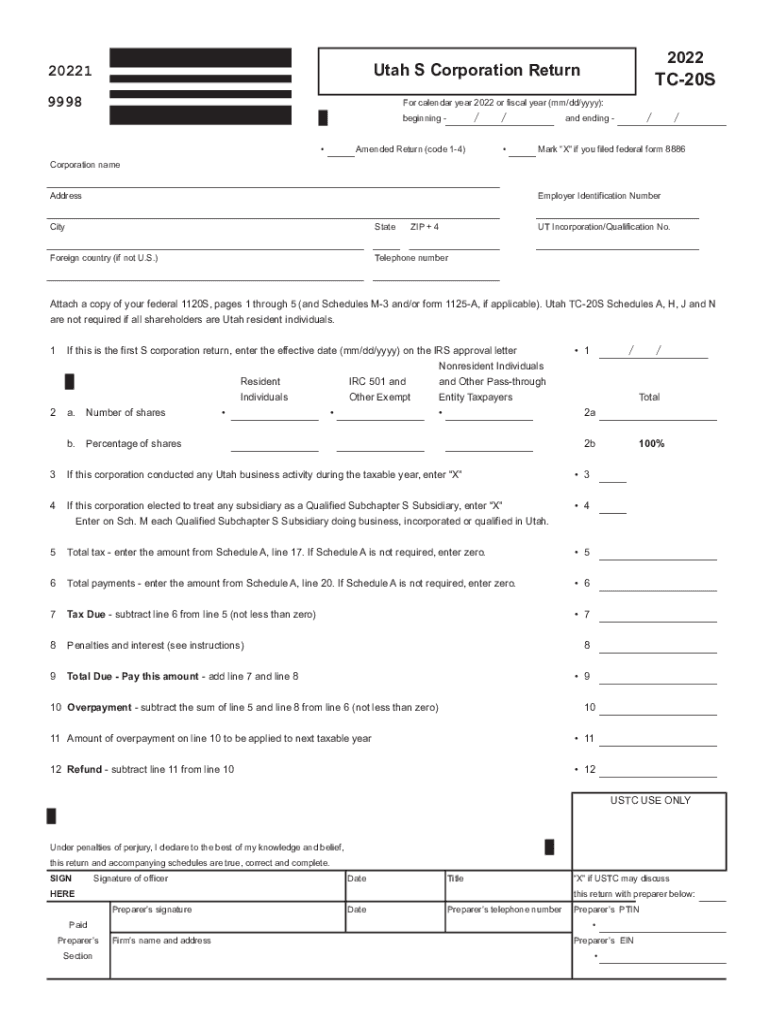

Understanding the Utah TC20S Form

The Utah TC20S form is essential for S corporations operating within the state. This form is used to report income, deductions, and credits for S corporations and is crucial for ensuring compliance with state tax regulations. It is important for businesses to accurately complete this form to avoid penalties and ensure proper tax treatment.

Steps to Complete the Utah TC20S Form

Completing the Utah TC20S form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate information regarding your corporation's income and deductions.

- Ensure all shareholders' information is included for proper allocation of income and credits.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Utah TC20S Form

It is crucial to be aware of the filing deadlines for the Utah TC20S form. Typically, the form must be filed by the fifteenth day of the third month following the end of your corporation's tax year. For corporations that operate on a calendar year, this means the form is due by March 15. Missing this deadline can result in penalties and interest on unpaid taxes.

Key Elements of the Utah TC20S Form

The Utah TC20S form consists of several key sections that need to be completed:

- Identification of the corporation, including name, address, and federal employer identification number (EIN).

- Reporting of total income and deductions to determine the taxable income.

- Allocation of credits and other adjustments applicable to the corporation.

Legal Use of the Utah TC20S Form

The Utah TC20S form is legally binding when completed and submitted in accordance with state regulations. It is essential for S corporations to ensure that all information is accurate and that the form is filed on time to maintain compliance with tax laws. Proper use of this form helps protect the corporation from potential legal issues related to tax obligations.

Form Submission Methods for the Utah TC20S

The Utah TC20S form can be submitted through various methods:

- Online submission through the Utah State Tax Commission's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Penalties for Non-Compliance with the Utah TC20S Form

Failure to file the Utah TC20S form on time or inaccuracies in the form can result in significant penalties. These may include monetary fines and interest on any unpaid taxes. It is important for corporations to adhere to filing requirements to avoid these consequences and maintain good standing with state tax authorities.

Quick guide on how to complete s corporation tax forms current year government of new york

Effortlessly Prepare S Corporation Tax Forms current Year Government Of New York on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage S Corporation Tax Forms current Year Government Of New York on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign S Corporation Tax Forms current Year Government Of New York with Ease

- Obtain S Corporation Tax Forms current Year Government Of New York and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to deliver your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign S Corporation Tax Forms current Year Government Of New York and ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s corporation tax forms current year government of new york

Create this form in 5 minutes!

People also ask

-

What are the key features of Utah TC20s?

The Utah TC20s offers a variety of key features designed to enhance document management, including eSignature capability, customizable templates, and secure storage. With these functionalities, users can streamline their signing processes and ensure compliance. The intuitive interface makes it easy for businesses of all sizes to adopt this solution.

-

How does pricing work for Utah TC20s?

Pricing for Utah TC20s is structured to be cost-effective, offering various plans that cater to different business needs. Each plan may include features like unlimited eSignatures, integration options, and customer support. By choosing a plan that fits your needs, you can have access to high-quality signing solutions without breaking the bank.

-

What benefits does using Utah TC20s provide to businesses?

Using Utah TC20s provides numerous benefits, including increased efficiency in document workflows and faster turnaround times. By eliminating the need for physical documents, businesses can save time and reduce costs associated with printing and shipping. The solution also enhances security, ensuring that sensitive documents are handled safely.

-

Can Utah TC20s integrate with other platforms?

Yes, Utah TC20s offers integrations with various third-party platforms such as CRM systems, cloud storage services, and productivity tools. These integrations ensure that you can seamlessly include eSigning in your existing workflows. Integrating Utah TC20s with other tools helps in creating an efficient document management system.

-

Is Utah TC20s user-friendly for non-technical users?

Absolutely, Utah TC20s is designed to be user-friendly, making it suitable for both technical and non-technical users. Its simple interface allows anyone to create, send, and manage documents with ease. Training and onboarding resources are also provided to help users get started quickly.

-

How secure is the Utah TC20s platform?

The Utah TC20s platform prioritizes security with robust encryption and compliance with industry standards. Users can trust that their documents and data are protected with advanced technology. Regular audits and security updates further enhance the commitment to maintaining a secure eSigning environment.

-

Can I customize documents using Utah TC20s?

Yes, Utah TC20s allows users to create and customize documents easily, enabling you to add logos, signatures, and fields specific to your needs. This customization ensures that your documents align with your brand and meet organizational requirements. The flexibility offered makes Utah TC20s suitable for various business scenarios.

Get more for S Corporation Tax Forms current Year Government Of New York

- Quitclaim deed from corporation to individual oregon form

- Warranty deed from corporation to individual oregon form

- Quitclaim deed from corporation to llc oregon form

- Quitclaim deed from corporation to corporation oregon form

- Warranty deed from corporation to corporation oregon form

- Quitclaim deed from corporation to two individuals oregon form

- Warranty deed from corporation to two individuals oregon form

- Oregon deed trust form

Find out other S Corporation Tax Forms current Year Government Of New York

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free